Investing today is not like it was last century.

Yet so much of Wall Street would like you to think it is.

Stock-picking services that produce mediocre results, putting excitement above risk management, and using tired approaches to allocating assets, and limiting themselves to a constrained investing toolbox. We say enough!

The markets of the 2020s require a different approach for a rapidly-growing group of serious investors who prioritize keeping what they have, then making as much as they can beyond that. Sure, they can try getting stock picks from dozens of sources.

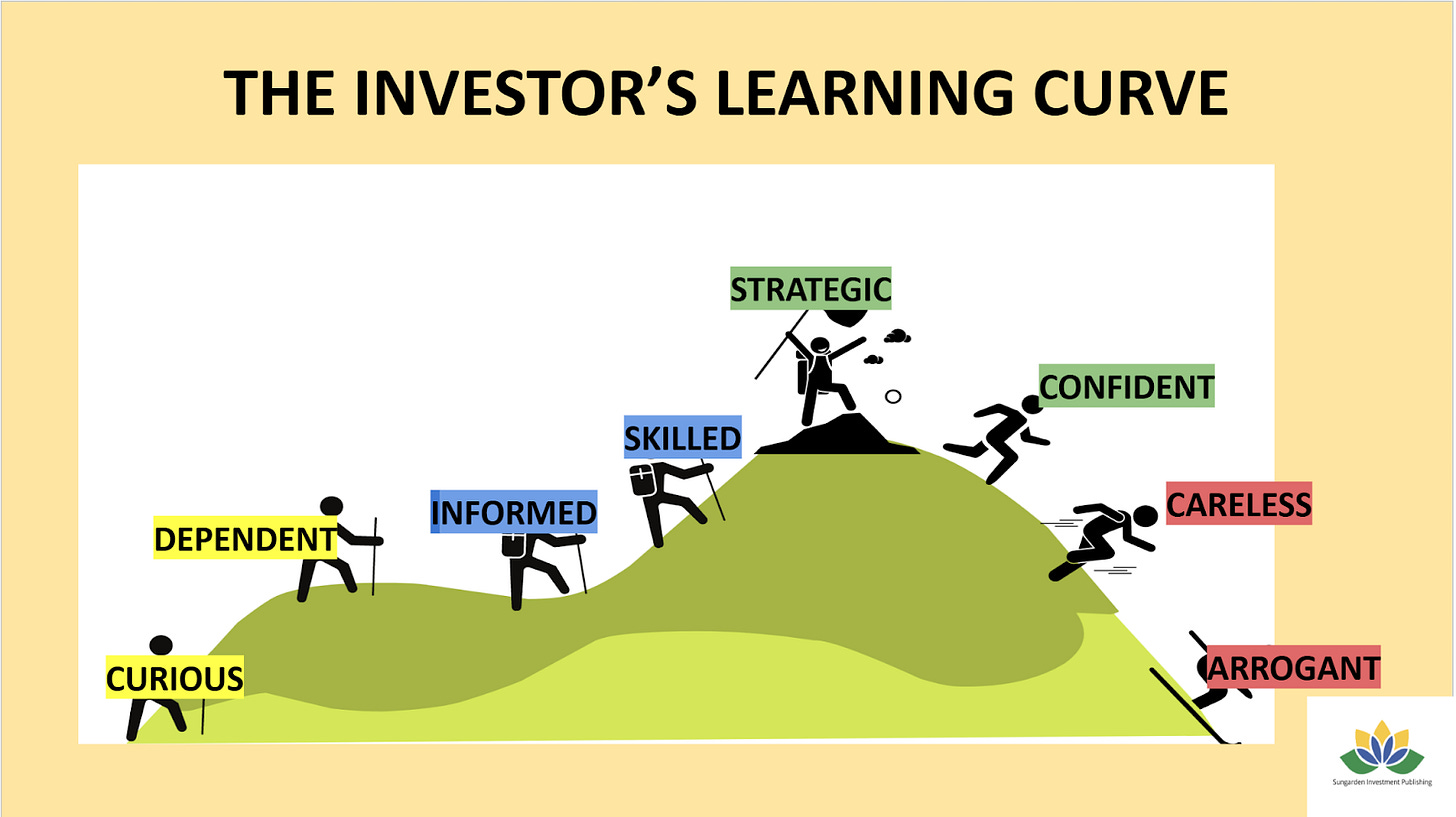

But as the expression goes, that feeds you for a day. If you want to learn how to fish (for a well-structured, defensive-minded investment portfolio), you need to move up this INVESTOR’S LEARNING CURVE...without falling off the mountain (red zones on right).

