"Simple" 2-ETF Portfolio: all DIY investors need?

For DIY investors, just 2 ETFs and an effective allocation system covers a lot of ground. Here's some of the mounting evidence.

I’ve spent more than 30 years as a professional investor. By my count, I’ve devoted more than 130,000 hours to evolving my craft. First as a product manager for portfolio managers, then as a CIO, fiduciary advisor and fund manager. And now, as a semi-retired writer and researcher.

Where has all of that sweat equity led me? To a conclusion that I never would have imagined 30 years ago, much less 5 years ago. For many investors, their core portfolio can consist of as few as 2 ETFs. In this post, I’ll discuss a few of the key, secular reasons I think this way. But perhaps the most striking visual to make my point is this one.

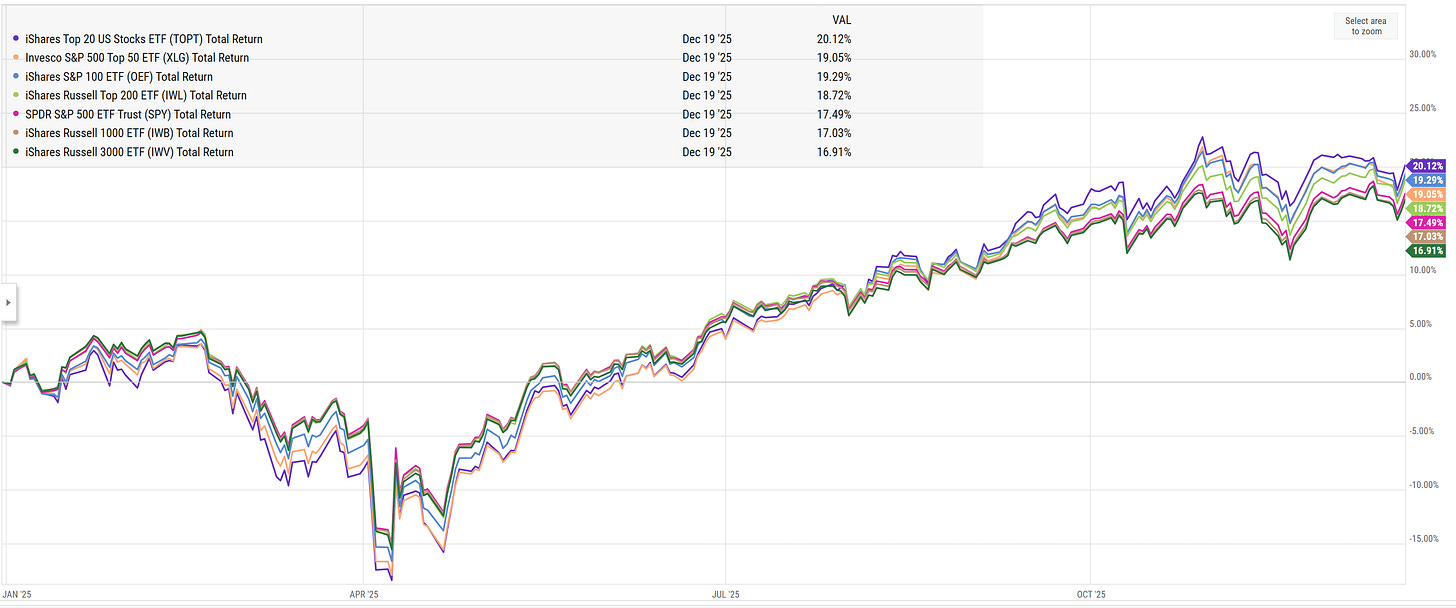

The chart above shows a set of 7 measures of the US stock market, and how they performed during 2025 (through 12/19). You can see that they are all in tight range, with just a few percentage points separating the 7 ETFs.

Those 7 ETFs are all weighted by “market capitalization” a.k.a. company size. But each has a different number of stocks in it. 20, 50, 100, 200, 500 (the S&P 500, where most of the index money goes), 1,000 and 3,000.

What’s the point? DIVERSIFICATION DOESN’T MATTER LIKE IT USED TO.

And each year, that becomes more apparent. If you pride yourself on stock-picking, good for you, have at it, and best of luck. But for most people who see investing as a means to an end, and do not have (or want to devote) the time to learn “everything” about investing for themselves, I think the 2-ETF approach will cover a lot of ground for them.

My response: create a 2-ETF portfolio, and mixing method

Using my own money (which is always part of the process here - I’m the guinea pig), I began the year 2022 by starting to write on the Substack platform, maintaining a portfolio that had nothing but the tickers SPY and BIL in it. SPY tracks the S&P 500 index, and BIL tracks 1-3 year US Treasury Bills. “Stocks and cash.”

