How I confronted the pandemic crash and other market events. And lived to tell about it.

When risk management is life-changing.

Attached is an auditor’s report from back in my investment advisor days. We sold our practice to retire to a life of lots of research and writing, aiming to help a broader audience. So far, so good

.

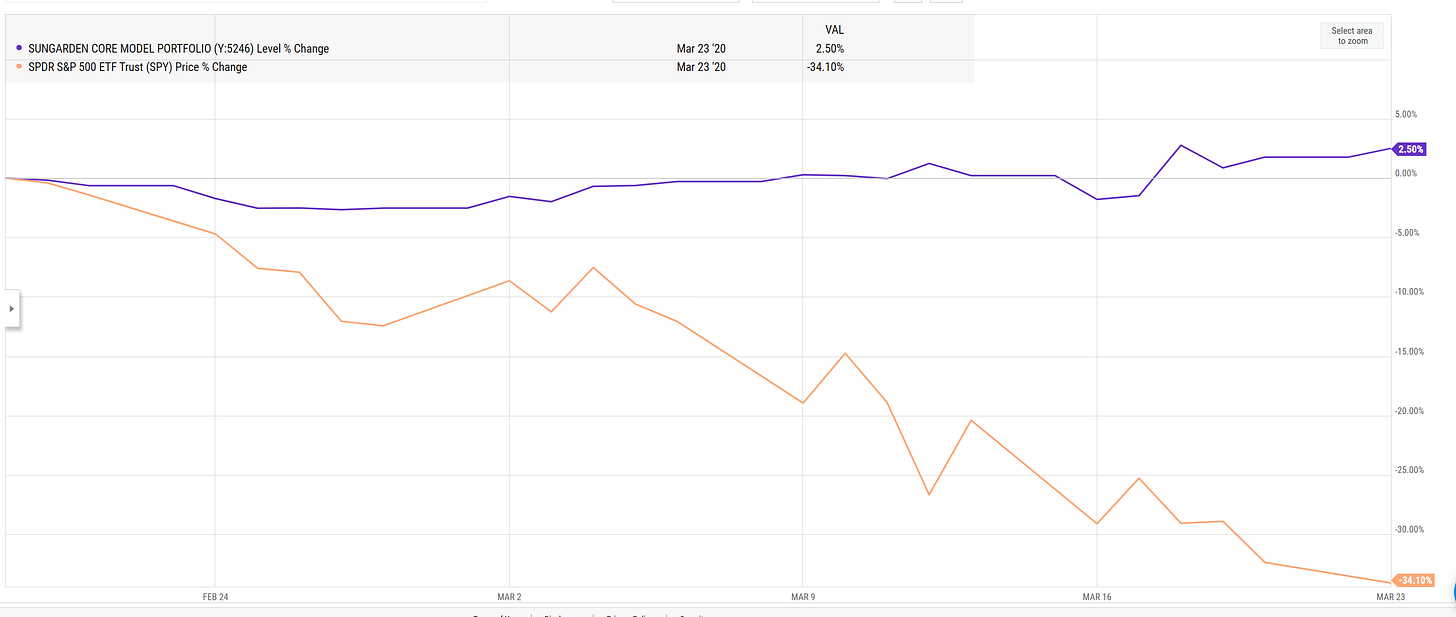

That report covers one segment of my asset management career. from the start of 2017 through June of 2021. It was a tumultuous period which included among other things, a 34% S&P 500 decline in just 5 weeks, as the Covid-19 pandemic invaded our lives and in turn the financial markets. We have much of my record in various forms, at multiple venues, going back to 2002, in a separate article here.

How to analyze my (or anyone else’s) track record

But to me, there’s really only one thing that matters in that record. And it is not what my “total return” was. It is my ability to do what we aim to here: teach DIY investors how to avoid big loss…then make as much as they can.

There are 2 types of markets. There are those in which a rising tide lifts all boats. For S&P 500 investors, much of the current decade has been that way. For more than 10 years earlier this century, that was absolutely not the case. Nearly half of this century has seen the S&P 500 go down, recover, and end up “net nowhere.” Keep that in mind during this time of market excitement and FOMO.