Investing successfully today means

Manage risk

Keep it simple

Stay humble

What you get for $15/month or $150/year:

The Weekly ROAR, published each Tuesday. Our comprehensive private letter to paying subscribers, featuring Rob’s latest market views, charts and commentary.

Actionable ETF model portfolios, updated Tuesdays and when conditions dictate.

Quarterly live sessions in our “clubroom” on Zoom, where Rob presents his latest thinking, and answers your questions.

Video library contains educational clips that we’ve recorded, and the latest session recording is updated within 24 hours of the live event.

In addition, for $600/year, Premium members will get:

Weekly live sessions in our “clubroom” on Zoom, where Rob presents his latest thinking, and answers your questions.

Ongoing coaching on typically under-covered, value-added strategies, such as bond ladders and option collars.

One thirty minute private Q&A session.

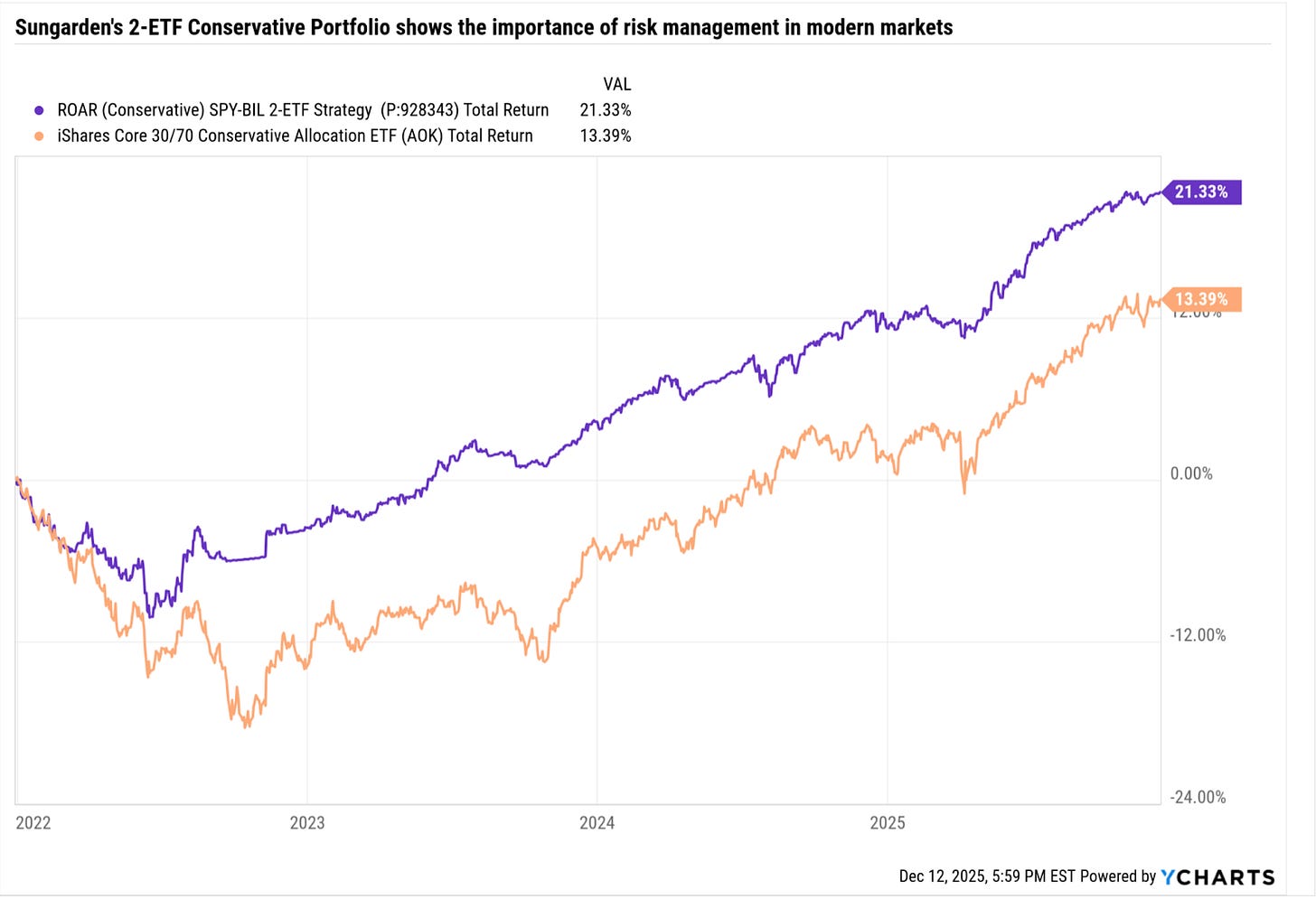

The Simple (yet very effective) 2-ETF Portfolio

Sungarden Founder Rob Isbitts, leader of ETF Yourself, has run this 2-ETF portfolio, simply allocating to SPY (stocks) and BIL (cash) with his own money since the start of 2022. He shares it with his paying subscribers every Tuesday in The Weekly ROAR. It is based on the ROAR* Score he created to consolidate his 40 years of charting stocks and funds.

