Introducing the Sungarden YARP™ Portfolio: A new investment group focused on yield at a reasonable price (YARP), a trademarked investing approach with a strong emphasis on risk management.

YARP uses strategic position sizing, options, and ETFs to protect capital and stabilize dividend income, even in bear markets.

Subscribers get 24/7 access to my portfolio, trade alerts, weekly commentary, and a curated learning library, all aimed at modern dividend investing.

I'm thrilled and honored to announce the launch of a new Investing Group at Seeking Alpha, Sungarden YARP Portfolio. Here, you're buying a process, not a product. Utilizing strategic position sizing, options, and ETFs to protect capital and stabilize dividend income, even in bear markets, users of the YARP process get the tools they need to grow their portfolio and manage risk. I bring to the service 30 years of hands-on, in-the-trenches investment management experience, and my risk-managed, tactical approach to the typically mundane world of income investing.

There's a big discount for "early birds." The first 35 subscribers will receive an annual subscription at 35% off the full price. As loyal subscribers of our Sungarden Investment Publishing Substack, we want you to be able to take advantage of this legacy pricing.

Why we are introducing this service now

Post-pandemic markets are just different. This is particularly true of dividend investing. Yields have been falling in part due to a relatively strong stock market, but also from companies choosing to do other things with their cash flow, such as buying back stock.

Recent history has seen iconic dividend payers suspend or eliminate their dividends, rendering traditional routes such as "dividend aristocrats" or chasing the highest yields less useful. And thanks to 11 Fed rate hikes in 2022 and 2023, U.S. Treasury Bills offer yields investors have not seen in a generation. That creates competition for dividend-paying stocks and opportunities for proactive investors.

But the "same-old" dividend approaches need a new approach. I created the Yield At a Reasonable Price (YARP) dividend approach last decade because I think investors require a way to invest in yield stocks in a manner more in sync with what modern markets reward and punish. The approach we offer and teach to investors in this service is a timely alternative to the historic level of complacency we see from "the usual suspects" in income investing.

I have evolved my own process over the years to meet the markets where they are. The bottom line: Owning and renting my stock and ETF positions. And rotating their position sizes based on the indicators and grading systems I've developed over 30 years of professional investment experience.

Sungarden YARP Portfolio: Disrupting Dividend Investing

Our goal is simple: Disrupt dividend investing by providing a modern approach to solving an age-old investor issue. At the center of this time-tested portfolio management process is YARP: Yield At a Reasonable Price, a valuation approach designed to grade dividend-paying equities and ETFs. I created YARP several years ago when I was managing "other people's money," and it's now about to be awarded a registered trademark. That means the YARP methodology is only available to investors one way: Through this new service at Seeking Alpha.

But most traditional approaches expose portfolios to too much risk of major loss. Because even dividend stocks are still stocks. So when the stock market climate gets tough, most of those standard approaches fail.

It just doesn't have to be that way

The portfolio I manage is not just "real money," it's quite personal. It represents more than 80% of my own liquid assets. So as they say in the hedge fund business, we "eat our own cooking" at Sungarden!

3 Reasons The Sungarden YARP Portfolio is a viable alternative for income investors who prioritize risk management and total return

1. Portfolio, not just picks

Investors are overwhelmed with "stock picks" from an endless number of "experts." We offer something different: We educate our subscribers on how to construct a solid, total return, risk-managed portfolio. Because successful investing is like a team sport, where the players all work together for a common goal.

2. Tactical position rotation, not "reaching for yield"

A stock that yields 7% or more in today's stock market is signaling that it may have a much higher risk attached. So while we're constantly searching for "hidden gems," we generate higher income through a systematic approach to adjusting the amount of each stock we own over time. The goal is to capture more dividend income and avoid the biggest price declines. The portfolio we run targets a 7%-10% annual dividend yield, but it doesn't get there by just hoping our abnormally high yielding stocks don't implode.

3. We treat our portfolio like a business

Successful businesses have a clearly-stated mission, values, a documented approach, and repeatable processes. All with the goal of creating a sustainable enterprise that can grow, pay its people, and avoid major steps backward. We think an investment portfolio should run like that… so we run ours that way!

