ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 20 for the 5th straight week. It was last changed back on August 5, from 30 to 20, where it has remained since.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would now be 20% SPY and 80% BIL. A more moderate risk version of that, which allocates 50% to SPY and the other 50% based on the ROAR Score, would remain at 60% SPY, 40% BIL, given the current ROAR Score of 20.

I don't often talk about which way ROAR is "leaning" as I let the market tell me its story. But since it's a new season for investors (post Labor Day), I will note that the "bias" is down in the score, not up, as of this writing. Stay tuned.

3 Quick Thoughts on markets

Take your pick: "Dancing in September" by Earth Wind & Fire, or Green Day's "Wake me up when September Ends." As for me, I just go where the markets tell me. But just listen to the all the media coverage on the fact that September is historically the worst month of the year. In a market so globally connected with technology, and instant communication, self-fulfilling prophesies are part of modern investing. So watch out in September.

I wrote here a few months ago that while I don't go all "crystal ball" on my audience a lot, I did suspect that "buy summer, sell autumn" as a general outlook sounded fair to me. Now, the charts are starting to show it.

But we've seen this market escape so many times. So what about now?

US separating from the world order? No biggie.

Long-term US Treasury rates threatening to hit their highest level since 2007? So what.

Labor and housing markets getting uglier by the day? Hey, whatever.

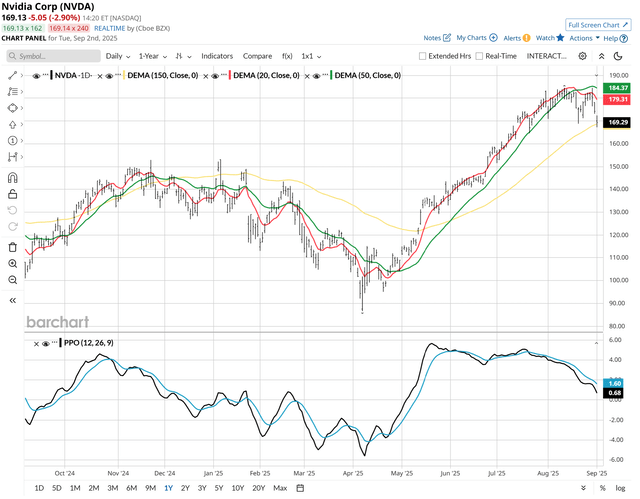

NVDA is down 3% today? Crisis! That's the type of market vibe we have.

3 ETF (or index) charts I’m watching

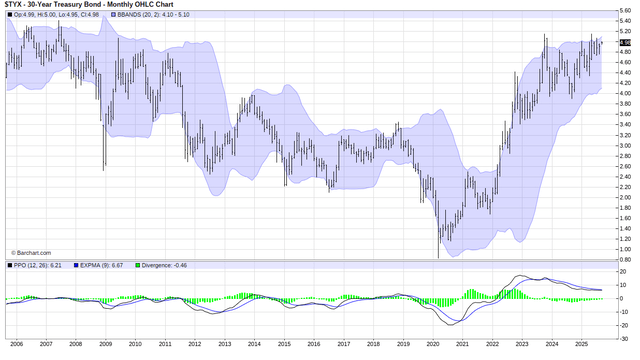

Like I said here last month, while everyone else is watching stocks, I'm watching this. And others like it. The 30-year US Treasury rounds to a 5% yield. As I was just discussing on a soon-to-be-released edition of Seeking Alpha's Investing Experts podcast with my analyst friends Jack Bowman, Julia Ostian and Kenio Fontes, the lack of enthusiasm from my Baby Boomer generation for locking in generationally-high rates is astounding to me. But hey, when you can lose 30% on a stock in a month, then see it rally 45% in a a few months to earn what bonds would have paid you over that time, why be so boring?!