* ROAR = Return Opportunity And Risk

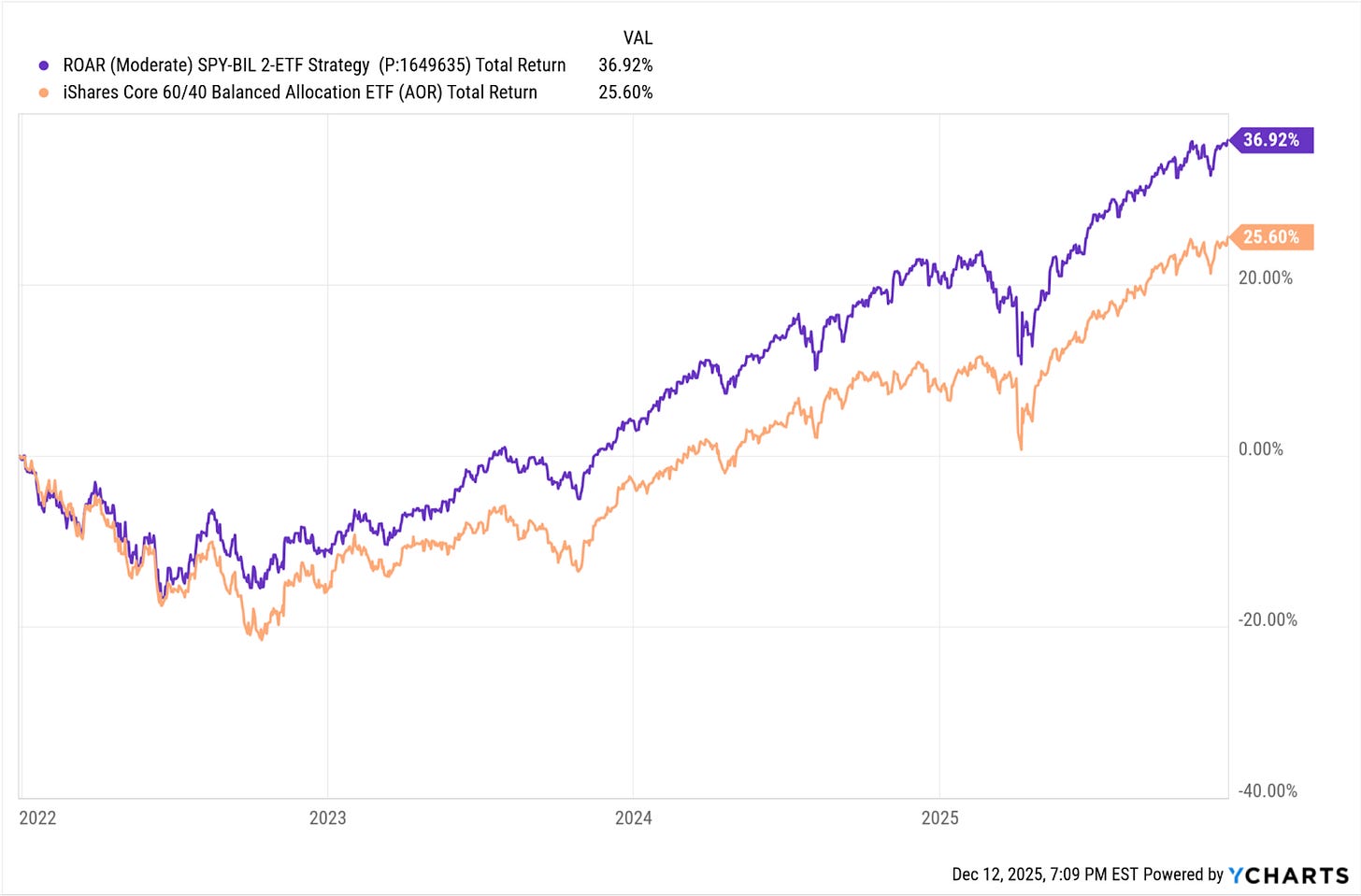

And, here’s a second, more moderate-risk version of that 2-ETF concept. In this portfolio, Rob allocates 50% to the SPY ETF and allocates the other 50% using the ROAR Score approach.

