This will be the last full free issue of the 3s Report and our proprietary ROAR Score

The weekly 3s Report, delivered every Tuesday, will continue to be sent to our free subscribers, but in limited form. Most of the report, including the ROAR Score, will be "behind the paywall" as they say. To continue to receive the ROAR Score update each week, as well as the 3s Report and the new ETF Scanner (see below), investors have 2 outlets:

Sungarden on Substack, our new weekly service for serious readers and writers. This is where more than 2,000 people current receive this email for free every Tuesday, as we've done for nearly 4 years.

Sungarden Investors Club the investing group Seeking Alpha tapped us to run on their platform just under one year ago.

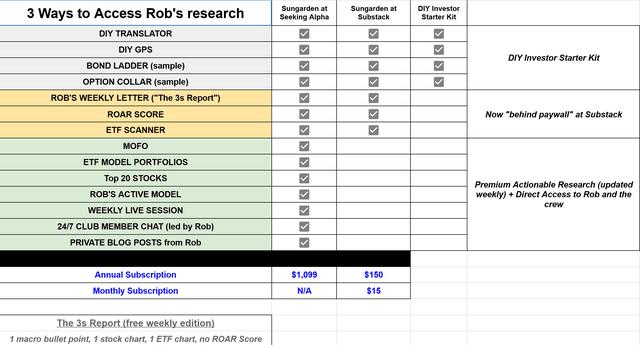

At last week's live "open" Zoom session, I walked attendees through the entire Sungarden investment research platform, which has 3 parts:

The DIY Starter Kit (free) is a set of educational tools we developed to help self-directed investors think about what I believe are some critical "prerequisites" for anyone investing on their own. I was a fiduciary advisor for 27 years, and a fund manager on 3 occasions. After Dana and I sold that practice in 2020, I semi-retired to a life of investor education and research. That's today's Sungarden.

The DIY Starter Kit includes those free tools, as well as a sample version of my personal investing research deck, which members of Sungarden Investing Club have 24/7 access to, and reference during our interactive weekly live Zoom sessions.

The new Sungarden on Substack service also has a live research deck, with the parts of my ongoing work that are included in that service. Here's a quick comparison chart from the DIY Starter Kit.

Why this? Why now?

The answer my family will give you is "he just doesn't know how to retire!" And I'll accept that explanation!

However, while trading my own accounts and writing for 2 of the few remaining stand-up publishing platforms, Seeking Alpha and Barchart, is a way to try to transfer my experience "in the trenches" one bit at a time, I still have "a lot in the tank" as they say. I want to continue to share my mistakes and successes, insights and biases, and help investors across a wide spectrum.

I want to help them to navigate the unprecedented investing landscape that greets us every morning when we wake up, and do so in part by "busting" the myths and misdirection delivered by so many across Wall Street. I'm no longer operating as a fiduciary, as my research is not personalized to any particular investor. But that doesn't mean I don't care!

The ROAR Score has been a staple of my public investment work since the start of 2022, when I began writing this weekly report to a broad audience. During that time, ROAR has been featured in several publications, and has essentially become Sungarden's "calling card." While it is complex to produce, it is simple to understand.

These days, we all like simple when we can get it

ROAR is going "private" because we want to provide our club members with all of the best thinking that comes out of Sungarden Investment Publishing. The last public ROAR Score will be published on Tuesday, September 16, 2025.

We now offer 2 different ways to ROAR through these markets. Please consider joining us. And, for those not ready to take the leap, an abbreviated weekly report will continue to be delivered every Tuesday. I'll also publish occasional blog posts on Substack.

And, my articles at Barchart and Seeking Alpha are available on those platforms. We even have these discount codes to become a subscriber to either or both of them, for our followers here.

______________________________________________________________

Now, on to the final "no paywall" weekly edition of the 3s Report.

ROAR Score weekly update

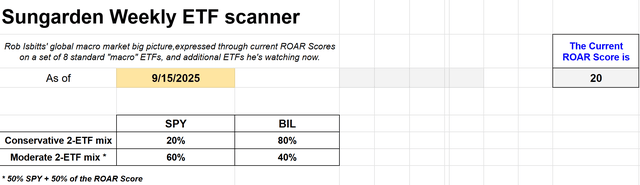

Our "Reward Opportunity and Risk" (ROAR) score remains at 20 for the 8th straight week.