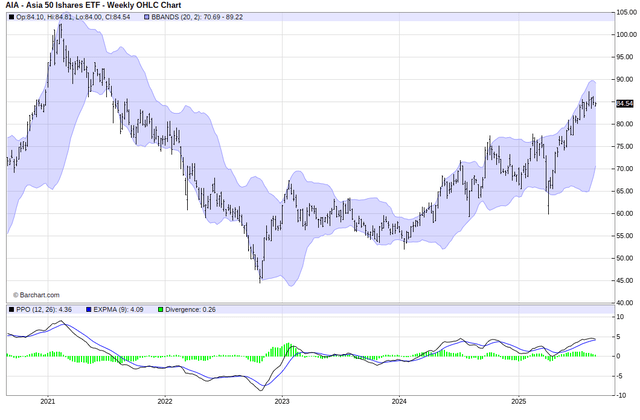

I was really all set to go in big on Asian stocks. But this is starting to look more like another case of rally, then slow, then roll over and give most/all of it back. This has been happening for a few years to most of the S&P 500 stocks, not that many have realized it. The bottom line to me: if I'm going to move beyond trading around a big, hedged (collared) SPY position and venture out to non-US and small cap stocks, commodities, etc., I'm going to need to convince myself that it is in something that, when I look back after selling, I don't say this again: "it was just a beta play, so many asset classes and stocks just move in sync." The ALPHA is now less in WHAT we own, and more in HOW we actively manage a small set of investing "tools." That includes SPY, as well as a relatively small number of ETFs and stocks.

Every week in my stock research, I'm drilling down further into this question: how many stocks actually matter now? In this age of indexation and algorithms, I think fundamental analysis is useful, but more in very long-term analysis. This is TOPT, an ETF that simply owns the top 20 stocks by weight in the S&P 500. It has been correlated to but returning more than SPY since its inception. And for most of the decade.

That doesn't mean "buy" TOPT. It means we should recognize that to the extent one aims to generate S&P 500-ish returns, I think starting with the top 20 or so, and operating within that more confined range of names, is a good place to start.

3 stock charts I’m watching

What would be my biggest surprise of 2025? If NVDA did what it appears to be starting to do (fall by 20-30% or more from its recent peak), and the broad stock market doesn't follow suit. Because this stock is now nearly 8% of SPY and nearly 10% of QQQ, not to mention 40-60% of some investor's hopes for early retirement. There's too much riding on a small number of giant stocks. It might work out. But if it doesn't, it won't be like there wasn't a long list of warnings.

Here's MSFT, another 7% of the entire S&P 500 index by weight. It too looks very "droopy" (technical term, ya know).

OK, enough of that negative stuff. Let's go find a bunch of stocks within the Dow 30 that, unlike NVDA and MSFT, look really good here.

......polling....polling....polling....

OK, scratch that. None look great. But CVX is the best-looking of the group. That says more about a possible pickup in the price of oil than it speaks to an analysis of CVX's next quarterly earnings projections. It might also mean that inflation, while moderating in some spots, is still alive in others. That is not the type of environment the Fed wants to cut rates into...even if they end up doing so in 2 weeks. Let's see what Friday's employment report says.

Final thoughts for now

If the top 15% of SPY is potentially in trouble, can the other 85% save it? That is what is top of mind for me as we enter September. EWF (Earth Wind & Fire) or Green Day? Just don't fall asleep in September. Or October for that matter.

Free offer for our readers:

As a reader of The 3s Report and/or our work at Seeking Alpha, we at Sungarden Investment Publishing invite you to join us for a special edition of our live weekly Investment Webinar on Zoom next Tuesday, September 9. This is normally for paying members only, but not on this occasion.

SESSION TITLE: Ladders And Collars and ROAR, Oh My!

How do-it-yourself investors can manage risk while generating competitive long-term returns

How to create a bond "ladder" as a portfolio anchor Using option collars to reduce the risk of taking stock market risk

Why Sungarden's proprietary ROAR Score can turn any collection of investments into a real portfolio

Don’t miss this opportunity to see what our paid subscribers are getting! Sign up HERE today. Spaces are limited.