Chevron (CVX): Position Size Matters

And broader thoughts on how I navigate volatility in my YARP dividend portfolio

(Note: this article was originally written for one of the platforms I write about stocks for. However, sometimes my non-traditional approach to equity investing and portfolio management, while it has served me well, doesn’t fit the mold. So instead, I decided it would make a good combination stock analysis/education article for our Sungarden subscribers on both of our websites. We’ll put out more like this in the future, since we have seen that the freeform style of the Substack community is an ideal landing spot for this type of insight. Enjoy this first single-stock article from us here!).

A few things I've learned about buying and selling stocks in the energy sector since I first started investing professionally back in 1993:

1. They track the price of oil too closely to ignore the price of oil. Fundamentals of these stocks matter, but only up to a point. They cannot escape the commodity they are attached to in their business, even in the case of diversified or "integrated" energy giants like Chevron (CVX)

2. In the US, this industry is somewhat oligopolistic. That is, a small number of huge energy companies dominate the business. As an indication of this, CVX is a 17% weighting in the Energy Select Sector SPDR ETF (XLE), second only to the 23% weighting in Exxon Mobile (XOM). Add in Conoco Phillips (COP) at 8%, and you have 3 stocks making up more than half the market capitalization of the Energy sector of the S&P 500. That ought to make companies like CVX rate highly in terms of expected sustainability of their profit margin and other profitability measures.

To me, this is more important long-term than what the current valuation is, since the key differentiator (I think) to my dividend stock investing approach a.k.a. Yield At a Reasonable Price (YARP) is that the 40 stocks I hold are important, but the weightings of those stocks in the portfolio at any point in time are more important. The latter is what drives returns and cash flow from dividend income, more so than the "names" on my 40-stock list.

3. Energy stocks can't be trusted! By that I mean I tend not to expect to "hold" them as much as I am "renting" them. I'll show below how with CVX, this has been especially helpful to investors in the stock over time.

CVX: good enough to be in my "40" but only at a low weighting for now

Think of my view on any stock as falling into one of these categories:

1. In the portfolio, larger position

2. In the portfolio, moderate position

3. In the portfolio, small position

4. Not in the portfolio, but in consideration as an addition down the road

5. Not eligible (no dividend paid or yield is too low)

6. No way/no how! Stocks I won't even consider including in my YARP dividend stock portfolio. These could be dividends that are just too risky, prices that are way too inflated, even on a very long-term basis, and anything else that simply makes me think to myself "there are many other fish in the sea."

CVX currently lands in category #3. It is a 1% position in my portfolio, in which all 40 stocks are held at all times (unless/until I kick them out, in which case they don't get back in until I decide to replace a current member of the 40). But the portfolio weights (at cost) are from 1% to 5% (in 1% gradients, so every stock is 1%, 2%, 3%, 4% or 5%).

And those weights can change frequently, as I am trying to optimize my return for a combination of dividend income, price appreciation and not losing big along the way. So as a 1% position, CVX is like a player on an NBA or WNBA roster who tends to only play when it is "garbage time" in a blowout game.

CVX: important analytics and why I currently carry a low weighting

CVX is an international player in the energy sector, and is engaged in the 2 ends of the fossil fuel "food chain." Its upstream division handles exploration, development, production, and transportation of crude oil and natural gas. It also deals in processing, liquefaction, transportation, and regasification of liquefied natural gas, and transportation via pipelines.

Downstream activities include converting oil into petroleum products, manufacturing renewable fuels and plastics for industrial uses. CVX has something in common with several of the stocks in my 40-stock portfolio. It has been existed as a corporation a lot longer than and current living human, dating back to 1879.

CVX has the top quality I look for in a member of my 40-stock portfolio: a history of consistent profitability that has a strong chance of being sustained. And while the stock has rallied this year, though its return since 2022 has been practically all from the dividend. So that consistent profitability may not be given as much credit from the market is it could be in the future. This adds to the attraction of having this energy giant in “the 40.”

As noted, I owned a small position in CVX and earned the dividend last month. But this is where my style of dividend investing is somewhat unique. At least I think it is. Because CVX is essentially along for the ride at this point, because I want to own at least that token 1% position, but it has shown me little reason to lift it above that point recently.

