Understanding the ROAR Score: A Guide for DIY Investors

ROAR stands for Reward Opportunity And Risk. Developed by Rob Isbitts, the founder of Sungarden Investment Publishing, this proprietary scoring method was created to dismantle traditional “asset allocation” myths. Instead of relying on stagnant, long-term buy-and-hold models, ROAR is designed to be a flexible, adaptive tool that syncs with the reality of modern, volatile markets.

The Core Philosophy and Purpose

The primary goal of ROAR is to provide DIY investors with a clear assessment of the current risk environment. Unlike traditional “buy/sell/hold” ratings—which can be binary and often fail over time—ROAR evaluates whether market conditions are high-risk, low-risk, or somewhere in between. By shifting the focus from “what” to own to “how much“ of it to own, ROAR empowers investors to make less emotional, more confident decisions throughout different market cycles.

How the ROAR Score Works

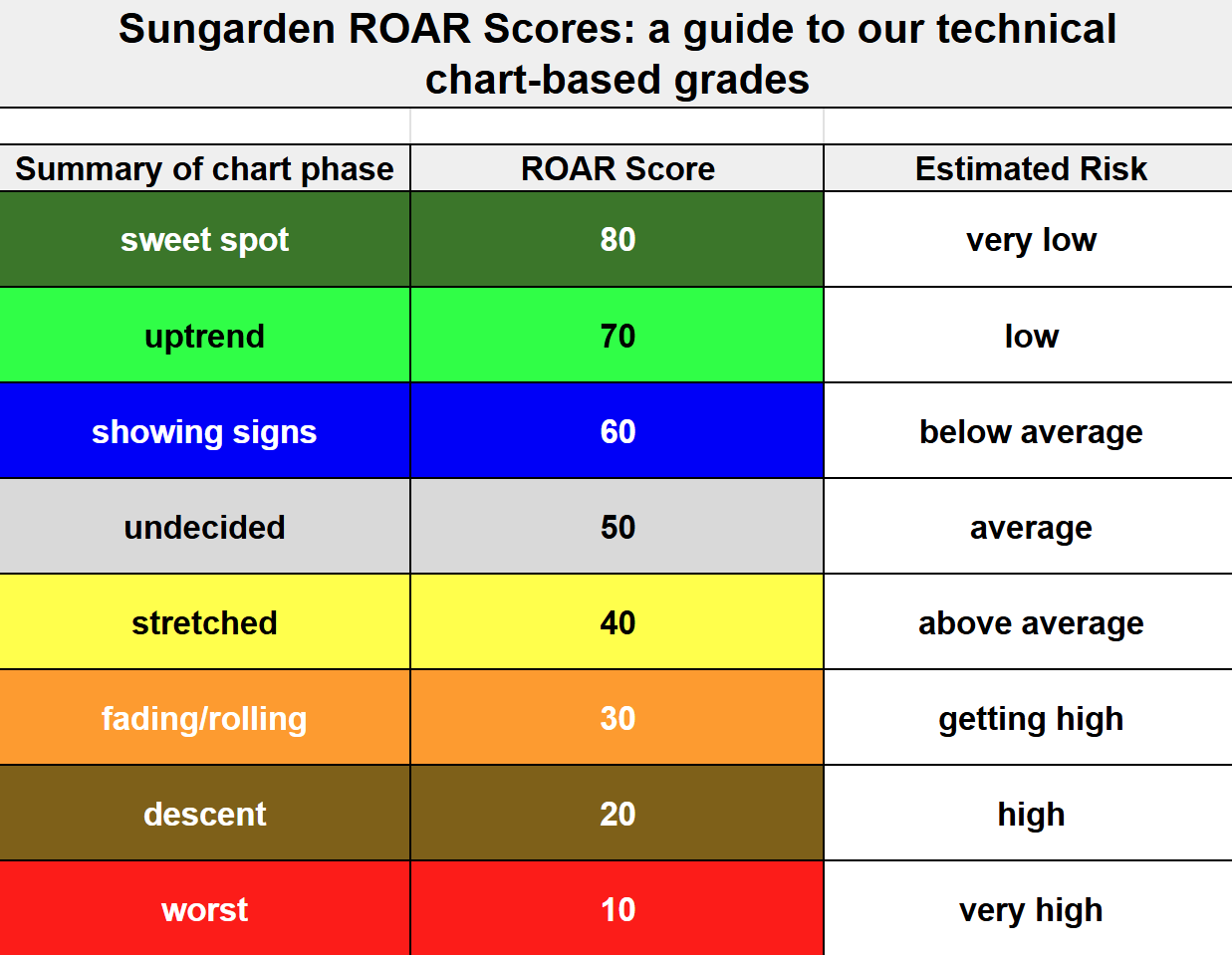

The ROAR Score is represented by a number from 0 to 100. This number fluctuates based on a technical and chart-based assessment of a security or index:

Scores closer to 100: Indicate that a security has a higher potential return relative to the risk being taken at that moment.

Scores closer to 0: Suggest that while return potential may still exist, the risk required to chase those gains has become disproportionately high.

Essentially, a ROAR Score of 30 implies that a security has a 30% chance of rising 10% before it falls 10%. It is a relative analytic tool rather than a crystal ball, helping investors determine position sizing rather than just “all-in” or “all-out” entry points.

In practice, ROAR Scores should almost never be at 100 or 0. That would imply that a security has virtually no chance of falling hard (if 100), or no chance of rising strongly (if 0). That’s not realistic in investing. So scores tend to fall between 80 and 10, to acknowledge that anything can happen, even if the chance is very slim. Zero and “non-zero” are two different things.

History and Real-World Application

While the underlying concepts for ROAR were developed in the 1990s, the formalized SPY ROAR Score was launched at the end of 2021. Since 2022, Isbitts has used his own capital to manage a “defense-first” portfolio consisting of just two ETFs: SPY (S&P 500) and BIL (1-3 Month T-Bills). The success of this simple model led to the expansion of ROAR “grades” for a wide range of individual stocks and specialized ETFs.

For more on ROAR

Rob writes about topics related to his proprietary ROAR Score in his column at Barchart.com. CLICK HERE to be directed to the ROAR primer he published there in April, 2025.