ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 20, where it dipped to last week from 30. It had spent more than 2 months at the 40 level prior to that.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would now be 20% SPY and 80% BIL.

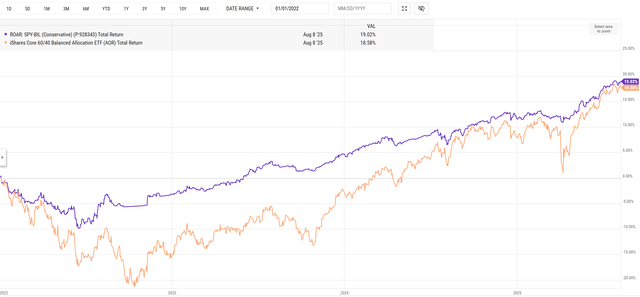

That ROAR 2-ETF (SPY-BIL) portfolio has remained ahead of the "'60/40" portfolio (ETF ticker AOR) since we started running it at the start of 2022. The chart is below. While they ended up in the same place, the ROAR portfolio got there with about 1/3 the risk. Because it is intentionally designed to be an alternative to a conservative portfolio. Yet it has outperformed AOR, a "growth" or "balanced" portfolio every step of the way. This reminds us how much of investing success this decade is about RISK MANAGEMENT. As we see it, if we do that diligently and consistently, the long-term returns will be just fine. And the path A LOT less emotional.

3 Quick Thoughts on markets

What I'm focused on: squeezing as much return out of what is left of a strong 4 months in the stock market as possible.

How I'm doing it: some call it a "barbell" approach. I have a lot of my portfolio earning a nice, minimal-risk return. That acts as a buffer, which allows me to pursue high returns with the other, smaller portion. The tactics change and rotate according to market conditions, but the toolbox is loaded: ETFs, stocks, options longer-term positions, trading positions. But with Avoid Big Loss ("ABL") as the first order of business, always.

This all "lives" at Sungarden Investors Club, the investing group I lead. While our weekly live sessions are members-only, we are planning to have a live session in which non-club members can attend for free, to see what it's all about.

That special session will take place in early September (date to be announced later this month). We're limiting the number of non-member attendees out of respect for our existing members. So if you are interested in being alerted to the specifics of that live, online event, email us at info@sungardeninvestment.com.

3 ETF (or index) charts I’m watching

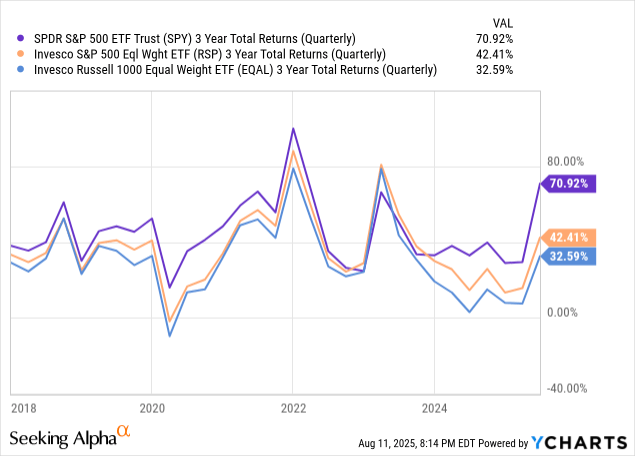

After nearly 40 years of market-watching as a career, these are the types of visuals that jump out at me. "Rolling" 3-year returns of SPY, RSP (equal weighted S&P 500) and EQAL (equal weighted Russell 1000). Takeaway: in nearly every quarterly rolling period since the start of 2018, SPY has outperformed. THAT is what creates a market in which many stocks (even most of them) are less capable of adding value.

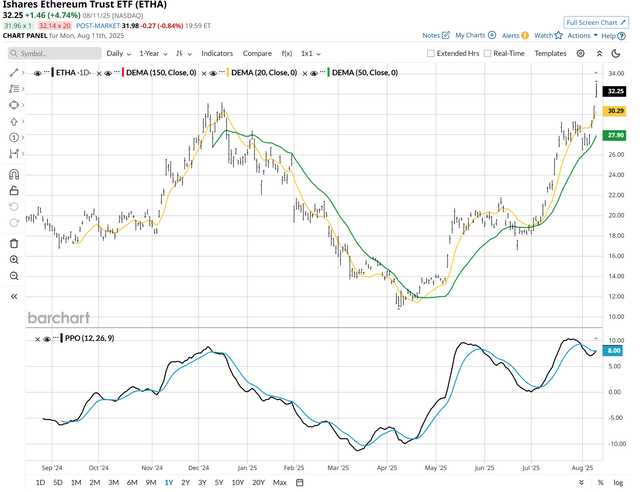

That's an Ethereum ETF, and that's a breakout. Caveat: crypto is much less reliable technically than index ETFs that track stocks and bonds. Proceed with caution.

