ETF Yourself Quick Start Guide

For paid subscribers

Here’s a tab-by-tab guide to what you see on our site, and how to start working with it. Don’t feel like you have to master it all. These are principles and features of ETF Yourself I’ll keep coming back to, over and over again.

Here, we walk you through the key steps to start thinking like a portfolio manager. Our long-time subscribers have helped us get this far in breaking down some powerful concepts and helping me to translate them from my portfolio manager’s brain to a format that a wider audience of serious investors can adapt as they see fit. We look forward to you being part of that continuous brainstorming process as you get comfortable with how this all works.

And if you are in the Premium version of our service that includes our weekly live session, we’ll interact live, and you can ask me questions as you learn the process I’ve used for decades, managing money professionally.

HOME

As with many other publications on the popular Substack platform, ETF Yourself’s home page is a starting point, containing some of our latest public posts, and some timeless content we think subscribers will want to keep front-of-mind.

Now, let’s take a look at what’s in each of the main tabs.

LEARN Our Process

Learn Investing Basics…accurately. That last word is so important.

Our observation about today’s instant-gratification, popularity-driven, adversarial online culture? We’ve never had more information at our fingertips, and we’ve never used less of it! We try to approach it differently.

That means clarifying and correcting some common misinterpretations of traditional investment education. Some of what DIY investors learn is just fine. But too much of it is neutered by sound bites, oversimplification, and greed of the communicator. Not here. Ever.

This is where you will find perspective posts on things like our proprietary ROAR Score, which grades ETFs based on their current level of risk. There are so many “rating” systems that conclude that you should “buy” or “sell” something. But to us, what really matters is how much RISK we’re taking on at any point in time, in owning that security.

Key perspective here: any ETF or stock can go up in price at any time, for any reason. The difference between one security and another? How much risk of major loss is attached.

