ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 20.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would now be 20% SPY and 80% BIL.

ROAR's low level implies that while upside is always possible, risk of pursuing it is historically high right now.

3 Quick Thoughts on markets

The Fed's annual Jackson Hole Summit has been a market-moving event in the past. But the issue this year is that nearly anything can be a market-moving event.

That's what happens when algorithmic trading and indexed investing come to dominate market trading, as they do now. Lack of recognition of this is, in my view, the most significant risk DIY investors now take with their money. Because while the coast might turn out to be clear, if it isn't they won't know what hit them. This is why I'm still so active as an investment "talking and writing head." I think there's a better way to invest than just counting on that inanimate object, the stock market, to get you retired and/or keep you there.

To me, the biggest issues for the stock market are these: 1. the bond market. Remember, the Fed controls overnight interest rates, but the long-term end of the yield curve is controlled by the bond market. 2. euphoria is clearly present, with the S&P 500's strength currently trumping the fact that every one of the other 9 components of the US Index of Leading Indicators are flashing warning signs. Stay tuned.

3 ETF (or index) charts I’m watching

This is one of many clean energy ETFs that have certainly had a bid to them recently. It still looks higher, but there's so much political risk here, that has to be accounted for.

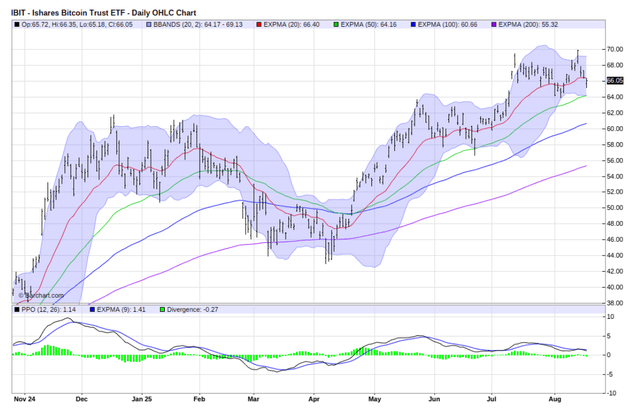

Bitcoin is its own animal, but I'm less enthusiastic about it technically than I was a few months ago.

United Healthcare's spike last week on an investment by Berkshire Hathaway and others caused this ETF to spike. Upon further review, it looks more like a trap than a prolonged rally to me.

3 stock charts I’m watching

Defense stocks look like they do when the market starts to sense there will be less war. Let's hope that's the case.

This one is close to breaking out. But this has been the year of the breakout failure, unless you're a Mag-7 stock. We'll see.

Too many stocks look like this to make me think there's an obviously directional tilt to the market right now. This type of flat but not broken chart is not only for energy stocks. It is across most sectors. Best guess: by mid-September, we will know a lot more than we do now.

Final thoughts for now

This is the slow season for markets. Maybe the Fed will change that. Or maybe it will be NVDA earnings later this month. But the bigger risks likely occur in September and October. Either way, I'm poised to pounce on any opportunity, in any direction. To me, that's what investing in modern markets is all about. Being proactive, not simply reactive.