The 3s Report: Hammer To Fall?

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 10. Again, "barely."

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 10% SPY and 90% BIL.

I remain cautious...which for me means playing lots of defense, but ready to exploit either a steeper market decline or a sustainable rally, if we get one. That's "playing offense and defense at the same time."

3 Quick Thoughts on markets

The plot thickens. And so should our skin. The stock market fell right to the 10%-down mark (S&P 500), then rebounded. That's like the 400 points they give you on the SAT test just for signing your name.

The only reason I have not moved toward zero on ROAR is that this bull market has been the most resilient of our lives. "Buy the dip" might not be done, even if the hourglass is running out of sand. We've been here before.

As always, I separate what I "think" should happen (deep further drop in major market indexes) from considering all conceivable scenarios. More on that in the "final thoughts for now" section below.

3 ETF (or index) charts I’m watching

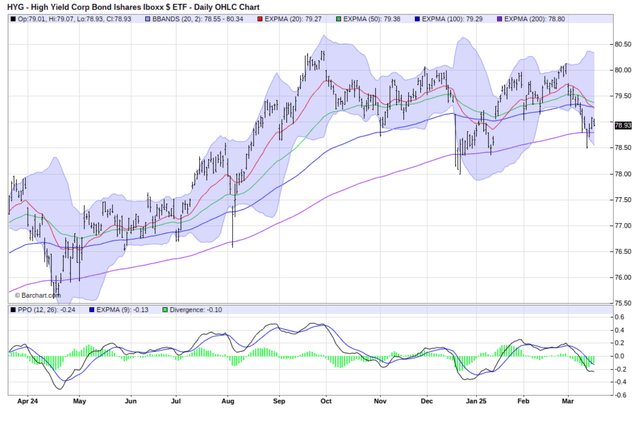

It's not a true "crisis" until high yield bond spreads break out (widen) and HYG falls hard. Not yet.

Gold continues higher, unabated. Impressive and concerning at the same time.

We are one or two more bad days from the Mag-7 stocks risking a decline that could make us forget about what's already happened. So far, it's a "correction" but another big leg down and it looks more like a bubble busting. Stay tuned.

3 stock charts I’m watching

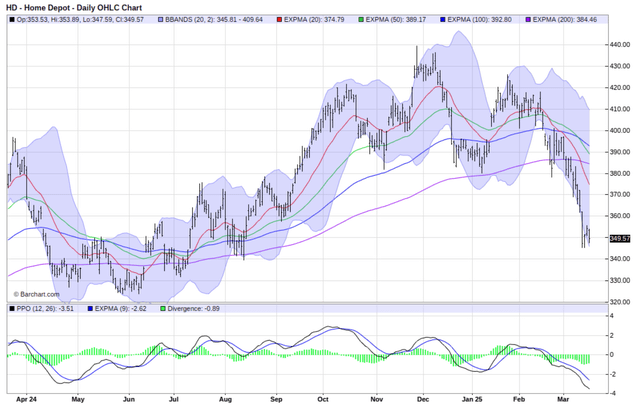

I'm a big fan of the Dow 30, but they don't all look good all the time. Here's one setting up to possibly take a huge dive.

Here's another...

And another...

Final thoughts for now

In a market starved for strong buy ideas (other than maybe some inverse ETFs and T-bill ETFs), I have a new innovation that I've started sharing with my subscribers at Sungarden YARP Portfolio. In the coming days and weeks, we aim to make this more widely available. And if you have followed my work here for a while, you already know what it is...sort of.

ROAR SCORES: FOR INDIVIDUAL STOCKS AND ETFs!

Same concept, but hundreds, even thousands more investments evaluated through that type of lens. If you would like to be among the first to try it out, contact us at info@sungardeninvestment.com and let us know. We'll add you to our list of "beta-testers" and you'll hear from us soon.

Want to be part of our Investment Group over at Seeking Alpha? Sign up HERE and become part of our unique learning service.