THE 3s REPORT: Cracks In The Foundation, As QQQ, TLT Weaken

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 20 for the third consecutive week

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 20% SPY and 80% BIL.

Subscribers now get access to the original ROAR 2-ETF portfolio, but also 3 others (QQQ/DIA, XLG/SH, YMAG/SQQQ)

3 Quick Thoughts on markets

This might end up being just another stock market false alarm, but the market climate leans against that.

The average S&P 500 stock (RSP) is down 8% from its peak, while the S&P 500 high dividend ETF (SPYD) is down 10%. Does anyone notice?

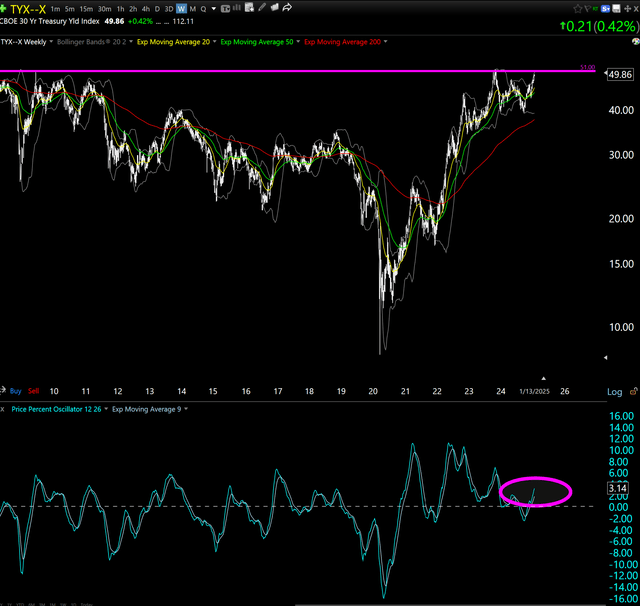

The bond market likely holds the cards here. Long-term rates are edging higher. Did investors finally decide that $36 trillion in debt was the tipping point?

3 ETF (or index) charts I’m watching

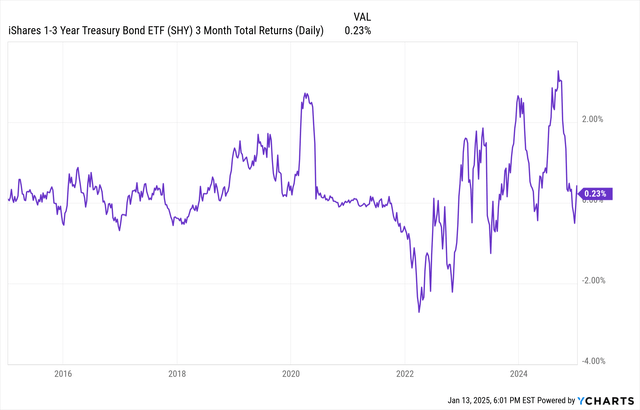

I remember when an ETF that owned 1-3 year US Treasury notes...and nothing else...didn't move at all. That's changed for several reasons, and it just adds to the instability for those pursuing ways to invest "normally."

While everyone is watching the 10-year bond, I'm focused on the 30-year. Because investing in the "full faith and credit" of the US for 30 years is the best signal of what the market requires as compensation to seriously help fund the debt. The 30-year closed at 4.986% on Monday. It has not been sustainably about 5% since...wait for it...2004. I don't think today's consumer takes that in stride.

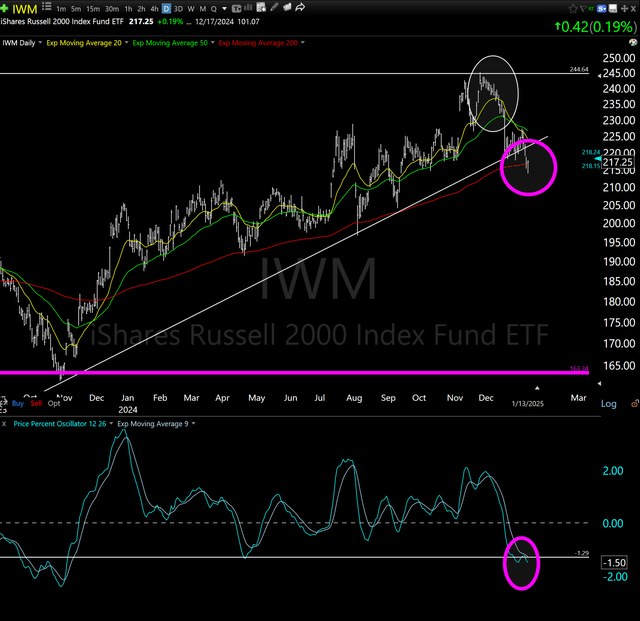

Small cap stocks continue to look awful. That means a high likelihood of one of two things. Either it plunges from here (let's say another 10-20%), or something strikes the market like a bolt of lightning that produces yet another "buy the dip" scenario. This leans toward the former, but never count out the latter. This is one stubborn bull!

