The 3s Report: Is It Over? Yes, But Not How You Think It Is.

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

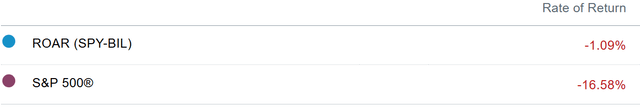

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 10 for the 8th straight week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 10% SPY and 90% BIL.

I'd say that sounds boring to me, except for what it has done to preserve capital in this most historical of market conditions.

3 Quick Thoughts on markets

Investors are asking professionals and others, "it is over?" If the question is about the recent market drop, spike in bond yields, and fall in value of the US Dollar, no one knows. But the era of expecting markets to just recover on a dime every time? I think that is ending, after 16 years of bliss. That does not mean bull and bear markets don't continue to trade off. It simply implies that some important guidelines have changed.

Since March 25, just 3 weeks ago, we've witnessed the CBOE market volatility index (VIX) go from a nervous 17, to a freaked-out 60, and back to a hopeful 29. In 3 weeks!

I am far from the only market strategist that views right now as the most risky investment environment of our lifetimes. However, while many are knee-jerking this round of "buy the dips," I'm taking a different path.

How am I responding: by positioning for as many possible outcomes the rest of this year as I can, one at a time, in each of the Sungarden Strategies. Ironically, the one that has not moved an inch since back on February 25 is the ROAR Score, 2-ETF portfolio. Here's my personally-invested tracking account since that time. THIS is the risk management process in action.

3 ETF (or index) charts I’m watching

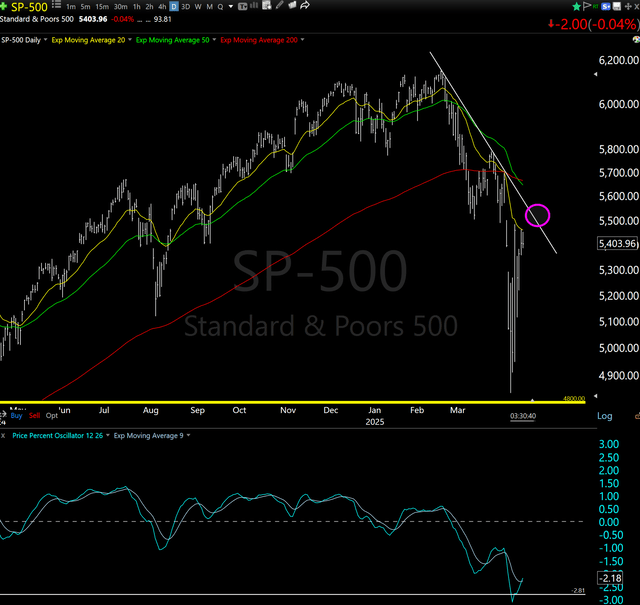

This is the S&P 500's latest "line in the sand" I'm watching. It is a slippery slope up from here, and for a rebound to be taken seriously, I'd need to see the index move toward the 5525-5550 area, give or take. So the next 2% up from here is simply completing the latest round of the same downtrend that got us here from above 6100 just 8 weeks ago. I suppose I'll just sit on my hands until then. OK, not really.

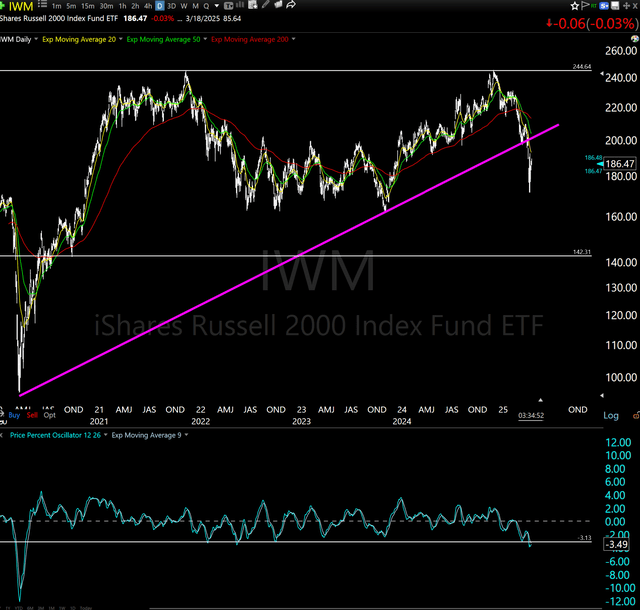

To paraphrase an classic Jay-Z song (first time I've done that), the Russell 2000 small cap index has 99 problems, but a bull market isn't one of them. It is far from that. As with all major stock market gauges, IWM dove, spiked back up as it always does and now is in the technical analysis version of "no man's land." As opposed to the S&P 500, above, IWM will need to run another 10% higher before it even reverses the downtrend's damage. And that still leaves it another 20% short of where it peaked last year. I have positions throughout my accounts to try to capitalize on a next downdraft here if it happens. Yes, when it comes to small caps, I've gotten very "shorty."