Who We Are

While I've had a solid four-decade run as a professional investor, I'm really just a middle-class kid from New Jersey. I grew up near New York City, and when I was 16 years old, my late father, a self-directed investor his entire life, taught me to chart stocks. No computers at first, just pencil and graph paper. I started working in New York City in 1986, and investing is the only industry I've ever worked in. Yes, I'm a "lifer."

Fast-forward from those humble beginnings, I've managed three mutual funds, written three investing books and more than 1,000 investing articles. I spent 27 years as a fiduciary investment advisor, the final 10 of those years running my own advisory firm. Along the way I was the Chief Investment Strategist of a then-$3 billion investment firm.

While my father is no longer with us, he did live long enough to see his son build a career in the industry he loved. That's why I'm so happy to be able to take my own investment experience beyond the limits of the limited number of high net worth investors I advised from the mid-1990s until we sold our firm in 2020.

This is a family business. My partner is also my wife of more than 30 years. Dana Isbitts has overseen the operational and administrative aspects of my investment work for more than 20 years.

What Do You Get?

Direct access to a process that has endured and evolved

Subscribers follow my lead as I navigate the complex, challenging yet highly opportunistic markets. We use a combination of quantitative, technical, and fundamental analysis to identify and rotate among a basket of stocks, ETFs, and options.

You get direct access to us. The Seeking Alpha community has come to know me as someone who doesn't sugarcoat his views and is humble enough to learn from what doesn't work as well as what does. We'll deliver that same level of commitment and responsiveness seen in the thousands of answers to reader comments during my first two years of writing on the Seeking Alpha platform.

Current portfolio holdings, allocation, and analytics

Subscribers get much more than a list of buys and sells. They learn how to analyze stocks, ETFs and options, but also how to truly treat a portfolio as a living, breathing entity.

Anyone can throw around "stock picks" and watch lists, but few subscription services take the critical extra step of operating within a true portfolio structure. That's one of the key reasons to consider the Sungarden YARP Portfolio. My current positions are updated each night to Seeking Alpha from my brokerage account nightly. So you never miss a beat.

Trade alerts, as they happen, with clear explanations

Whenever I make a move with my portfolio, subscribers hear about it within moments of when I make trades myself. This portfolio represents the majority of my liquid net worth. It's what Dana and I rely on to produce lifestyle income and grow our wealth, four years after selling my advisory practice and retiring (just kidding, I don't plan on ever retiring!). Those trade alerts include easy-to-understand details about what I bought or sold and why.

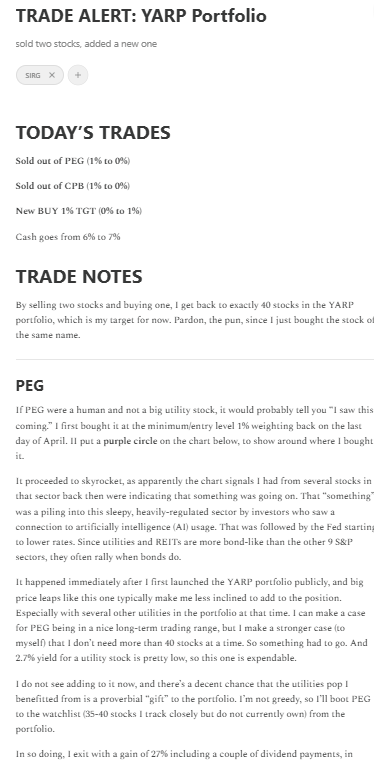

Here's a sample:

Live, interactive sessions to develop and maintain investment skills

I've been immersed in markets and portfolio management since the 1980s. Now I'm opening my playbook and inviting subscribers to follow along. That happens in our active chat room and through an innovative weekly program for subscribers called "office hours."

I'll be in the same Zoom room each week, simply fielding questions and discussing what I'm working on and thinking about for the portfolio. The goal at Sungarden: Get better every day, and never settle for what "the market" gives us.

The Sungarden Research Deck: A no-nonsense toolkit for modern dividend investors

Subscribers are a click away from my live research deck, which includes my proprietary scoring system I use to determine what I own, and just as importantly, how much I will own. I'm a fan of Seeking Alpha's Quant Factor Grades and use those among the "raw materials" incorporated into my own proprietary evaluation system for stocks and ETFs.

