The 3s Report: Chip In NVDA's Armor, Now What?

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 30 for the second straight week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 30% SPY and 70% BIL.

This is a good time to remind subscribers that changes to the ROAR Score typically occur on Tuesdays, but I reserve the right to adjust it on any trading day. So if Monday's AI stock fiasco has some "legs" that 30 ROAR Score might not make it until next Tuesday. We'll see what happens.

3 Quick Thoughts on markets

It was one day, but it just goes to show that risk happens fast. And, that the Dow 30 is often a nice complement to the Nasdaq 100. The Dow was up 290 points Monday.

These types of "impulse" reactions, where traders dump tech stocks and buy sheepish sectors like healthcare and consumer staples instead, don't tell us as much as a wholesale dumping of equities does. So we'll see soon if there's more to this story.

What it does do is remind us of many of the key tenets at Sungarden: manage risk first, then try to make as much as you can. Use options if/when needed to support the portfolio, and be prepared for the market to have a very narrow focus for extended periods. That makes stock picking far less relevant.

3 ETF (or index) charts I’m watching

I own this one in my all-ETF Core portfolio. Except that I also own S&P 500 put options in that same portfolio. And DIA, which tracks the Dow Industrials. And a transports ETF. In fact, ARTY was the only down position I had in Core today, and the YARP Portfolio lost all of 0.15%. It is one day, but this what I mean when I say risk management cannot start once the market gets wild. By then, some of the best hedging tools and ways to profit from downturns are off the table.

That's a fine looking chart there, and healthcare stocks are way overdue. But this is a "whipsaw" market climate, so shorter-term charts are to be trusted a bit less than usual.

I don't provide "trade ideas" through this brief weekly publication. That's what the Sungarden YARP Portfolio service is for. But I always like to help investors frame up what I think might be possible. Because I've seen it before, many times. These patterns repeat, over and over.

In this case, here's what I see: IEI tracks the 3-7 year part of the U.S. Treasury curve. So think of it as akin to a 5 year bond. Those don't move much in price...usually. But after the recent sell-off, there's at least a hint that IEI could return to 120 from 116. Big deal, that's only about 3.5%, right? But there's also a yield, which adds nearly 1% per quarter to any price return on IEI. Back during the 2020 Covid crash, the idea of making, say, 3-4% total return over a few months as stocks were falling by 20-50% or more is appealing to me.

3 stock charts I’m watching

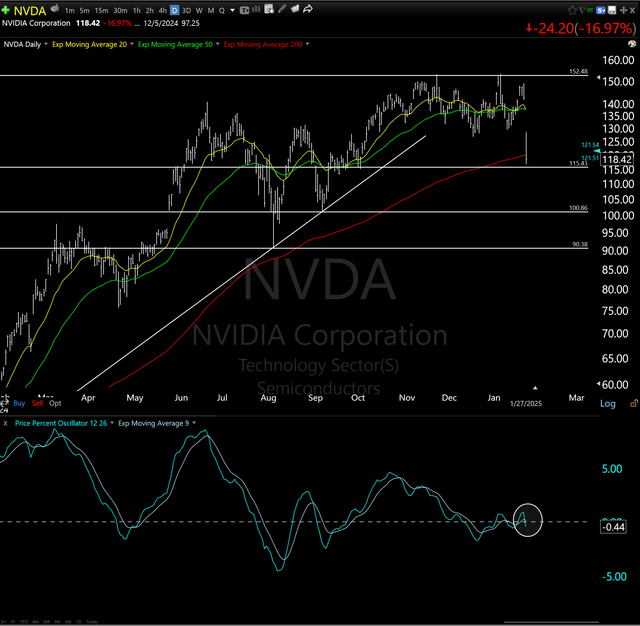

Hmm...where should we start today...let me think...ah, how about this one? NVDA just gave back its entire gain for the the last 8 months in a heartbeat. This is just another layer on top of what I think will be THE story a year from now: that individual stock selection, while still very helpful, has to be WAY more selective. No more "list of buys" that have 50 names in a screen. Too many of them now take their cue from this one stock.

If it bounces and acts like Monday never happened, I can't imagine many will be surprised. But if it doesn't, I drew 3 target lines below. The stock closed Monday at $118, and the lines are at $115, $100, and $90. The latter would be a 40% drop from the recent highs. Has that ever happened to NVDA? Yes, 3 times during the past 10 years.

Coca-Cola (KO) is one of the stocks I am proud to own, but cautious enough to have put an option collar around it. After a nearly 20% dip and trading only slightly above its level during the Covid outbreak 5 years ago, this was a good "Dog Collar" candidate for me.

Here's a good example (PG) of a stock that would have been a nice Dog Collar candidate several years ago in 2018, and again in late 2022. I whiffed on owning this one, and while it is hanging in nicely, and the market is coming around to these classic quality names, there are better places to look. For a short-term venture, maybe, given the dip. But for a bigger commitment, as they say, this dog has left the barn. Oh wait, that's horse, not dog. My bad.

Final thoughts for now

I'd like to be able to proclaim that finally, after the most brash, bold, and in some cases, silly multi-year rally I've ever seen, the Nasdaq/AI/S&P 500 trade is finished. But I'm not saying that. Not after one very bad day for King Nvidia.

The keys to what happens next lie more in how big investors and masses of investors were positioned before this. Few were ready for it, and that might play out in margin calls, etc. in the near future. That would be a clearer signal that the U.S. stock market has broken.

Frankly, I don't care much either way. I just want a firm, sustained direction to try to exploit via my portfolio combination of stocks, ETFs, options and cash. Let's see if the investing world has changed by next week's issue, or the next one after that. Or, if it's all just another fake-out.

Not a Sungarden YARP Portfolio subscriber on Seeking Alpha yet?

Click HERE to become an IG subscriber and receive all trade alerts as well as access to our portfolio.