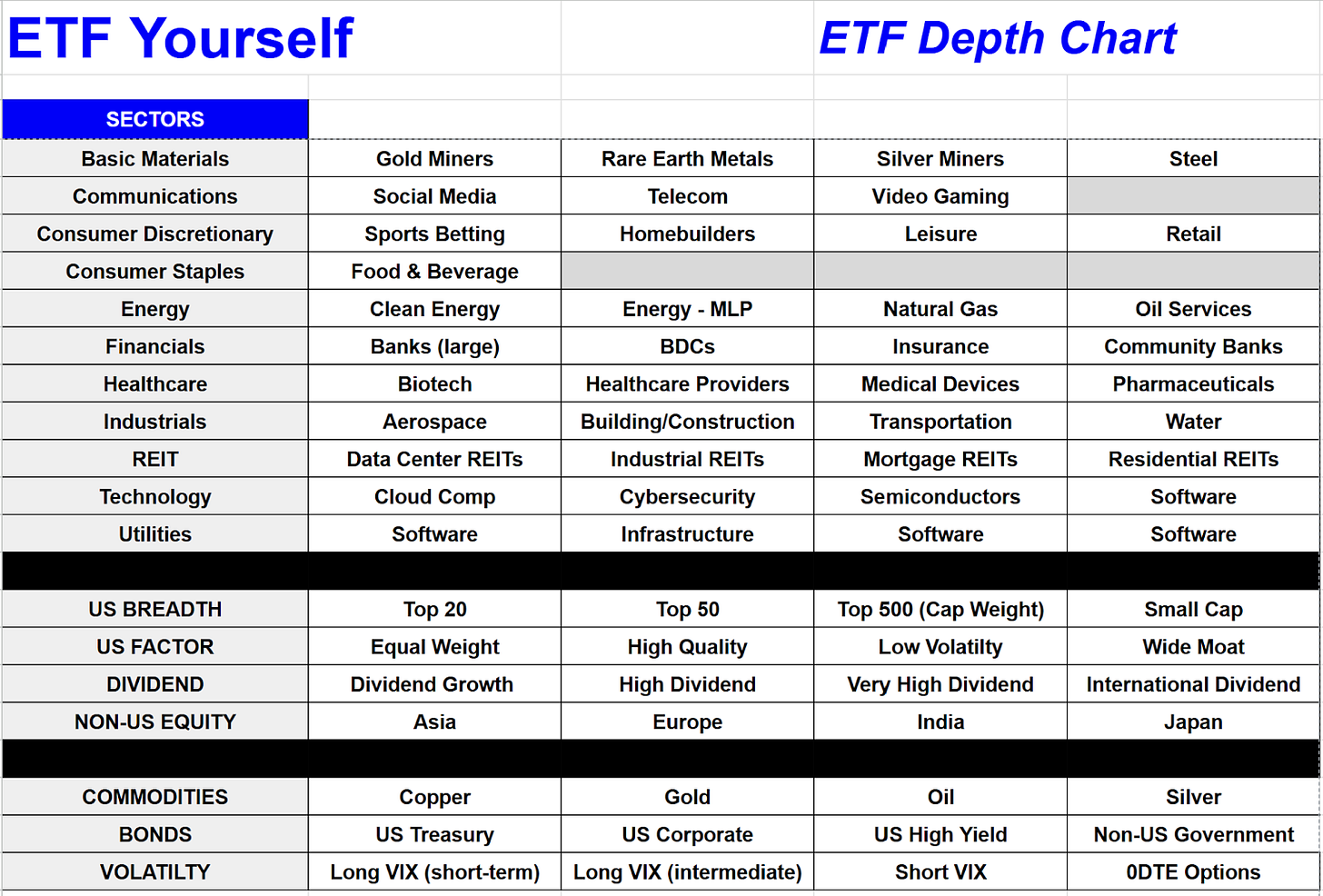

A featured post here is our “Depth Chart.” The idea is to allow subscribers, at a glance, to picture the jigsaw puzzle that is today’s global markets. Through the lens of ETFs.

The depth chart is a name we borrowed from the world of sports. A team has a roster, and each position on the field has starting players and bench players to back them up. Some don’t make the roster at all. But that can all change over time.

Our version of the depth chart shows the 11 S&P 500 sectors, some associated industries within them, and continues with some additional types of investment segments including factors within the stock market, and non-stock asset types.

The depth chart table is shown here in one form, with the names of the investing segments. Subscribers also see the ETFs we believe best represent those segments. And in paid subscriber posts from time to time, Rob will comment on particular areas of strength or weakness he sees among that map of investment styles.

This is far from a complete list. It contains about 75 different ETFs. But it helps subscribers who want to go beyond the 2-ETF and 10-ETF universes we provide to vary their own research menu as they like. And, to ask us questions about all of it, whenever they wish.

BUILD Your Portfolio

It starts with building simpler portfolios.

You can always get more exotic once you have your “center” as an investor. This section contains high-level insights that help you connect with our investment philosophy and process. Remember, just because we do it this way, that doesn’t mean you need to follow it 100%. Or even 50%. This site is all about explaining, implementing and evolving key concepts Rob has used for decades. So each subscriber can personalize it as they wish.

Each week we will focus on a pair of ETFs that can be used as a simple but complete portfolio.

MANAGE Risk

Managing risk is THE priority for us. Steep losses simply take too long to recover from. So why not do all we can to avoid them? Does that mean performance suffers? Not in our experience. It just means it is less exciting. To us, that’s not a bad thing.

ETFs are the central investment vehicle we use here. However, Rob’s diverse work in managing risk spans well beyond that. So this section of this site is our ongoing focus on how to manage risk, with ETFs and beyond. Explanations of strategies like bond ladders, option collars and our macro risk indicators are found here.

Weekly Letter

This is our flagship publication. We’ve published it each week here since 2022. You’ll see what’s included below. This is really the main “deliverable” for subscribers in our basic service.

Each week, the format is as follows:

In the issue. A quick introduction. This is available to non-paying subscribers as well, absent the key details reserved for paid subscribers.

Robservations, Rob’s blunt assessment of the current market climate, and potential drivers of portfolio results. This covers multiple time frames, from what’s happening right now, to a few months out, and even a few years out

Charts I’m watching. A set of charts covering ETFs, indexes, economic indicators, and some stocks too. This is where Rob bottom-lines how his chart work informs his views on risk management and where he thinks money will be treated best.

ROAR Score weekly update. A quick statement about the current level of our primary risk indicator, and how it maps to the allocation of our simple 2-ETF portfolios. Note that while ROAR is an overall risk indicator for investors to consider, its application here is specific to determining the allocation between stocks and cash, via an allocation to the ETF tickers SPY and BIL. So factors such as T-bill interest rates, analysis of the S&P 500 versus other indexes, and Rob’s general bent toward conservative investing have a heavy impact here.