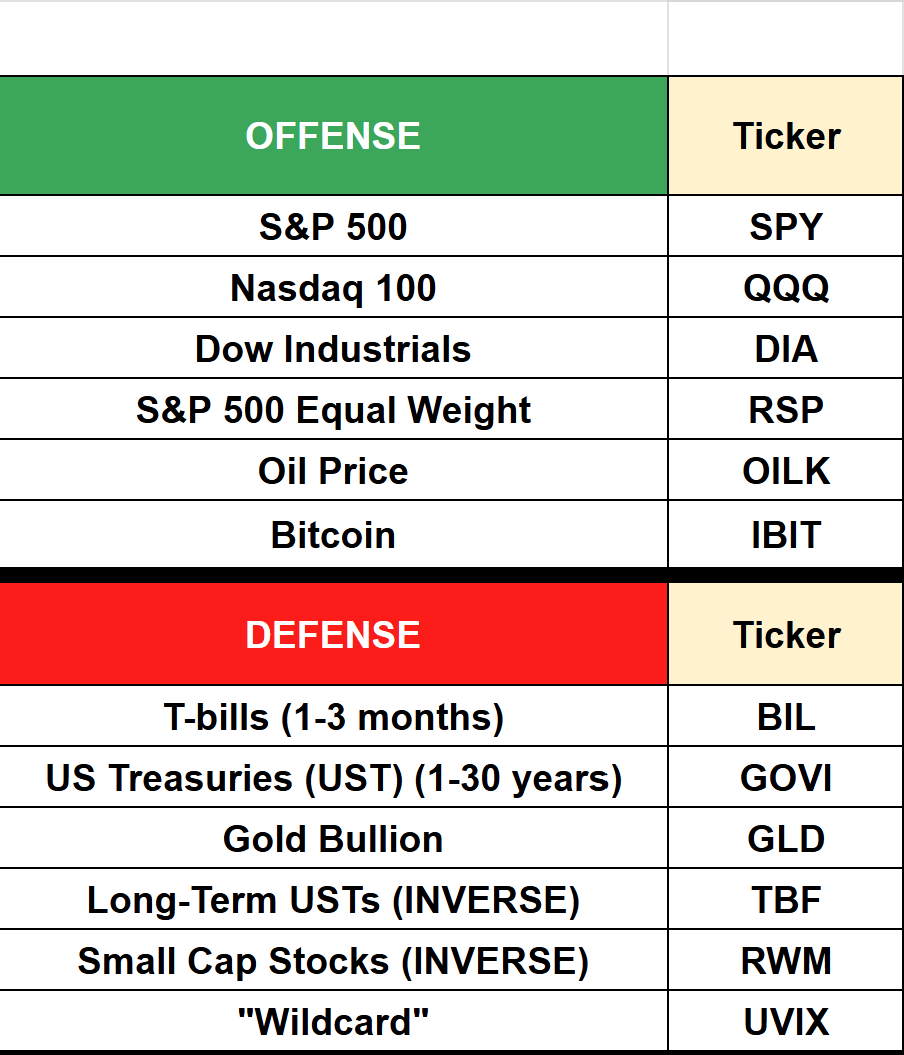

And, our Long-Short model takes the 2-ETF model and adds a “go anywhere” segment that can own any US-traded ETF.