The other type of market is where we get no help from the markets in our pursuit of making money, and less so when it comes to protecting it. The attached report shows one of those periods, albeit a brief one.

It gets dark early, sometimes

My question is always this: if the market surprises “everyone,” ducks down suddenly, and this time around it takes years to get back to where the major indexes started, how can I still retain 95%, or perhaps worst-case 90% of my peak capital? In other words, how can I keep my “drawdowns” limited. THAT is true risk management. And it is imbedded in the process, all the time. If not, then as people found out during past cycles, “it gets dark early.”

So if you do review that report, and any of my other “track record” information displayed on this site, remember this: if you are using my ongoing work as research, you are the one who owns the track record. My goal is to teach you to do that responsibly, since most of us have other humans relying on our investment decisions. My scope for that used to be a group of high net worth families. Today, that oversight is limited to what I do investing for my own.

My investing career goes back to before the dot-com bubble, all the way to the 1987 crash, when I was an assistant to 3 portfolio managers at a Japanese bank in NYC’s beloved World Trade Center. Over the past 4 decades, I’ve focused primarily on one thing as an investor: RISK MANAGEMENT.

How I’m adapting my former career to help subscribers at ETF Yourself

My rationale is as follows: any security and markets as a unit can go up in value at any time, for any reason. What separates them at any moment is how much risk of MAJOR LOSS is attached to pursuing those gains. For more than 25 years, I had the distinct honor and pleasure of working 1:1 with a set of about 30 families, each of whom had a different view of investing and managing risk. My job back then was to treat each of them uniquely, even though their common thread was “don’t lose big.” They had made their money, and didn’t want to ever think about going back to work, or changing their lifestyle.

Fast-forward to the start of 2026, and I’m several years removed from that mission. My work now is not personalized, and I’m not a fiduciary as I was then. I’m just a self-directed investor who’s been around the block few times, and made plenty of mistakes along the way. They were all learning experiences.

ETFYourself.com is where my “best thinking” from decades of analysis, research, ups and downs lives. And while I’m not one to wax poetic often about what I did in the past, my current work is focused on portfolios of 2 to 10 ETFs, for our mass audience of subscribers here. It is no longer personalized, but the goal is for each DIY investor to learn from what I write and speak about, and personalize it for themselves. That’s why we called it ETF YOURSELF.

But…does it work?

And since risk management is at the center of my work, as it always has been, one question we get from time to time, and expect to hear more often as markets get rougher, is this one: does all that risk management stuff actually work?

My response: it depends on what you mean by “work.” If your goal is to not lose more than you pre-determined would be acceptable, I can teach you how I do that for myself…with an “uncle” level of only 5%. In other words, for every $100 I have invested, ain’t no way I ever want to see $94.99! But in order to pursue that, I am also willing to not have too many 20%+ years in the markets. Much less 50% years.

The great thing about the setup we have now, where this is research and not personalized advice, is this: ANYTHING I do and show our subscribers can easily be adjusted on your end, to invest as you want. But do so with a greater sense of what risk management is, and how you want to apply it to be a DIY investor.

Here’s one piece of that record. S&P 500 off 34% in 5 weeks. The “Core” portfolio I ran as my main strategy then (essentially the predecessor of the 10-ETF allocation portfolio we run here) actually gained more than 2% during that time.

