THE 3s REPORT: ROAR Score Ties A Record

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 10 for the 9th straight week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 10% SPY and 90% BIL.

This ties the longest weekly unchanged streak in ROAR's history. Last summer it was stuck on 30 for 9 weeks in a row.

3 Quick Thoughts on markets

There's nothing like 3rd party support to make investment innovation go. On Tuesday, this article on the Sungarden ROAR Score at Barchart.com (authored by me), published. This marks the culmination of many hours spent converting how I have read stock and ETF charts for decades into something more easily understood by investors at large. Many thanks to my editors at Barchart.com for their support of this effort.

This also brings us to the precipice of what I hope will be the most value-added research effort I've ever done. Specifically, while we know ROAR as a simply 2-ETF portfolio, highlighted here each week, it is much more. The core idea is explained in the article, which is really more like a whitepaper on modern risk management for investors.

It appears ROAR had its coming out party just in time. Even with some intermittent rallies, the S&P 500 is off 12% since the downgrade to 10. The index stood at 5,955 then. More importantly, the ROAR system has not to this point been "whipsawed" the way many technical analysis ratings systems tend to be. And that, in a word (whipsaw) is what we have right now. Not an uptrend or a downtrend, a whipsaw.

3 ETF (or index) charts I’m watching

To put this in traditional technical terms (which I usually refrain from doing), there are 4 different moving averages above the current S&P 500 level. They range from 5,400-5,700. That allows for a giant "bounce" of up to 8% without changing the new downtrend we are in. And I sense that some real-world damage has been done this year that is not likely to just go away. We'll see.

If you have not dropped by one of the great live Spaces on X.com run by George Noble, it might be worth the time. And not because I do regular audio cameos there. It is straightforward insight and discussion about making thoughtful investment decisions. And I cannot recall anyone ever calling another speaker "bro." This is ILF, the most popular ETF devoted to Latin American stocks. It is not at liftoff yet, but it is darn close.

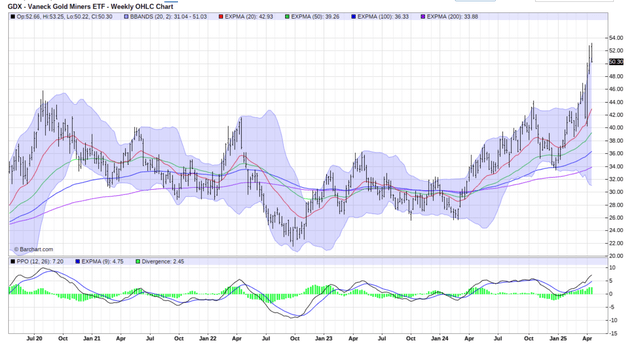

Gold and gold mining stocks have done very well so far this year. And ETFs like this one (GDX) seem to be on everyone's lips. I certainly see what all the fuss is about. But my natural "fear of heights" after a 50% year to date move makes me cautious. Often, gold stocks act like gold for a while, then start to act like stocks. And stocks still look very risky.

3 stock charts I’m watching

This is the chart of a Cupertino, CA-based company that makes...OK, just kidding, you know what AAPL (Apple) does. Down, looking gassed, but this is when I start to pay attention. Because I'm not so smart that I think I can pick every bottom. $260 was expensive. But under $200? We'll see.

When will it be "safe to go back in the pool" for stocks broadly? When even those like Estee Lauder start to show a reversal after a, wait for it...85% price decline. Don't ever say a stock is "bottoming" with certainty. That's one of my guidelines, and I see investors ignoring it constantly these days.

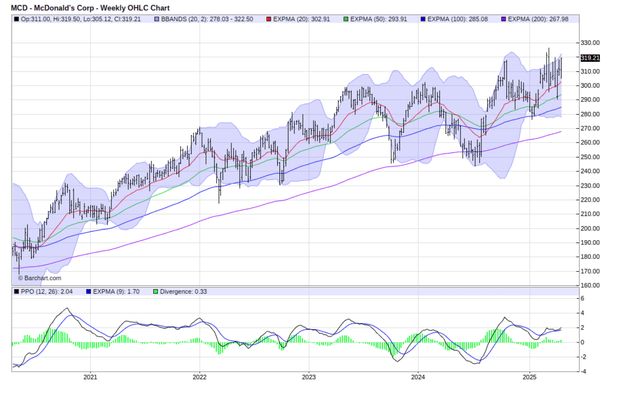

The other decision stock investors will need to consider is what role is potentially played by steadier stocks, like MCD has been through this market turmoil. Low volatility sounds great at times like this. But human nature is that investors and the market in general are always tempted to go for something sexier, the moment they think the coast is clear.

Final thoughts for now

I do not think the coast is clear. However, one of the best lessons markets have taught me over the years is this: old habits die VERY hard. I'm talking about the urgency to "buy the dip" which we saw today (Tuesday). This is part of markets finding their way. The adjustment I've made, thankfully with good results, is that even when my "evidence" decidedly points to things getting worse, I always include in my portfolio what I call a "counter-position."

Its role is to help offset the whipsaw and keep portfolio volatility low. It works well in strong up markets too, since shocking sudden drops don't phase me. I always have the "tails" covered, as they say. That's an important consideration for investors today.