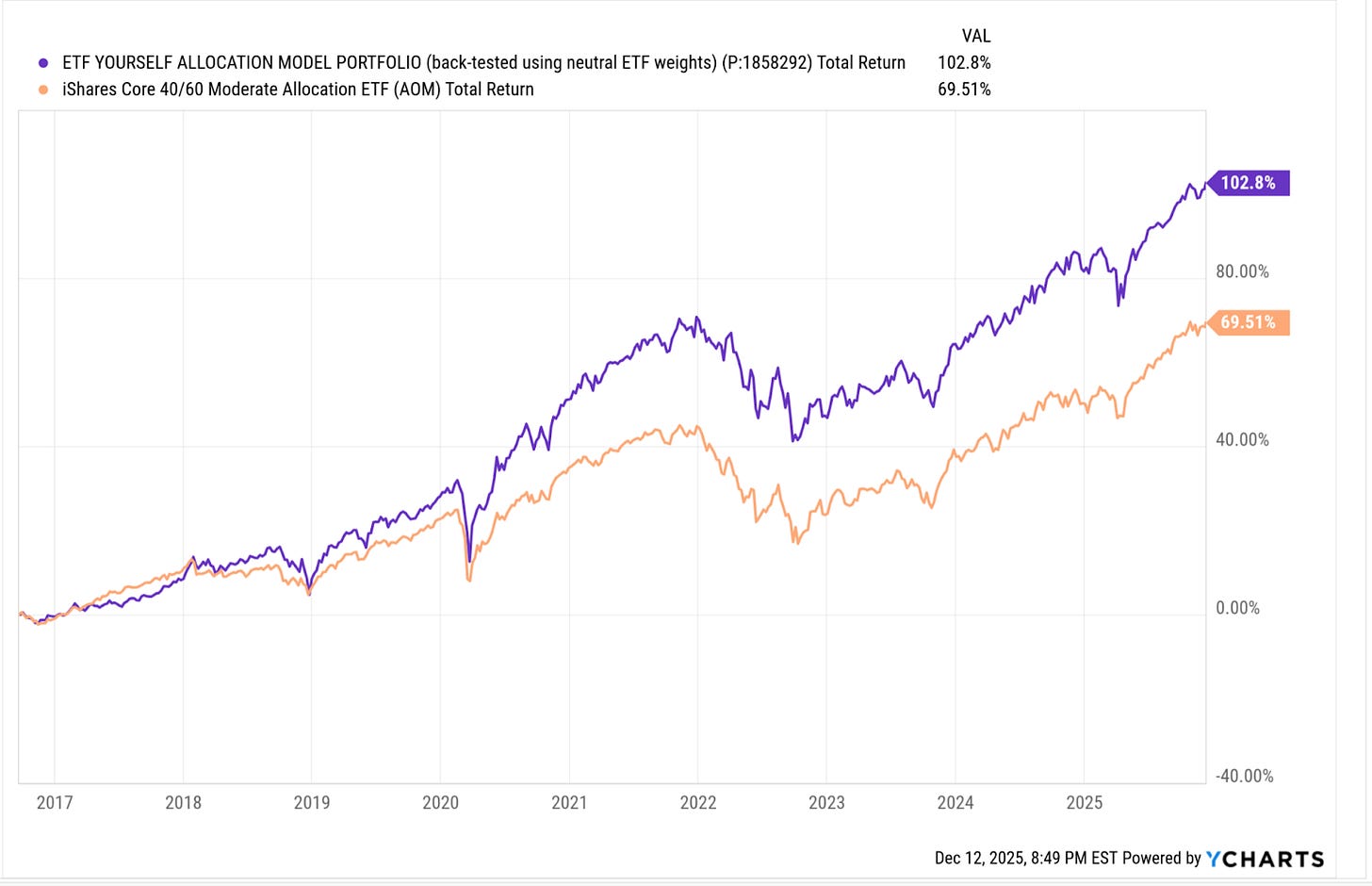

The Allocation portfolio

We believe in “playing offense and defense at the same time.” We provide you with portfolio models ranging from 2-ETF models like the one shown above, to our Allocation model that selects from and rotates among the 12 “macro market” ETFs shown here.

This model was created more recently, but we created a back-tested performance analysis based on the “neutral” allocation Rob uses to actively manage and allocate to most but not all of those 12 ETFs at any time.

