ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 40 for the sixth consecutive week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would now be 40% SPY and 60% BIL.

But hey, simplicity is working quite well in this post-pandemic market. See below. And you'll see why my running theme these days is "are we all just making this too complicated?"

3 Quick Thoughts on markets

As this week's title implies, the stock market is largely a waiting game for the moment: turmoil in the Middle East that seems to be different this time, lack of earnings catalysts, a Fed on hold (unless they surprise us tomorrow), and all of that stuff I pay less attention to than most market pros.

I'm all about price, and what it tells us about how much risk I am taking at any point in time, for the reward I seek. Any asset can go up in price at any time, for any reason. But the difference between one stock or ETF and another is how much risk of major loss I'm taking in pursuit of those profits. I think this is THE most overlooked aspect of investing. Yes, we are all trying to make this too complicated!

Here's the most basic "how much risk am I willing to take" indicator I have ever built: the ROAR Score that we report here each week. It is my view based on a combination of technical, quantitative, fundamental, and sentiment inputs, and ultimately relying on decades of experience tracking market movements. It all boils down to a single number each week. And while this is its simplest form (a portfolio mix with only 2 choices, SPY and BIL, to allocate between), our Sungarden Investors Club members know that this same basic "tactical" approach to modern markets can be as simple as this, or as detailed as stock and ETF trades, option collars, etc.

3 ETF (or index) charts I’m watching

Sticking with the theme here, that the average S&P 500 stock (RSP) is only up 16.2% from the start of 2022 through yesterday's close is something I think is largely lost on the investing public. That's about 0.4% return, including dividends, from the S&P 500 for nearly 40 months, folks. Very T-bill-like. But with much more risk. Sure, the more popular capitalization-weighted S&P 500 is up by double that of RSP over this time. So about 8%. A nice return, but driven in large part by a small number of stocks that I suspect many do not understand the risks of. And, an 8% annualized return over 3 1/2 years is historically average, not the stuff that manias like the current one are typically made of.

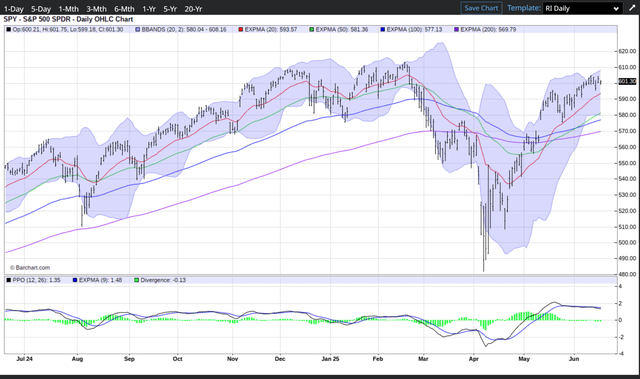

Here's SPY over the past year. It is at a proverbial fork in the road. As I like to say at times like this, "no fast moves, Rob."

SPY has risen by $56 a share. $33 of that came from just 9 stocks. You probably know who they are! Their first letters spell "JAPAN," plus NPRT. I'm not great at Scrabble, so I'm out of luck making some nickname out of that. But I do know the J and P are worth more than the others (in Scrabble).

And hey, speaking of Japan, here's the ETF for it (EWJ). It looks to be rolling over after a strong up move. Much of the non-US equity market looks like this. And that makes long term investing there tough, if we're looking for a good entry point. This could fall 10-20% without missing a beat.

3 stock charts I’m watching

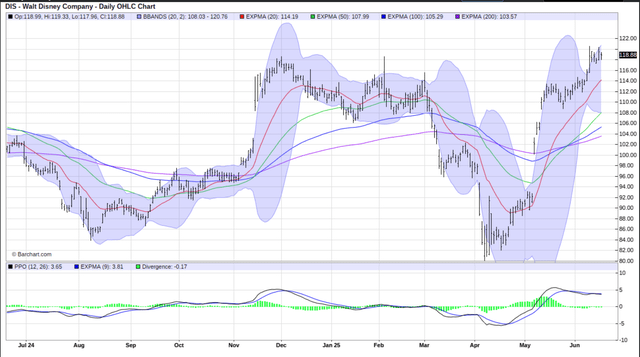

Disney (DIS) has had a "magical" run lately. I'm way up on it, and have it collared. And this is why. Because like so many stocks, it is in the midst of its longest "stall" point in a while (bottom of chart, flat line across). Many stocks have stopped trending at all. And so until the signal is stronger, one way or the other, it is just guessing and gambling. I'm not prone to either.

I regularly maintain a list of stock that are "losers" over an extended time period, seeing if any of them represent long-term "contrarian" buys. I started building a portfolio as part of Sungarden Investors Club, but of the 25 names I seek to fill the list, I'm only about 1/3 in. Here are 2 that are not yet in, but I'm checking them out.

Encouraging chart here. Will see if the other boxes are worthy of a check.

This one needs a catalyst. Very politically-tied right now. So the chart only tells me part of the story. Intriguing, though.

Final thoughts for now

I am all about risk management. Because if I do that right, and stay humble throughout the process, the gains will come. But today's stock market barely resembles the one I grew up with in the 1980s, 1990s and even the first 20 years of this century. The question for all investors is this: are they going to count on what just worked in the S&P 500 and Nasdaq indexes continuing to work for a long time in the future?

I don't dismiss those stocks, I even own some of them. But it is HOW I strategize around owning them that I hope investors get out of our work at Sungarden. Whether it is the simplest way (ROAR, SPY-BIL) or the more involved approaches (option collars around stocks and ETFs I want to own long-term without taking a big loss along the way), there's a lot to learn. And a lot of hype out there to avoid.