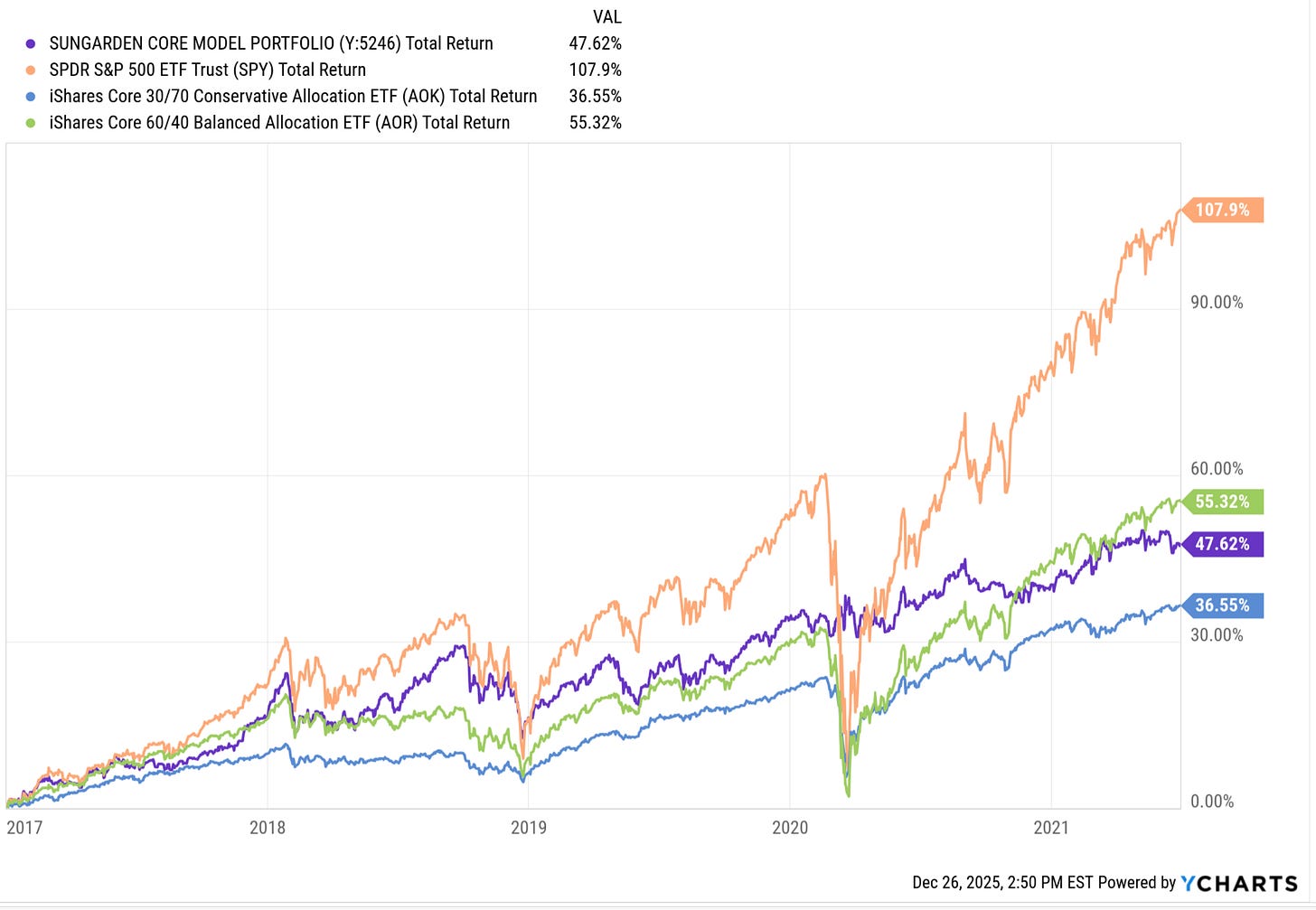

The flip side of that, as shown in this chart (not from the auditor’s letter, since I wanted to include more benchmarks here) is that over the full period covered (2017 through mid-2021), my risk-averse approach was no match for the S&P 500. Since it is not designed to be. In fact, those purple and orange lines bear little resemblance.

More importantly, the portfolio comfortably outperformed and managed risk much better than a classic “conservative portfolio” mix of 30% stocks/70% bonds (blue line). And was quite competitive with a much more aggressive “60/40” mix (green line).

The takeaway

This post is a little bit about my specific record in the distant past, and a lot about managing risk. And doing so with an investment process, one you create yourself. At ETF Yourself, we’re here to help you adapt what I’ve done and still do for myself, to whatever you want to accomplish with your own portfolio. If risk management is a top priority to you, we think you will feel quite comfortable around here.