ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score stays at 40 this week. This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 40% SPY and 60% BIL.

The ROAR Score has taken on a life of its own, if you will. With all of the intellectual property I've created over the decades, this simple "offense/defense" spectrum I've used to set broad portfolio strategy since back in my fiduciary client advisory days might be the most popular. At least with those who follow my work most closely.

And since the markets are quite mixed (which is another way to say totally confused leading to a trading range and an ever-present risk that "something disruptive" is coming), I'm devoting this issue to the simplicity of the 2-ETF portfolio structure I created back at the start of 2022. I'll do so in the context of current market activity. We welcome your questions, comments and feedback!

3 Quick Thoughts on markets

I've used the analogy to the gameshow Name That Tune since I started experimenting with simpler, technical analysis-driven 2-ETF portfolios a few years ago. I did so without realizing that the show, which started as an NBC radio program in the 1950s, and ran on TV during the 1970s and 1980s, had made a comeback this decade. And like the simple challenge of naming a song by hearing a small number of notes, building a portfolio that covers risk management, total return and competitiveness with whatever one's benchmark is was an idea whose time had come.

By no means do I conclude that using only 2 ETFs to cover one's total portfolio allocation is an all-purpose solution. But the use case has become clear to me. That simple tradeoff between growing assets and preserving them (via a combination of SPY and BIL ETFs in the original version) is a way to teach a broader investor audience what matters at the "macro" level. From there, constructing a portfolio is up to each investor, based on what makes them tick, and what they learn to understand about markets and themselves. For newer investors, the advantage of this simplicity is clear. For more experienced investors, this simple structure is not so simple in one respect: you need to get the mix right.

The 2-ETF portfolio is also known to my investing club subscribers as the ROAR Score, since the original 2-ETF portfolio was created to test the effectiveness of simply allocating between SPY (stocks) and BIL (T-bills) based on that single score, updated weekly, and during market "emergencies" if needed. In the ETF charts section below, I'll show a few visuals to update you on how its going. Then I'll cover a few stocks of note to finish this week's report.