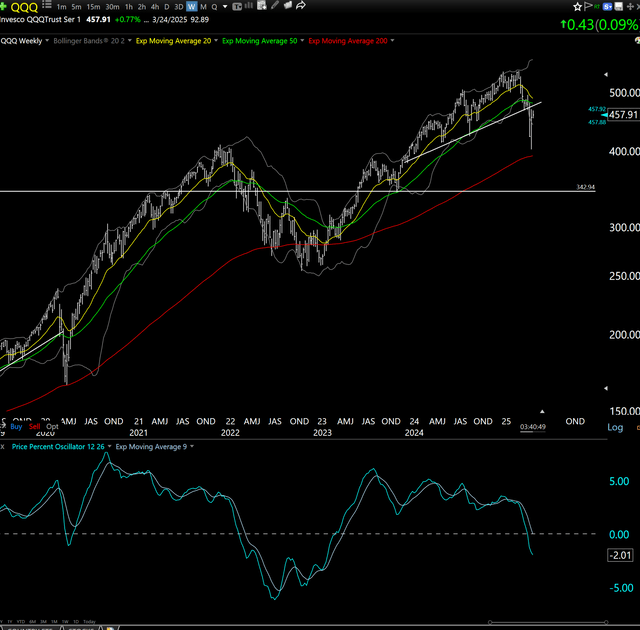

I'd like to introduce my new bestie, the 20-week Exponential Moving Average (I need to find friends with shorter names). Here's QQQ and that cute yellow line is pointing down for the first time since early 2022. Before that, it had not looked like this since February, 2020. And before that, October of 2018. If there were such a thing as "implicated in the murder of the stock market," this would be the perp. Every one of those dates lines up with a market decline of 20%+. But we just had one of those. Summary: can't call any type of "bottom." I can only say that risk is still dangerously high. Some try to buy into that, some don't. Just understand what you're dealing with.

3 stock charts I’m watching

I've charted hundreds of stocks and they nearly all look terrible. But that either means the gradual turn upward is a bit away, or that we ain't seen nothing yet. Since I don't include predicting the future in my job title, here are 3 of the more "optimistic" ones I see for now.

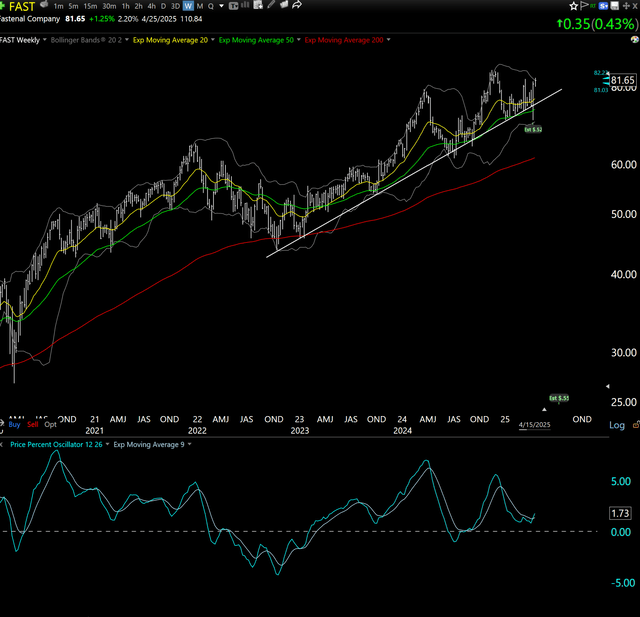

The stock market has been on a "fasting diet" from profit-making so far this year. But Fastenal (FAST) has one of the less-bad charts I see. Perhaps that hints at what I alluded to in my recent appearance on the Seeking Alpha ETF Spotlight podcast in which I cited the industrials sector as one that might come around and have long-term appeal.

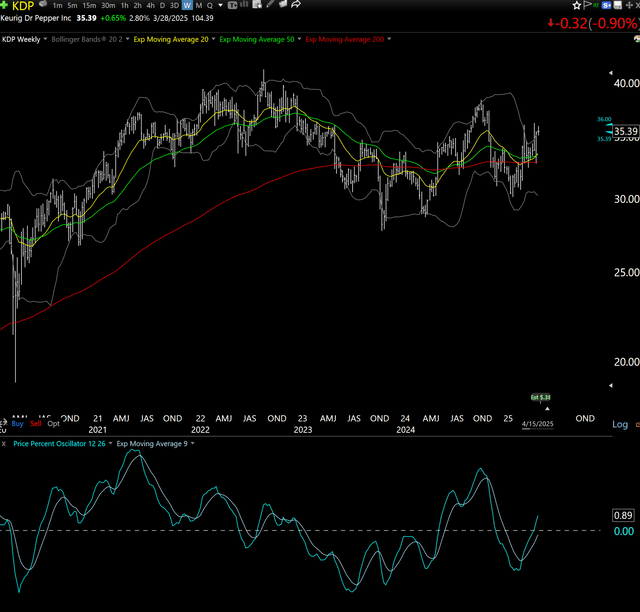

In the movie, Forrest Gump, Tom Hanks' title character suspected he "must have drank me about 15 Dr. Peppers" on a visit to the White House. Nowadays, I think investors would settle for one good soda stock that doesn't give them a bad aftertaste.

This does seem like one of those parts of the market cycle where defense stocks might suddenly be part of the "in" crowd. LMT has gone from the low 400s to low 600s, and now sits toward the bottom of that range. No strong signal to me yet, but it is, shall we say, on the radar.

Final thoughts for now

It's quiet. Too quiet. The shock of late March and early April has nearly all investors noticing. My key message to all: this is the most opportunistic market environment I've ever seen. But only if you understand how to play defense as well as offense. Everyone is good at buying and holding...because for more than a decade, with tech stocks in particular, it has been very easy. Like the NBA and NHL, this is more like "playoff" investing.

The strategy is different, even if it overlaps somewhat with the playbook used during the "regular (markets) season." Sungarden Investment Publishing and the investing group I lead at Seeking Alpha have been doubling up on our efforts to teach good "investment hygiene." Risk management, expanding the toolbox of techniques people can use (if they learn how), and most of all, staying humble, not emotional.

Because the secular period of "number go up," and even a lot of what made stock-picking so popular with a new generation of investors, is now being put to the test. This is where the true alpha happens.