The 3s Report: Bull Durham Market

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 10 for the fifth straight week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 10% SPY and 90% BIL

We continue to be in a period in which the broad stock market indexes are chaotic and as trendless as I've ever seen (in 39 years of doing this). As such, I remain on guard to adjust the ROAR Score any day, not only on Tuesdays as we usually do.

3 Quick Thoughts on markets

I was truly honored when out of thousands of analysts on their crowdfunded investment research platform, Seeking Alpha asked me to write this article, relating perspective on research, analysis and discipline during volatile markets. And my friends, we have one now.

In that article, I referenced one of my favorite movies, "Bull Durham" and a particular line that sums up what any self-respecting investment pro should be thinking now: "I don't know where it's gonna go."

There are more than the usual market influences at play now, but as I'll explain through the charts below, things have fallen back into some old habits. Read on!

3 ETF (or index) charts I’m watching

Good shot at a further bounce here, but as I view this, the next big move is still more likely south than north for the most-loved stocks, i.e. the Magnificent Seven (MAGS). This is not "buy the dip" to me as much as it is "high reward but also high risk." That's why I "collar" nearly all of my stock positions these days. I've written about that a lot, but use the chat or email me if you have questions on that.

Since November of 2021 (yes, 40 months ago), the Midcap 400 index (MDY) is up...wait for it...3%. That's a weak annualized return compared to SPY and QQQ...and even worse when we consider that 3% is NOT ANNUALIZED! Bull market? Depends who you ask. 40 months, 3%, less than 0.1% per month. Don't retire on that. Dividends add another 1% or so per annum.

I, too, am excited for the potential return to relevance of non-US stocks. But this chart of EAFE (EFA) indicates that the initial flurry higher since early January may have run its course for a while. Stalling out potential here.

3 stock charts I’m watching

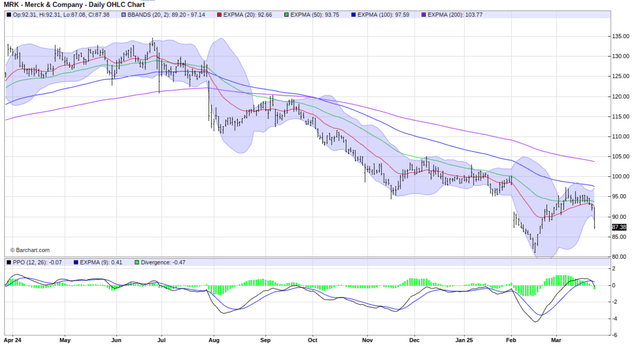

Merck (MRK) stock just can't get out of its own way.

For those who recall there is another automobile stock besides Tesla (TSLA), General Motors (GM) is starting to look as good as those young, exciting Detroit Tigers of the American League.

Mr. Toad's Wild Ride...I mean Boeing (BA) is back in no-man's land. Take your pick: is the stock up 20% in a few weeks, or 30% off its early 2024 high? That's the type of thing I see all over this market, which gives me pause.

Final thoughts for now

The issue for stock investors now is not what to buy, but how much risk are you willing to take when you buy, well, anything? That's the environment we are in. A little slice of the market looks good, but most of those are extremely overvalued fundamentally. The ones that look like good contrarian candidates (one of my favorite types to consider) are way down in price, but are prone to "false starts" or worse yet, total failures, when buying interest finally reappears.

This is without a doubt the most toxic investment climate I've ever seen. But I love a challenge! Because when your main objective is growing and preserving capital regardless of what direction the stock market travels, this is where "headline readers" get frustrated, and miss the opportunities that constantly present themselves.

Finally, this market rewards those who think not only about WHAT they want to own, and WHEN they want to own it, but also HOW they want to own it. That's what we do here: Sungarden YARP Portfolio.