What could change my view on Chevron?

What might happen to change that? A spike in the oil price, a strong price lift brought on by new information that lifts the stock out of its trading range, or simply a decent chart pattern in the stock as it nears its next dividend ex-date in August, or if not then in November.

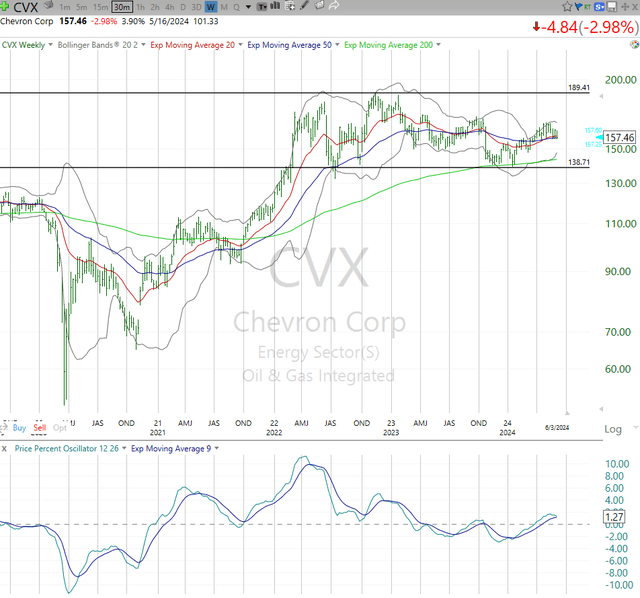

The chart below shows that on a long-term basis, CVX may be starting to get on a bit of a roll. Its 1-year trailing return is 12%, the highest in a little while, but well below where it has gone during past oil stock spikes. I won't count on another 80% 1-year return, but there should be opportunities to grab total return in smaller chunks, even in a rangebound stock market.

