The 3s Report

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 20 for the 7th straight week, following a 10-week run at the 30 level.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be % SPY and % BIL.

Based on some comments from our audience, it occurs to us that we should consider expanding this part of Sungarden. Specifically, more versions of this simple offense-defense approach, using 2-ETFs in tandem, but with the allocations varying based on my technical signals and desired reward vs. risk position as markets change.

If you would like to see more, let us know and suggest any combinations you think we should consider tracking. As with anything like this, I'll be putting some of my own money into an account to stand by what I write and speak about.

3 Quick Thoughts on markets

Little known fact: last Friday, the S&P 500 closed at 5,870. Where did it open at 9:30 AM ET on 11/6, the morning after the US election? 5,865. So much for the bounce.

Still, there's no breakdown, just a lot of stocks that look like they will break down over the next few months. This, while Bitcoin flies and the 10-year US Treasury bond rate hits 4.45%, up from 3.64% when the Fed LOWERED overnight rates on 9/18. Need more proof that the bond market, not the Fed, controls the bond market?

This is the time of year when market pundits start talking about things like mutual fund capital gains distributions and other tax-motivated reasons for markets to move one way or the other. Keep this in mind: they are usually just "talking their book" and spinning the views that help their asset levels stay up. Same reason that after every market crunch, if we go back and see the projections of Wall Street strategists, they all had the S&P 500 rising 8%-10%, regardless of the situation. Just saying!

3 ETF (or index) charts I’m watching

I may be the "teacher" here...in fact, we started our regular weekly "office hours" this week, where I show up in a Zoom room and you fire questions at me. But let's be clear: I learn something new every day in this business.

The most important think I've learned recently is what the market appears to be telling us in this chart below. See those 3 circles? Those are false breakdowns for the QQQ. They caused temporary concern, such as in early August (Yen Carry Trade episode) but the Qs snapped right back. This is a great indication that the power of positive sentiment has not broken, and that even when it does, we'll need to see it through before concluding a true sea change has occurred here. Markets work differently now!

Ex-Qs-Me?

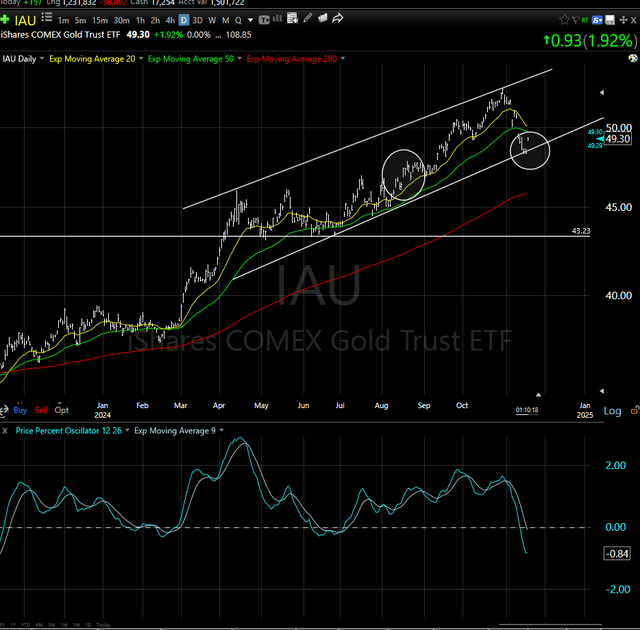

Gold digging near-term bottom?

Oil showdown ahead in 2025?

3 stock charts I’m watching

Winning by not losing...part 836

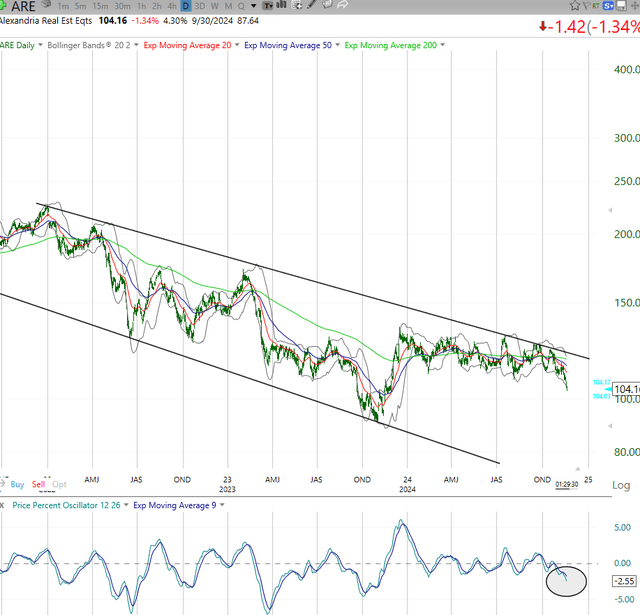

ARE you trying to tell me something?

Why isn't "SELL" in their vocabulary?

Final thoughts for now

I wake up every day looking for ways to make money. But that's not the same thing as figuring out what to buy! T-bills have been a great friend, and inverse ETFs and options have helped many investors manage risk while trying to make big returns.

But like a quarterback in the NFL, sometimes you move the ball down the field with short passes and running plays. This seems like one of those times.

Hi Rob

Question…

Is core being phased out?

I recall a earlier post on it but not able to locate

Thanks

JY