Our Approach

The Sungarden YARP Portfolio is a refreshing alternative to the "same old" approaches that thrive in good market conditions, but shrink when the going gets tough. Here's a high-level overview of how I structure my portfolio that subscribers access directly, move by move, in this service.

Chasing yield and holding stocks through vicious price declines is just not in my playbook

Sungarden YARP portfolio has a total return objective. Some years, dividend income will drive return, but my overarching No. 1 investing rule is this:

Avoid Big Losses - ABL

Like all of its peers on the Seeking Alpha platform, this is a non-discretionary research service. I show and explain what I'm doing and thinking in real time, so subscribers can determine for themselves how to best use our research.

Portfolios should sync with what modern markets reward, or else they're "sitting ducks." All investors are vulnerable to emotional reactions when things go wrong. I'm a very optimistic investor, but more importantly, I'm an opportunistic investor.

Sungarden YARP Portfolio is a highly organized and methodical investment process. For every stock, every quarter, there are at least five things that will happen, as shown below.

Is Sungarden YARP Portfolio Right for You?

That depends on how you answer two questions:

Is a total return, dividend-focused, risk-managed portfolio approach how you want to invest?

Is our Yield At a Reasonable Price (YARP) investment process attractive compared to traditional ways dividend investors operate?

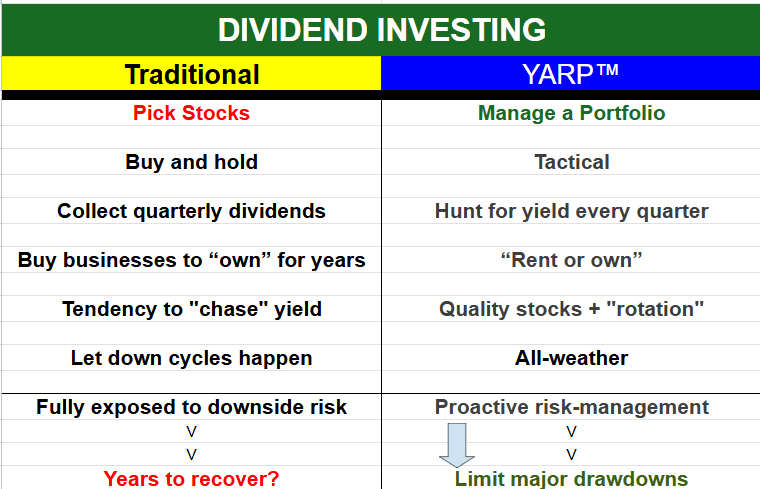

This chart summarizes our YARP process vs. standard dividend investing approaches.

Our approach is not for everyone. But it could be for you. We look forward to building a one-of-a-kind investing group at Seeking Alpha by filling gaps that exist in "mainstream" approaches to dividend income and total return. We hope you'll consider joining us.

How to Get Started- Special Introductory Offer

Annual Subscriptions for Charter Members - Introductory Price that doesn't go up

The first 35 subscribers will receive an annual subscription at 35% off the full price. You'll pay $975 for a full 12-month subscription to Sungarden YARP Portfolio. That's less than $85 a month. And as long as you keep your subscription running, that will be your permanent price. You will not be subject to future price increases.

Free Trials: Why we don't offer them

When I was an investment advisor, our average client had a $2 million portfolio and paid us 1%, or $20,000 a year. Sungarden YARP Portfolio does not offer personalized advice, but the investment component of what I did for decades is now available at a fraction of that price. While there's not a free trial to this service, Seeking Alpha offers a money-back guarantee if a subscriber cancels within the first 30 days.

Questions or comments?

We understand that you may have questions about the Sungarden YARP Portfolio. Just contact us through the Sungarden Investment Publishing profile page on Seeking Alpha.

Or, since the Seeking Alpha community is all about interaction among investors, if you have a comment about the launch of this new investing group, we invite you to share it. We'll respond quickly, even on weekends. After all of those years running a client-centered business, that's par for the course with us.

We look forward to your interest, thoughts, and inquiries about the Sungarden YARP Portfolio!