But First...AVOID BIG LOSS

Investing services and groups are a dime a dozen now. What distinguishes Sungarden Investors Club from the masses?

Making risk management THE priority. Every investor learns to play “offense.” Few devote much time to playing defense. This has led to very inconsistent results and thus, an inconsistent experience for the investor with the investing services they buy. Most investing services do OK…until markets become less-friendly. Then, as Warren Buffett says, “when the tide goes out, you can see who was swimming naked.”

A focus on the 3 key phases of the investment process:

WHAT we will consider owning “at a price” (our watch list)

WHEN we decide to own it (our depth chart)

HOW we own it (stock, ETF, options, time frame, exit plan, etc.)

Treating stocks, ETFs, etc. simply as tools to get what we want. We look at contemporary investing not as a way to collect securities to hold forever. To us, the markets are simply a great tool to get what we want out of life: a comfortable lifestyle and financial flexibility, through protecting and growing what we have earned and saved over time. Stocks, bonds, ETFs and options are simply the means to that end.

Leading by example. This is a highly collaborative and interactive online community of serious investors of all skill levels, where everyone is encouraged to participate and learn together. This has more the feel of an investment committee, not a continuous lecture. No ivory towers here!

No sugar-coating. Thoughtful investment research, delivered through a private members-only portal (see snapshots below). This is literally our personal research deck. You’ll know because you might catch us updating it while you are viewing the shared document! No big time gaps here.

Distinguishing ourselves from the “usual suspects” in our industry. This is not a get-rich-quick approach. We are not here to promote investing as exciting or greed-inducing. We’ll never be stars on TikTok or Instagram. Ours is a careful, methodical, ongoing process to stay truly “wealthy,” as each investor defines that.

Why investing success in no longer just about:

Buy-and-hold

Diversification

Static asset allocation

Owning great companies

Earnings growth

Dividends

To many others in our industry, they believe that these buzzwords above is what ultimately determines their investment results. Without a doubt, each of those plays a role. But it is not nearly as much as people think. It used to be, but a lot has changed. The problem is, the same Wall Street sales machine that hooked the investor masses on those concepts is still very much at work.

Wall Street compensation drives investor behavior

Because that's how they get paid. Keeping assets in accounts is the goal. Because assets in accounts earn management fees. And it is harder to get a new client than retain an old one. So, how do you retain them? Tell them it is all going to be alright.

We don't begrudge the industry from making a living. But think about it this way: if the stock market always goes up, why does anyone need "professional advice?" To make sure they share some of those ever-present stock market profits with people in cities wearing suits? There's plenty to gain for investors when working with fiduciary advisors. But being cajoled with sales pitches about stock market myths that don't hold up for real people with real money is not part of that fiduciary role.

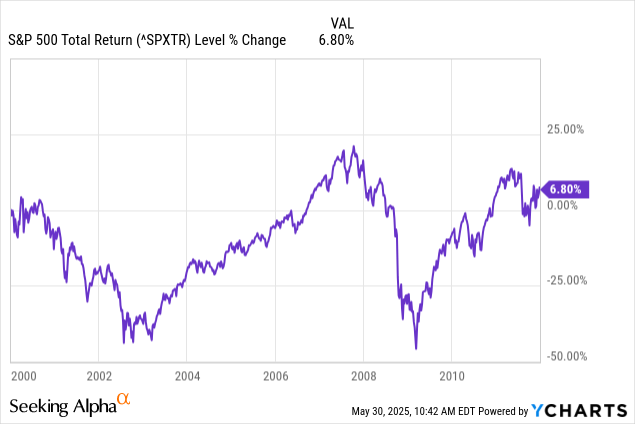

The S&P 500 Index most often produces total gains over a 3-year period. However, as this picture shows, there can be extended time frames where in 3 years' time, that index can turn $100 into $55. Even if and when it comes back, that all takes time.

We have more time for that when we are 30 years old. But what about when we are 60, 70 or older? Even having a "time suck" like this happen to wealth at age 50 can be emotionally and financially stressful.

Can we afford 12 years of near-zero returns?

And below, we can zero in on that, and hopefully make investors think about what's at stake when they simply rely on tired old phrases like "time in the market" and "buy the dip." This is the S&P 500 index from the end of 1999 through the end of 2011. That's 12 years. Or, said another way, close to 1/2 of the current century!

Above, we see that the S&P 500 index (including dividends) spent 12 years recovering from the dot-com bubble, a period in market history that has some parallels to today.

But Rob’s been in the investing business since 1986, and has seen its evolution first hand. That includes being a Wall Street rookie during the 1987 crash, managing his first mutual fund starting in August of 2008, the start of a 55% decline in the S&P 500 in just 7 months, and navigating the pandemic crash, 2022 and the 2025 tariff-driven decline!

Rob’s survived as a professional investor through many market cycles. Through that time, he’s been a “serial learner,” monitoring what works and doesn’t work when it comes to public markets investing.

For example, the original asset allocation studies in the 1980s were not supposed to be marketing pitches, yet they are prominently sold as that, four decades later. Much of Rob’s career and investment strategy work was created to counter those over-simplified approaches that have become popular for one reason: they have had a ton of marketing dollars behind them.

And as successful and inspiring as the Warren Buffetts of the world have been, markets simply don’t function like they did even a decade ago. Many of our peers have chosen to continue “waving the flag” for what used to work.

We prefer to focus on what markets reward and punish during this decade. That has been clear to us, especially since the pandemic outbreak in 2020.

Markets work differently now. Let’s evolve with them.

Algorithmic trading overwhelms fundamentally-driven investing

Index investing distorts the S&P 500 and creates a “crowded trade”

Dividend yields are lower and many former dividend stars are broken

Technical analysis now drives markets. Investors should learn it.

The options market plays a far bigger role than before

Sustained up moves in stocks are tougher to come by

The stock market is far more correlated (“risk on / risk off”)

Quarterly earnings season now a volatile “event”

How do we coach investors to adapt to all of that?

Replace “how do I make money” with Avoid Big Loss (ABL)

Replace S&P 500 envy with low standard deviation investing

Replace “stock picking” with portfolio construction

Replace “buy and hold forever” with willingness to rotate

Replace “income investing” with a total return focus