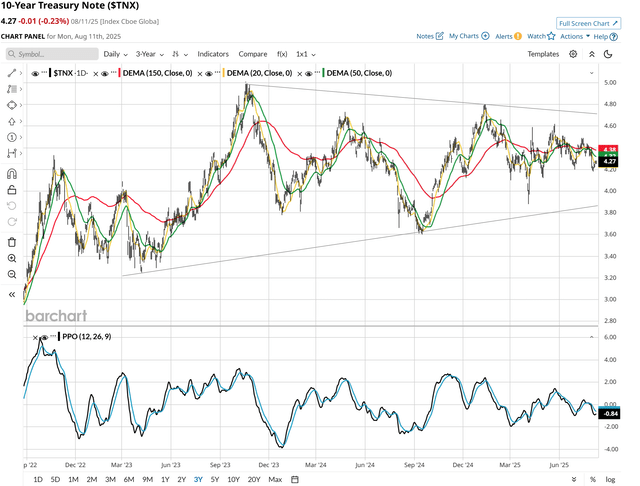

This is very good news for us investors who love our bond ladders, which we use to produce a pre-determined outcome ($X coming due every year, to supplement income or reinvest). Rates are very rangebound for now, and have been really for about 2 years. They have not skyrocketed, nor have they returned toward zero, where they were for about 15 years. A move of 0.50% in either direction would not change that condition. More than that? Different story.

3 stock charts I’m watching

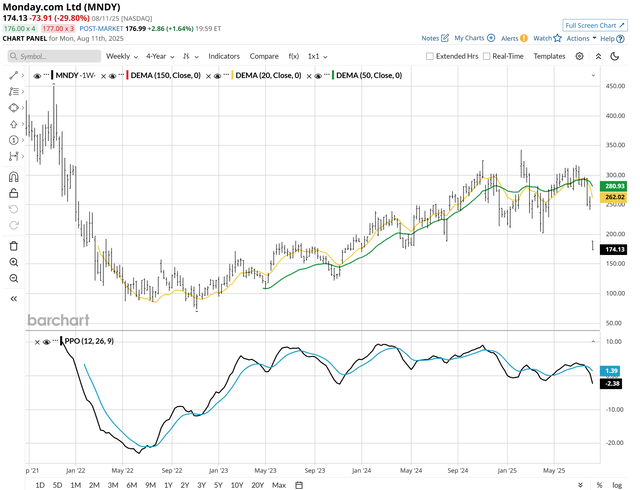

This first one is just too ironic not to point out. Monday.com (MNDY) gave back 3 1/2 years of gains. In a single trading day. It was on a Monday. Of course it was! This market has a sense of humor, and a sense of the macabre as well. Where's Bob Geldof, the Live Aid creator, whose band the Boomtown Rats sang "I don't like Mondays?"

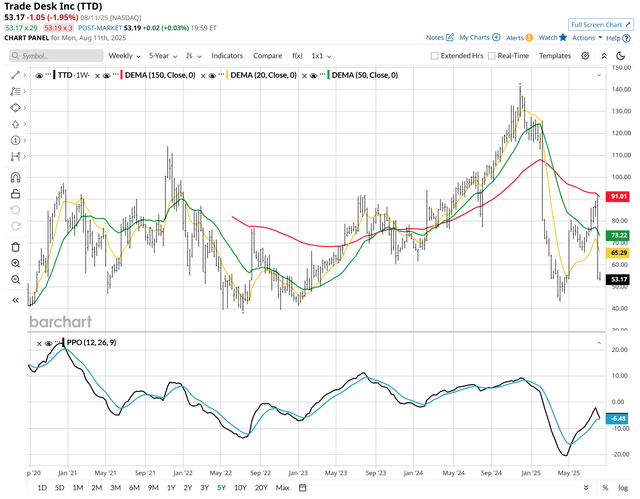

Oh, but Rob, that's an isolated incident with a company that was overvalued and due to take a big hit. Right? Yes, isolated...in that it got off easy relative compared to The Trade Desk (TTD). It returned to where it traded about 6 months into the Covid-19 pandemic. This is a "take nothing for granted" environment, no matter what the headline indexes are doing.

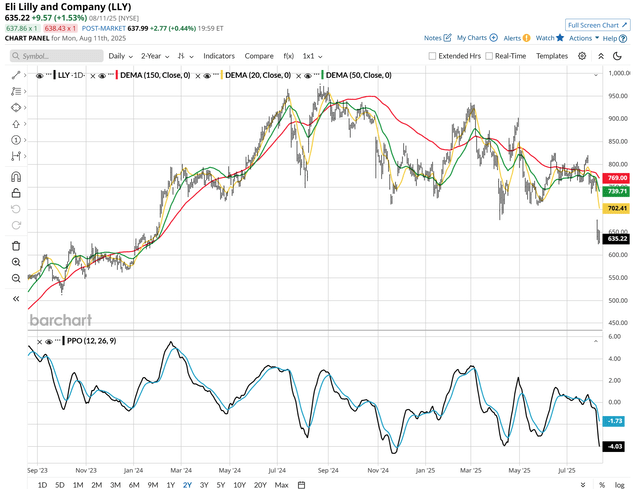

And, by a show of hands, who thought this recent market darling Lilly (LLY) was a sure thing to cross above $1,000 per share, instead of giving up its entire runup since the start of 2024? Anyone? Anyone? Bueller?

I don't say this for any reason other than what should be obvious to 3s Report followers: most stocks today are simply tools to get what we want out of our money and our lifestyle, now and/or in retirement. Don't overthink it. They are ALL vulnerable at some point, especially when the masses assume them to be invincible. Manage risk, manage greed, manage FOMO, stay humble.

Final thoughts for now

Most stocks today go up and down with the broad market, or they don't go up much at all. This is perhaps the most important aspect of the stock market now. Yet I sense relatively few investors realize the implications for stock-picking. This is just the tip of this iceberg, and I plan to discuss it more with Sungarden Investors Club members in the months ahead. It will certainly be a topic of discussion at the aforementioned live session in early September which we are inviting non-club members who follow us to attend.