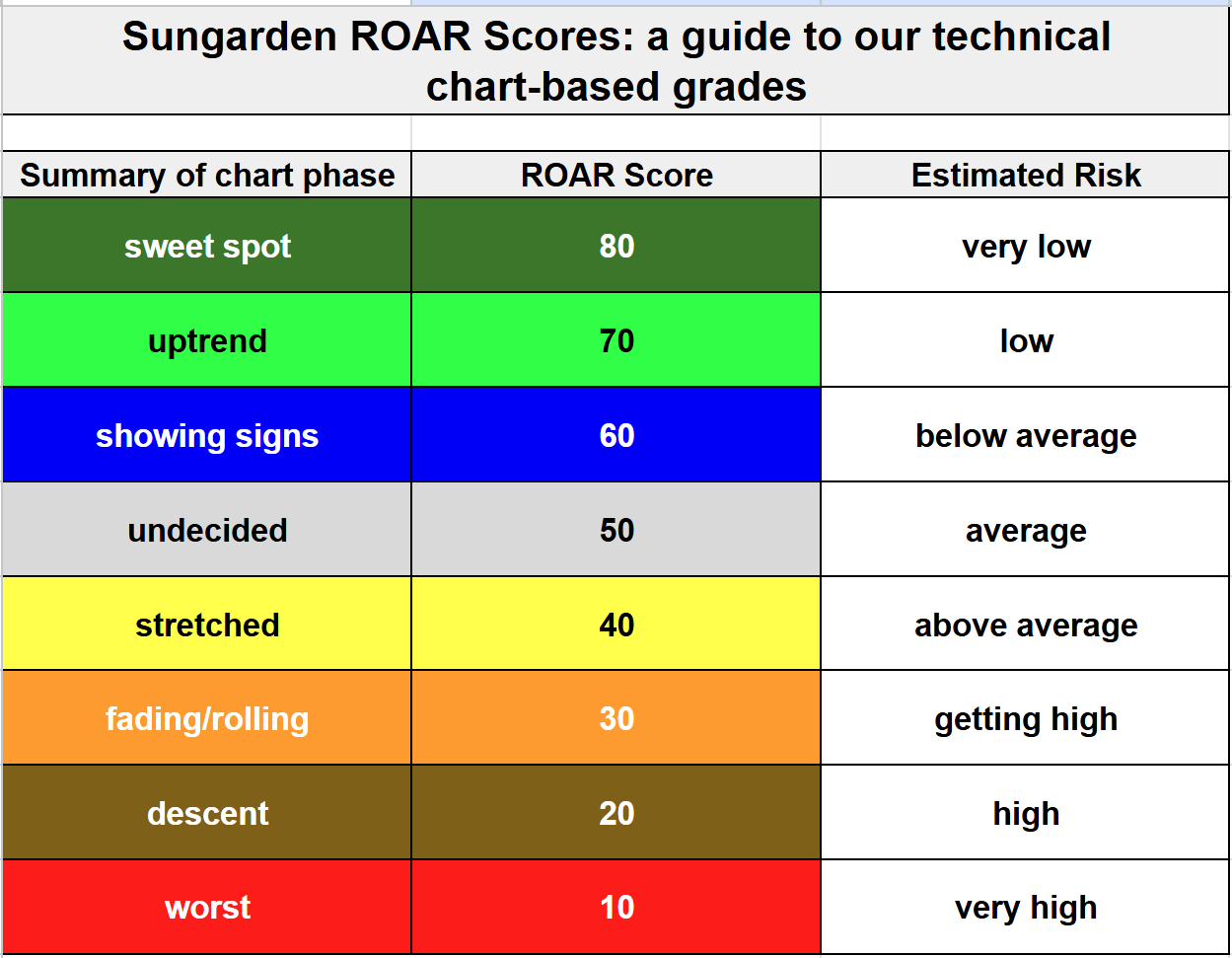

ROAR Scores: for better risk management

Most investment grading systems are based on how much you can make, without regard to the risk of major loss attached to trying to profit. ROAR approaches it differently, using technical analysis to ask “what are the chances that the next major move will be up and not down?” It’s not about “how much I can make” but rather “how can I not lose big?”

Here’s a guide we regularly review with Club members, which converts Rob’s experience analyzing chart patterns to ROAR Scores.

At Sungarden we use our proprietary ROAR Scores to:

Assess the broader risk climate (for our 2-ETF and other portfolios)

For an ETF or single stock, estimate: “how much risk is attached to the return I’m trying to earn?”

Because any security can go up in price at any time. But the difference between any 2 investments is the amount of major risk involved.

Rob Isbitts: Investing “Lifer” and your group leader

From one of Rob’s educational presentations for MoneyShow

Rob learned technical analysis using graph paper and pencil when his late father taught him at age 16. He then practiced professionally as an advisor and fund manager, until he sold his practice and retired in 2020.

Now, he uses that experience as the engine, to help self-directed investors to develop consistent investment discipline on their own terms. But with the benefit of Rob’s decades “in the trenches,” including navigating every bear market since 1987.

Since retiring from running his investment advisory firm, Rob has written more than 1,000 articles for Seeking Alpha, Barchart, Forbes and other publications. Sungarden Investors Club was created to allow self-directed investors to interact with Rob, rather than just reading his articles.

KISS: Keep It Simple, Sungarden!

We all try to make our lives as simple as possible, without sacrificing quality and bottom-line results. Yet so many investing services flood their subscribers with data and complexity. To us, investing for yourself is about preventing bad habits and learning to make clear, consistent decisions within the framework you set yourself.