Importantly, this was NOT a static mix. That’s one of the issues I have had with “asset allocation” strategies since last century. The classic “60/40” style portfolio has been very popular over the years. That’s where the manager invests 60% in stocks and 40% in bonds, and “rebalances” that mix back to those weights every 3 months.

But as I’ve written about for more than a decade, in many publications, that traditional stock-bond-static asset allocation became a dinosaur years ago. It’s too bad more investors didn’t figure that out sooner. Because in 2022, the year I started tracking this simple yet effective 2-ETF portfolio, T-bill rates rose sharply. And they’ve stayed up.

You know what also happened? Bond yields surged higher. What happens when bond yields do that? Bond prices crash. And so they did. But not T-bills. And while bonds will have their era again (it might be starting now), and T-bill rates will likely become less-desirable in the future, the specific ETFs I use in a 2-ETF portfolio are not limited to SPY and BIL. In fact, they can literally be any 2 ETFs.

Because for some investors, all they need is:

A way to play “OFFENSE” - something related to the stock market, most likely.

A way to play “DEFENSE” - something that can do well when stocks don’t.

A disciplined method of TACTICALLY allocating AMONG those 2 ETFs.

Importantly, this is NOT a choice between 1 ETF and another ETF. I own both of them, all the time. I just shift the mix. As frequently and/or seldomly as indicated by the allocation system I use. In my case, it is the ROAR Score (Return Opportunity And Risk) which is described elsewhere on the ETF Yourself Substack site, and in my articles at Barchart.com and Seeking Alpha. In fact, if you simply ask an AI system to “tell me about ROAR Score Isbitts,” you will get a very fine explanation of what I built there.

ROAR is what I use, and DIY investors can follow my lead on that if they wish. But since the Y in DIY stands for “yourself,” they are free to use whatever mix-maker they wish.

In addition, while a portfolio of only 2 ETFs, 1 each for offense and defense, is a core strategy I use for myself, that doesn’t mean it is the only 2-ETF mix I have. That’s where it is really “to each their own.” But the CONCEPT of the 2-ETF portfolio is the key takeaway here.

The biggest reason that ”simple” 2-ETF portfolios work is due to how markets now operate. It is very different than in decades past.

Algorithmic trading creates whipsaw moves up/down, the same day and over time

Indexed investing has become the dominant approach for stock investors

Individual investors are participating like never before

This has a lot of benefits for many parties. However, it also creates an environment where so many classic “edges” have been neutered, the main one we have left has nothing to do with stock-picking, market timing or leveraged high-risk gambling.

Biggest remaining edge for DIY types? Risk Management!

That does not mean cowering in a corner, waiting for the market to regain some sense of rationality, balance and reasonable valuation. Many debate whether we are in a “bubble” or not. Me? I just want to take what the market gives us, and “engineer” the best outcomes I possibly can, as often as I can.

One way to lose big is to assume that we can consistently find “great stocks” for the long run, or “great trades” for the short run. I’ve spend those 130,000 hours over 30+ years trying to do that. And I still do every day. But it is NOT the core of my approach. It is the garnish. “Take big shots with small amounts of money,” I like to say.

But for the core of the portfolio, the part that will truly determine how I live when I’m working less and need to rely on my accumulated savings? Sign me up for simpler!

Simple does not mean the approach is “dumbed down.” There’s some self-reflection in choosing pairs of ETFs, then rotating intelligently among them.