This means a conservative 2-ETF portfolio that can only be allocated 20% to SPY and 80% to BIL.

A more moderate risk 2-ETF portfolio would be allocated 60% to SPY and 40% to BIL.

Here's what it looks like in our new ETF Scanner. This is the top part of a more comprehensive report we deliver to members of both of our services each Tuesday.

3 Quick Thoughts on markets

As a friend said last week, "I'm waiting for you to get fully bearish or more bullish." My response: me too! But the process is the process. And with Powell and the Federal Reserve Board he leads (all of them in attendance despite some recent drama) likely cutting rates tomorrow, the story is not that. It is what the market does with that information.

I have tried to come up with a different explanation for how I see the investing climate this year. Because I've seen it the same way all year. And the description has not changed. This is the most dangerous AND opportunistic market of my nearly 40-year career.

Strategically, what does that mean? Whatever an investor wants it to mean to them, based on their own situation. That's why the ROAR Score has its core conservative version, and a moderate-risk version too. Because as a conservative investor, I'm not willing to go beyond a 20 "beta" to the S&P 500, with it being as skewed at the top as it ever has been. However, my own portfolio goes well beyond those 2 ETFs, SPY and BIL. And with that expanded tool set at my disposal, I can position to capture a lot more of the ups, while continuing to be well-protected for the next market collapse (stocks, bonds or both).

3 ETF (or index) charts I’m watching

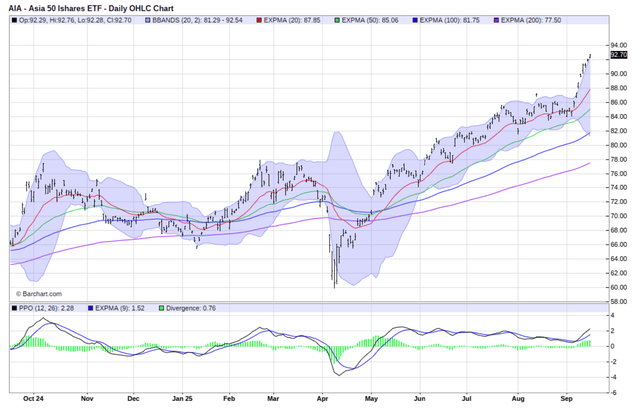

Asia (ex-Japan) has been flying. Let's see if this Friday's Trump-Xi call produces anything that spurs or changes that.

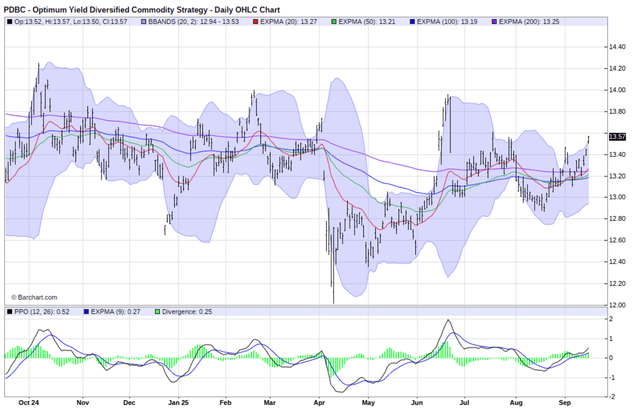

This is my go-to tracker for commodities, broadly speaking. It is allocated about half to energy-related stuff, with the rest in metals and agriculture. It looks higher here. The question is whether it can be more than a potential trade (5-10% gain in months) as opposed an investment (bigger aspirations over a much longer time frame). If inflation is still an issue, this goes higher. And if it does, why is the Fed starting to cut rates?

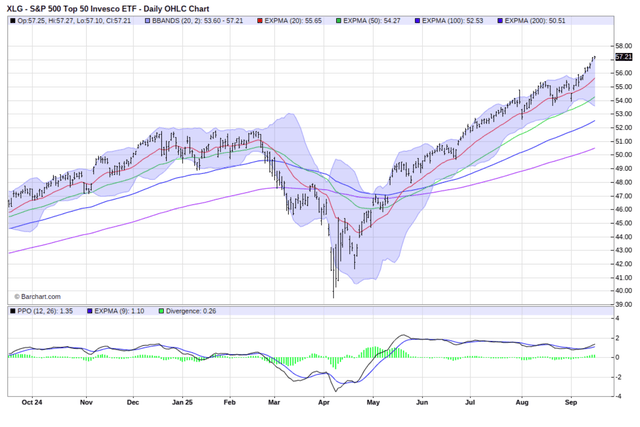

Have I mentioned that the top 50 US stocks (by market cap) have been carrying the rest of the market? Only every chance I get! This continues until it doesn't. Then, we look at 2000 and 2008-style scenarios. I am confident we will see one. I am only speculating as to when. And I try to avoid speculating.

