The 3's Report

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

Sungarden Founder Rob Isbitts to speak at Money Show Orlando next month

I am part the Money Show’s educational provider group (i.e. not paid for as a sponsor), and after a few online sessions earlier this year, my first live session will be at the huge Money Show Trader’s Expo in Orlando next month. My focus: DIVIDEND INVESTING. Our subscribers know well that my views on dividend investing in modern markets are quite a departure from the “same old” and I’m grateful to the Money Show crew for inviting me to be part of this long-running event.

Registration for the 3-day conference is HERE and if you will be there, let us know. Dana and I will be there most of the day Friday and all day Saturday, the day I speak. We’ve love to meet any folks from the Sungarden community there and say hi!

Now, on to the 3’s Report for this week

(note: we converted it to blog text style to fit Substack’s format. The 3’s Report will be updated each Tuesday in the “grid” format we created in both the SIRG research deck and ETF Yourself research deck subscribers have 24/7 access to.

ROAR Score weekly update

Remains at 30 for the eighth straight week (last changed on 7/30, when S&P 500 was at 5436)

The benefit of holding a high “cash” position (via ETF ticker symbol BIL) in the ROAR Score’s 2-ETF model is fading, as 3-month T-bills have dipped from 5.5% to 5.0% since six months ago.

Still, the SPY, the only other option in this super-simple portfolio mix, is threatening to post a “triple top,” which puts a ceiling on my willingness to lift ROAR. At least not yet.

3 Quick Thoughts on markets

Since I just stole my own thunder by mentioning the triple top potential in SPY above (nice going, Rob…), I’ll also mention that the DIA/QQQ wrestling match is again getting interesting. DIA hit a new intraday high Monday, while QQQ is 5% off its July high water mark.

US Treasury bond prices are sure acting like they think rates are going to not just tip lower, but speed lower. The Fed will likely confirm or halt that progress at Wednesday’s meeting.

I continue to believe there are micro-segments of the US equity market that look higher, even if the broader index mix can’t make up its mind

3 great takes from others

From Leutholdgroup.com (one of my all-time favorite quant research firms): The big escalation in unemployed also challenges the common belief that the upturn in the unemployment rate (to 4.2% in August from a cycle low of 3.4% for the first half of 2023) has been driven mostly by the surge of immigrants entering the work force. Still, we must add this development to the long list of recession warnings that have so far been rebuffed by the economy and stock market, alike.

From Damir Tokic, Editor-in-Chief, Journal of Corporate Accounting and Finance, and one of my peers at Seeking Alpha: The S&P 500 is facing a recessionary bear market with the Gen AI bubble burst. However, at this point, the recession is still delayed, and the Gen AI bubble burst is still in the early stages. Thus, the S&P 500 remains resilient, as each selloff is met with dip buyers.

From Liz Young Thomas, SoFi’s excellent market strategist: Click Here

3 big-picture issues to follow

Japanese Yen is rallying again. This is a red flag for all markets, given what we saw in early August. I don’t have the ETF on the watchlist, but you can watch it via ticker FXY.

Everything seems to have come to a sudden standstill this week, waiting for the Fed announcement on Wednesday. And that means that for the week after they drop rates (by .25% or .50%), the media will try to trace everything that happens back to that “event.” But like the Covid crash in early 2020, the market was already on its way somewhere, and Covid just lit the match.

Year to date, 3 of the 30 Dow stocks are down at least 25%. And 3 others are up more than 30%. The Dow continues to be the most interesting and useful major market index to me. That’s one reason why.

3 ETF charts I’m watching

Considering how awful some commodities have been, timber stocks are moving nicely.

REITs have rallied, but Mortgage REITs are just starting to show signs. Hmmm…

Am I the only one who sees the utilities sector chart and can’t help but think of the movie My Cousin Vinny? (“…these 2 utes…”). If you look at the new ETF research deck (or the sample version we provide for non-subscribers to review), this is what a technical grade of WHITE looks like. It isn’t neutral, it isn’t imminently dangerous, and it isn’t undervalued. It is just “extended” in price.

3 stock charts I’m watching

Haven’t looked at this one in a while. And NO, it is not a YARP dividend portfolio candidate :-) but it is on a path to something volatile. That’s what that narrowing “sideways triangle” at the top tells me.