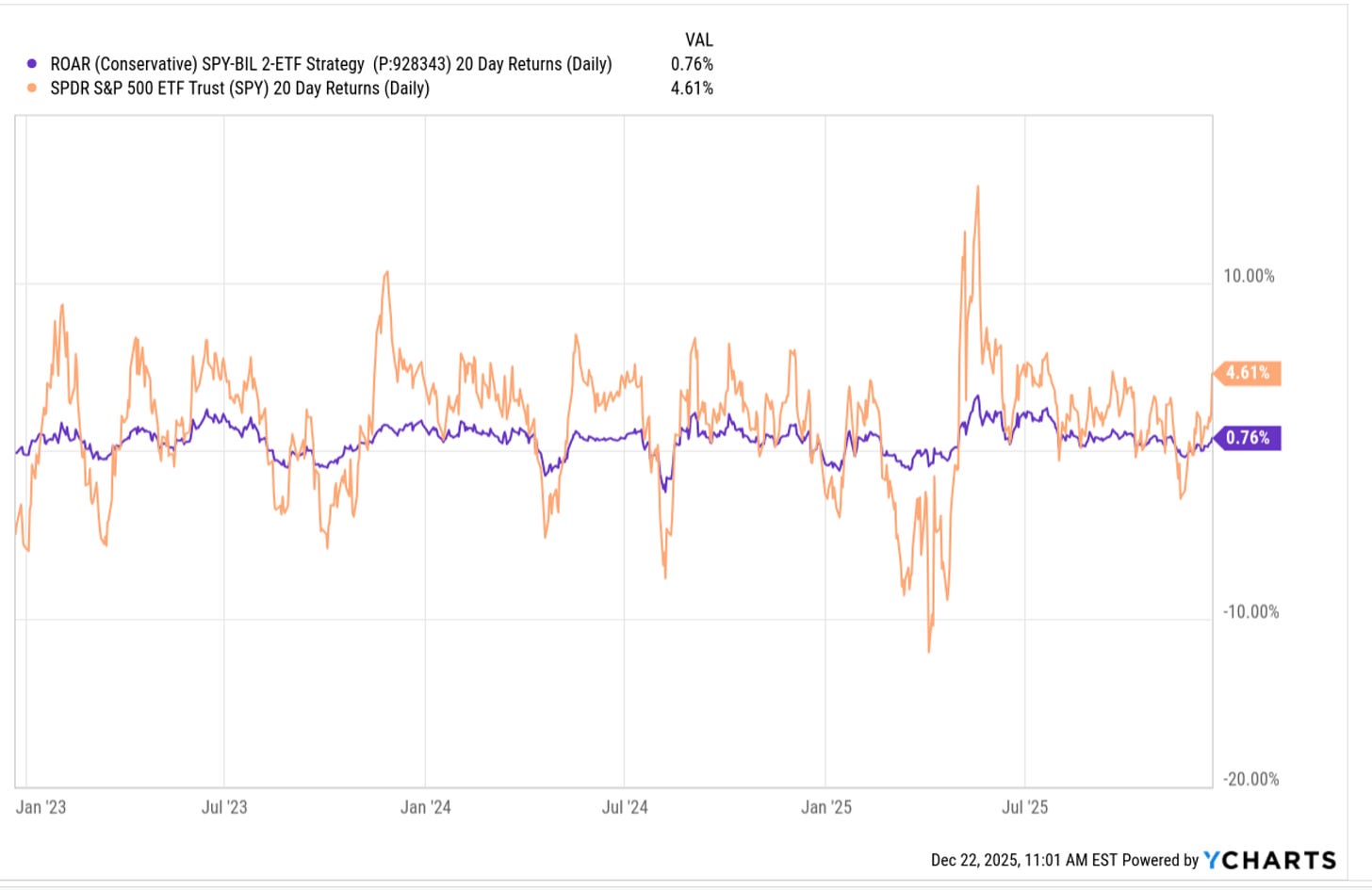

Some investors are about how much they can make. I’m about how much I can make…WITHOUT LOSING BIG. That chart above shows the dramatic difference between 20-day returns of the SPY ETF (orange) and the Conservative mix of SPY and BIL I have run since 2022 (purple). The range of returns for each on that 20-day basis:

SPY alone: +15% to -12%

SPY/BIL mix, tactically allocated: +3.3% to -2.5%

Now, this is not an apples-to-apples comparison, since the goal of my mix is to keep volatility low. It won’t compete with SPY in up markets. It also won’t cause me to break out in a cold sweat when SPY drops 20% in a month, as it tends to do. In recent years, those dips were bought.

If you are concerned that one day, they won’t be, then you care about risk management. It is not a requirement for investors. Unless they want to get a lot of out my work, that is!

I’ve also communicated the 2-ETF portfolio concept through a more Moderate portfolio mix. Same 2 ETFs, SPY and BIL. And same ROAR Score system to determine the allocation between them at any point in time (I updated it weekly for subscribers).

However, the Moderate portfolio mandates that at least 50% must always be in SPY, as opposed to the Conservative portfolio that can go to 0% in SPY and 100% in BIL (it has done so briefly, on occasion). When we add that simple additional constraint, here’s how its volatility compares to SPY alone.

The updated best/worst 20 day periods:

SPY alone: +15% to -12% (unchanged from above, of course)

SPY/BIL mix, tactically allocated: +7.8% to -6.5%

This article is about the 2-ETF concept, and providing some historical insight into it from a RISK MANAGEMENT perspective. We have a full performance recap available as well. And in my opinion, it provides the “proof of concept” that convinces me that 2-ETF mixes should be a central part of my own portfolio going forward. This 4-year test covered the worst year for stocks and bonds combined (2022) since the 1970s, some “normal” periods (2023) and a budding AI bubble (2024-2025), with an embedded flash-crash (February-April 2025) too.

To me, that’s a good reflection of how markets operate today. And it has focused a lot of my research time on enhancing the 2-ETF menu here, as well as our efforts to spread the word about this simple, yet effective approach to investing.

As I see it, modern markets demand simplicity, but not ignorance or arrogance. There’s plenty of both surrounding us in the investing world. So to help crowd out all of the noise, hype and greed, I’m dedicating a lot of our work at ETF Yourself to what I’ve done for more than 30 years professionally: develop, implement and teach investors how to use the realities of modern markets to their advantage. With humility and as much simplicity as I can.