3 stock charts I’m watching

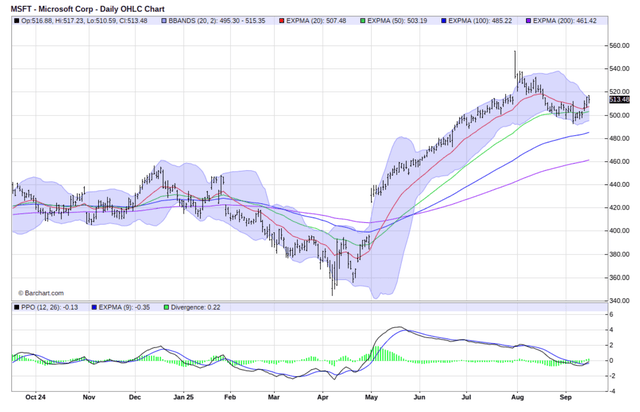

"Mr. Softee" (not an ice cream reference) is trying to re-rally after spiking on earnings up to nearly $560. Now 8% off of that late July peak, the PPO at the bottom of the chart hints at MSFT having more than a "puncher's chance."

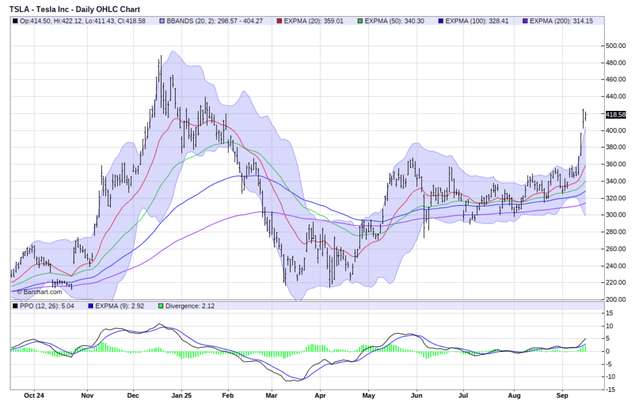

For a company I truly do not care about nearly as much as many investors and traders, I have this knack of making money on TSLA, over and over again. Most recently, in the tactical "Rob's Active Portfolio" I run for Sungarden Investing Club members. As with nearly any successful tactical move I make, its the charts that made me do it. Still, this one is so volatile (the stock, as well as the founder), some position-management is always front of mind.

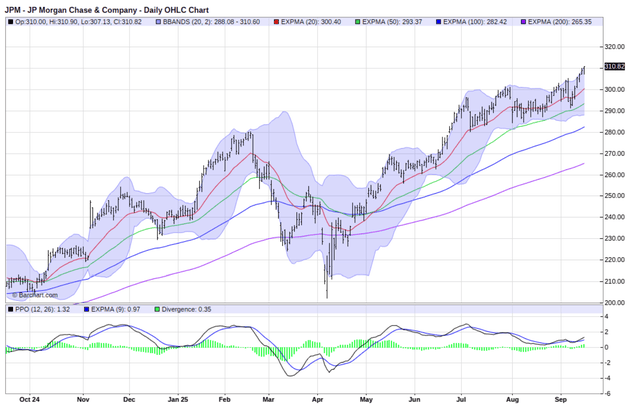

Banks are "obvious" beneficiaries of lower interest rates. In particular, if the Fed cuts rates, the only ones they actually control are overnight rates. Not the 10-year, etc. But a cut this week, with others assumed to be on the way, could lower rates we depositors, CD and T-bill holders get. To the benefit of...banks, who can borrow at lower rates, and lend at still-higher rates.

Final thoughts for now

What is risk-management to me?: prudently, tactically seeking returns, but without leaving oneself open to "big loss" as any investor defines it for themselves. That's Sungarden. And that's what we'll continue doing here, across multiple access points for investors and traders.