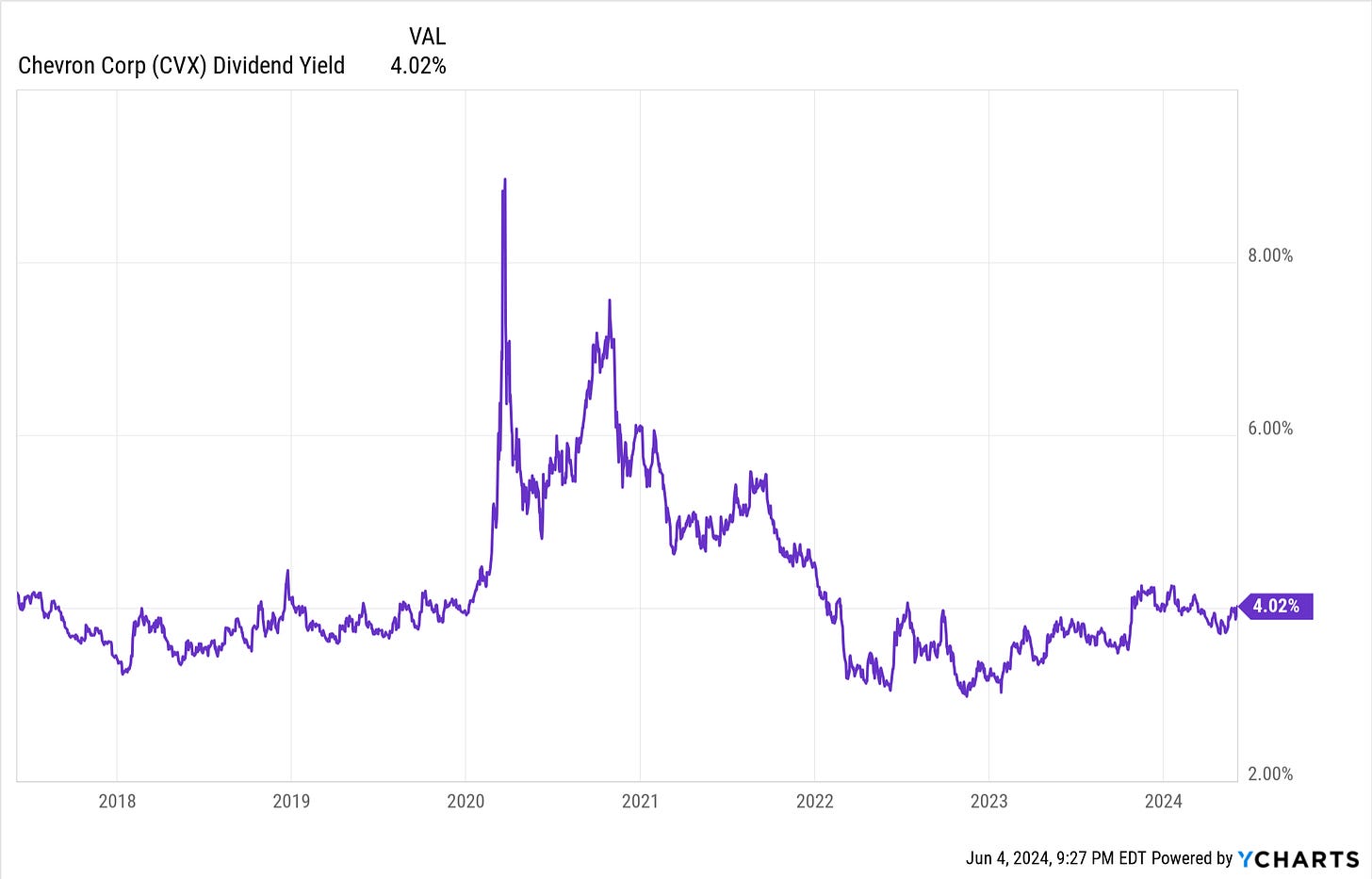

This is a shortcut version of a more detailed YARP (Yield At a Reasonable Price) view of where CVX stands. Again, I want it in the portfolio as a blue chip diversified energy stock, but I am more likely to take a position closer to 4% or 5% if the yield was closer to the top of its 7-year range, which is what I track closely. So perhaps a 5% yield, which would not occur for a while unless the stock fell about 20% or so.

Capturing as much dividend income as I can is a key driver of my YARP stock selection and rotation process, and a 4% yield is a good starting point. That yield is above-average in terms of security, and it has grown at a decent pace in recent years. That continues a run of dividend growth for CVX dating back to the late 1980s. And the payout ratio, at 49%, seems reasonable to me for a company in this industry.

The technical chart of CVX paints a similar picture of a stagnant, rangebound stock for now. That said, the range since 2022 is fairly wide, from about $140 a share to $190. That puts in at the bottom 1/3 of the range, but if it dropped, say 10% and the appeared to be bottoming where that lower line is, that would be a technical indication that there could be some upside, and that would make me more likely to try to get some of the dividend payments with a higher weighting.

Why CVX is a stock I want to keep around

This is how I operate as a dividend investor. I have plenty of other stocks in the portfolio running up in price, in other sectors. There will be a time when Energy stocks will be the focus sector because of price momentum, and I'll already have CVX there, following it in my research and ready to pounce if and when it drives higher. Equity investing is cyclical and I have one the names in the volatile energy sector that is less likely to implode on me. So I'll bide my time.

In other words, in a portfolio of 40 stocks, the more ex-dividend dates that approach with stocks in good fundamental and technical order, the more willing I am to own a higher percentage weighting in those stocks when ex date approaches. This is quite different from both buy and hold, where you get the dividend but also the price risk, and from chasing stocks higher just because they have nice "sticker prices" i.e. high dividend yields.

That last chart above shows how I truly believe dividend investing works for me in a market where most yield stocks have been mediocre performers for a few years. Since the start of 2022, CVX's total return is modestly positive. But that performance included 3-month time frames (during which exactly 1 dividend ex-date occurred) where the stock gained as much as 50% or lost as much as 20%.

No, this is not "marketing timing" to me. This is tactical rotation among 40 stocks I hold at least a little of (1% of portfolio) at all times unless or until I jettison them from the portfolio and "upgrade" them to another stock. Right now CVX is merely good enough to be in my "club" if you will.

It earned that right be being a fundamentally-sound sector leader. But until its price cooperates more than it is now, I'll maintain it at a lower weighting versus many other stocks in that basket of 40.