3 stock charts I’m watching

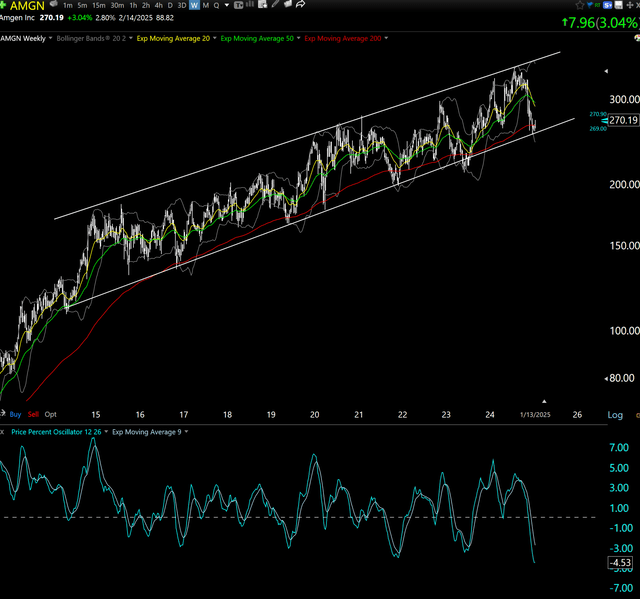

It is not difficult to find stocks to trade. But investing is another story. For instance, this healthcare stock was "due" for a nice bounce.

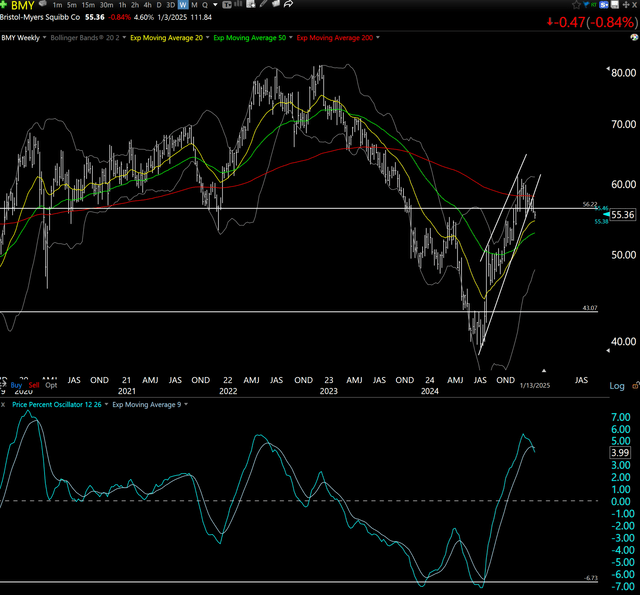

Which is what this healthcare stock had in July. And 6 months later, its 50% move is in peril. From $54 to $40 to $60 and now $55, all in a span of just 10 months. I see this all over the place. It is what has prompted me to pivot how I approach single-stock investing in 2025.

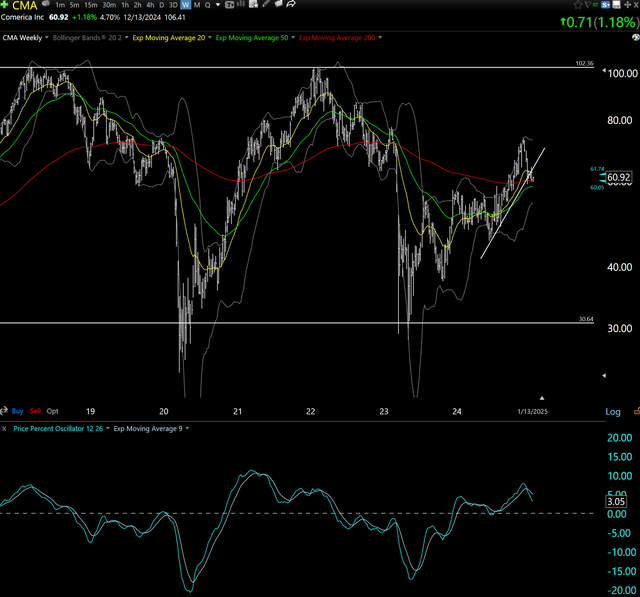

Folks talk about their home town as "a nice place to be from." I call this a stock I am glad I "used to be a shareholder of." Banks look very vulnerable here.

Final thoughts for now

What's with all of that bad news above? Actually NONE of it is bad news. That is, unless you insist on clinging to investing like it is before the Covid era. We had the financial crisis in 2008, yet so much of what ailed the economy and market liquidity was not addressed. Then came the pandemic, and the money flood continued. Now, it is either time to capitalize on the "can-kicking" phase ending. That's what I plan to keep doing.

Not a Sungarden YARP Portfolio subscriber on Seeking Alpha yet? Join us to receive all trade alerts as well as access to our portfolio.