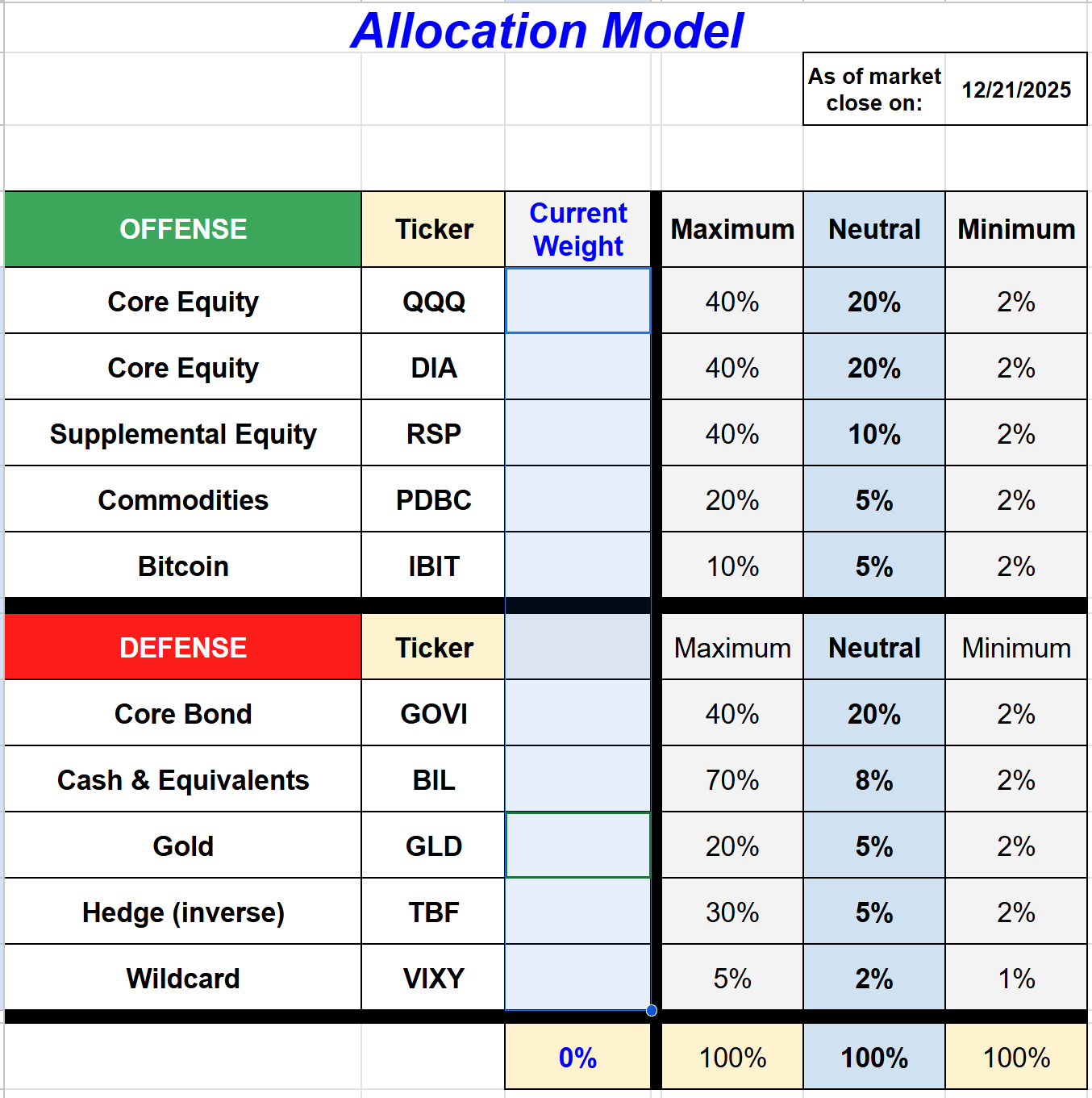

Allocation Model: weekly update. The 2-ETF portfolio concept is perhaps the fastest-growing aspect of ETF Yourself. Rob is constantly researching other combinations of ETFs that work well together as “offense/defense” pairs. But for those who like the idea of a more diverse set of ETFs in a portfolio, the Allocation Model will be a useful tool.

Each week, we display the current model, which is comprised of 10 different ETFs (5 offense, 5 defense). We gravitated toward a “permanent portfolio” concept here, in that the model allocates to all 10 ETFs, all the time. We show the current weight/allocation to each, and also compare it to our “neutral” weights. That’s our assumption of the long-term average weight we’d expect to assign to each one.

This allows subscribers to be as passive or active with the Allocation Model as they like. The neutral weights are intended for very long-term investing, while the current weights are the active investor’s guideline.

We also include minimum and maximum weights for each ETF, so that subscribers can see potential high and low levels of emphasis on a particular ETF at any point in the market cycle.

MEDIA

Those in our premium service also attend live and/or receive recordings of our weekly live sessions. That’s where Rob goes into more depth on his market views, what he’s writing about, what he’s investing in, and what he’s researching. This is where he updates subscribers on where he thinks “the puck is going,” so to speak. There’s also live Q&A each week, where you can “ask Rob anything.” These are not sales webinars! They are research-driven, and explained in a straightforward, non-jargon style.

This section links to our latest weekly live session recordings, as well as other audio/video content. And to Rob’s writing at Barchart.com, Seeking Alpha and elsewhere.

ABOUT

This last section aims to help you understand where we’ve been in the business of helping investors in many formats. That includes Rob’s 27 years as a fiduciary investment advisor, 3 stints as a mutual fund manager, and now, since 2020, as a researcher and publisher, delivering exclusively non-personalized investment content.