3 ETF (or index) charts I’m watching

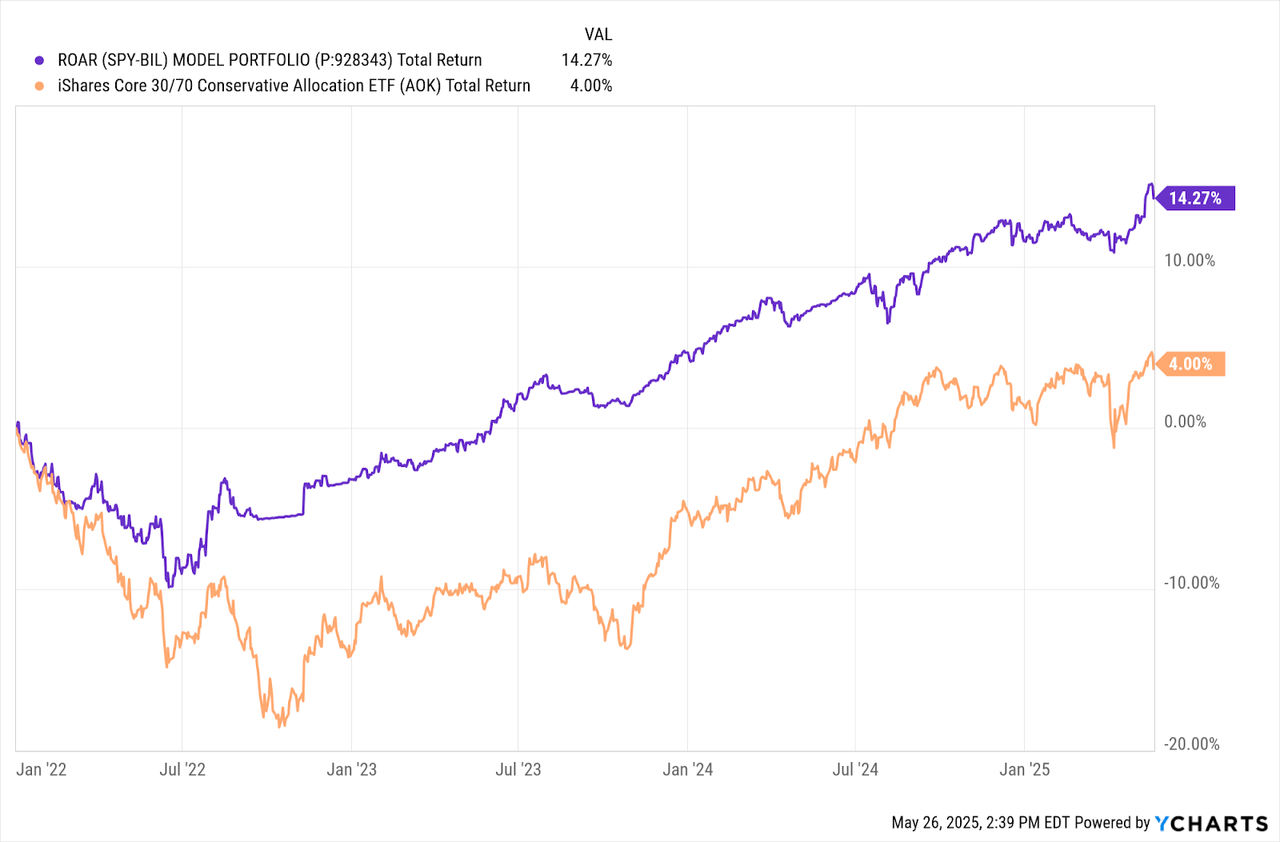

Below you will see the original SPY-BIL 2-ETF portfolio. I simply take the ROAR Score each week and allocate that much of one of my personal accounts to it. So for instance, ROAR is currently 40. That means that for every $100 I have in my account, $40 is in SPY and $60 is in BIL. That allocation will remain until the ROAR Score changes, which is a call I make each week, based on a ton of evidence I gather from a range of technical, quantitative, fundamental and sentiment-based sources.

This is essentially what I've done since the 1990s. But since the start of 2022, I've run a "top down, pure play" version of that concept.

Here's how the original has done so far. I benchmark it to the conservative portfolio ETF from iShares (AOK), which is the closest traditional allocation mix to the risk-managed, alternative style of investing I've used for decades.

I created 2 offshoots of that original. This one, which for lack of a better term I'll call "moderate," uses the same allocation technique as the original, but it has a hard minimum allocation to SPY of 30%.

So whatever the ROAR Score is, I apply that to 70% of this portfolio. The other 30% is always invested in the "offense" ETF, SPY.

This compares favorably to that classic, overused 60/40 mix, which has hundreds of billions of dollars allocated to it. My question: why?!

Finally, the "aggressive" mix uses that same approach as the one immediately above, except that the "hard minimum allocation" to SPY is 50%, not 30%. So essentially, this portfolio is 50% SPY and 50% whatever the ROAR Score dictates. So the current 40 ROAR Score translates to a SPY allocation of

50% + (40% of the other 50%) = 70%

All 3 versions are doing quite well over the past 3 1/2 years. I'm particularly encouraged by this because we've seen a lot. Now, on to a few stocks.

3 stock charts I’m watching

That's a lot of words on the simple portfolios concept above, so for the stock section, I'll just show 3 stocks with the same theme: they are traditional "dividend kings" which means they have the type that have raised their dividend payment for at least 50 straight years. That's impressive. But this group is also a symbol of the changing nature of markets. I find them better for tactical use than buy and hold purposes. Markets don't offer the same level of reverence to the "kings" as they once did. That makes them good to "rent" but less attractive to "own." Here are 3 examples:

BDX used to be a stock I considered too conservative to own. Now, maybe it is too dangerous to own? There is some bottoming potential, but high risk comes with it.

It is rare that I can say this about a stock, but...I've never heard of this company. That could be because it is not on many people's list of current favorites. That's a weak chart.

JNJ is one of 2 remaining public companies with AAA bond ratings (Microsoft is the other one). But that's not doing much for the stock. Potential liability and a sanguine market view of many big healthcare stocks has weighed it down for years. Again, quality is one thing, stock price total return is another.

Final thoughts for now

As noted above, I started that simple 2-ETF "offense/defense" portfolio concept at the start of 2022. Since that time, the markets have thrown a lot at us, including:

2022 being the worst year for “asset allocation” since the 1970s

2023’s “everyone in the pool” rally

2024’s “Mag-7 stock festival”

2025’s tariff-driven spikes in both directions

Is that simple 2-ETF mix all we need? NO. But does it cut through a lot of the BS that Wall Street offers (and charges a lot for!), and focus investors on a very critical part of the path to long-term investing success? I have convinced myself that the answer to that is YES. As with everything I do, this is rooted in risk management.

Particularly now, when markets correlate in a risk-on/risk-off fashion as never before, and with algorithms and indexing dominating trading volume, it makes total sense to me why a bit of simplicity can go a long way. Stock picking is not going out of style, but I do think a higher bar has to be set.

Because "alpha" increasingly comes from managing risk and not overdoing the detail when it comes to this stock or that ETF. There's value added for sure, but I think many people today assume that every stock and ETF is a different story. That may be true in business terms, but if the markets treat most of them the same, does it really help us?