This club leads by example, through a combination of live learning, proactive responses to Club member questions, and practical model portfolios. Rob shows you his own decision-making process, and you personalize it for yourself.

Most importantly, we are always striving to make our members smarter and more self-reliant. While reducing stress and complexity that often accompanies learning to invest for yourself.

Rob Isbitts has managed money professionally since the late 1990s, and these portfolios take those 130,000 hours of hands-on experience, and right-size them for self-directed investors learning to navigate contemporary markets.

Is it worth it?

If you are expecting the typical answer of “yes, for everyone”...you don’t know us yet! You see, Rob and his wife/business partner Dana have been working together for more than 30 years.

They were part of a $300mm RIA firm where Rob was a partner. Then Rob spent a year as the Chief Investment Strategist for a $3 billion RIA firm, before he and Dana started and ran their own RIA firm from 2012, selling it in 2020.

During that time, high net worth clients typically paid $20,000-$40,000 a year for a full-service advisory relationship. While that business delivered customized risk assessment and goals analysis, portfolio selection, trading and 1:1 advice, it was centered around the same investing philosophy and process Rob has used for decades.

That same risk-managed portfolio approach is the one he discusses and teaches every week at our live sessions, and through our weekly letter. Delivered in a DIY format here, for $150 (or $600 for Premium) a year.

Ready to ROAR with us?

Risk management is not everyone’s priority. Is it yours?

Simplicity is not what Wall Street is about. What about you?

ETFs and bonds are not as “sexy” as stocks. What do you think?

ETF Yourself:

We’re not for everyone. But we might be for you.