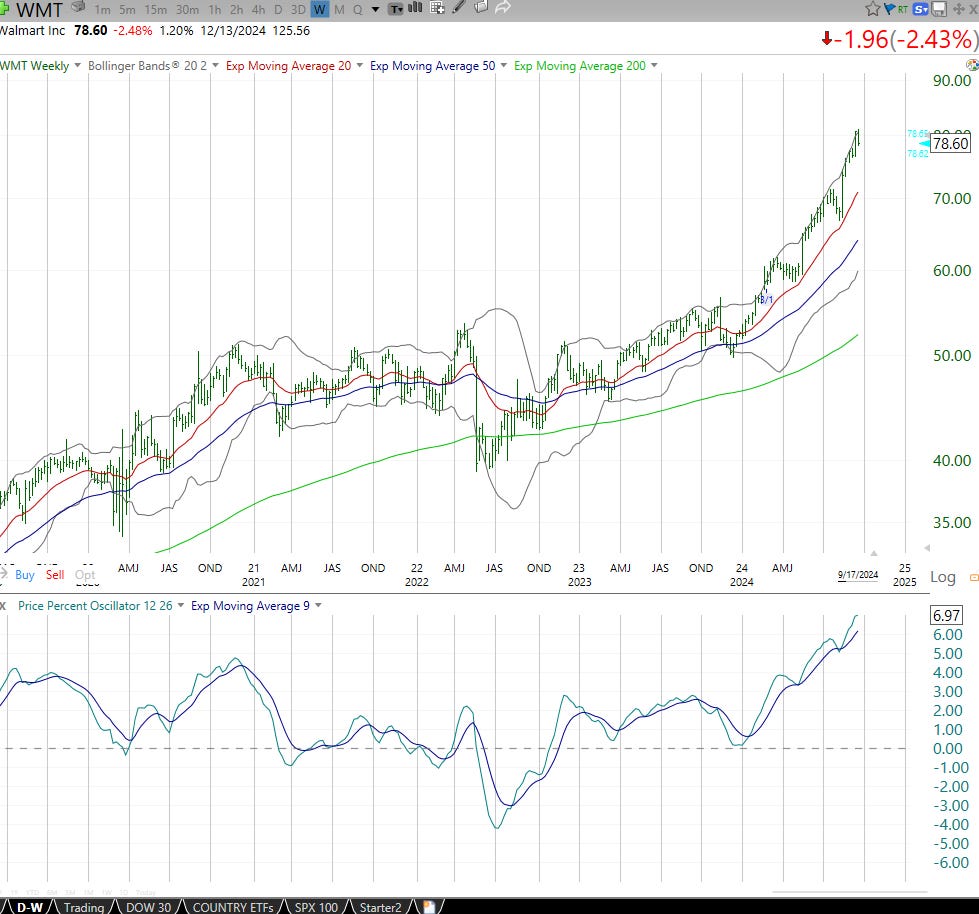

Best Dow 30 performer this year, up 50%. No, the symbol for Nvidia is not WMT! This is Walmart. This is what a technical grade of WHITE looks like applied to a single stock.

And in the interest of fairness (always, at Sungarden), here is one of the worst Dow stocks this year, off a mere 40%. To quote the late, great Matthew Perry (Chandler Bing from “Friends”), could this chart BE any worse? Yes, it always can. This is what a RED technical grade looks like. Oh sure it could bounce, but until it flies (pun intended) through that upper trend line AND the recent high, there’s a lot of “repair” (again, pun intended) needed here. Just a rough time for an iconic blue chip stock.

Coming soon

YARP research deck updates

Video tutorial on the both new research decks

A 2nd version of the ROAR Score (different from existing one)…the big reveal soon

Thank you for saying so! Over the past year, we had a couple of subscribers leave because they felt we were changing things too often. We don't begrudge anyone for feeling that way. But in the investment world, I guess Dana and I have always felt that, in portfolio management or in the toolset we offer on our research sites, better to continue questioning and trying to get better every day. Stagnation in this business tends to end up poorly. Thanks again!

I like this format A LOT!!!!!!!!!!!!!! Keep up the good work, and the tweaking of your product I appreciate that you continue to seek to improve your offerings to your subscribers Rob.