ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score moved up from 30 to 40, the second week in a row it has been lifted.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would now be 40% SPY and 60% BIL.

In my own live 2-ETF portfolio I have maintained since the start of 2022, I bought some SPY and sold some BIL to adjust from the 30%/70% allocation to the updated 40%/60% position.

3 Quick Thoughts on markets

This is all moving too fast. Not that I can't handle the market's gyrations. As my investing group subscribers know well, that part has been A-OK this year, defending the steep market decline and participating nicely in the sharp rebound.

That's what the whole process here is about. Because while the ROAR Score is a simple, broad "reward versus risk" discipline, even weekly adjustments cannot keep up when markets get oversold and over bought in just a few weeks. So while I'm lifting ROAR to 40 from 30 this week, equaling its highest level since 12/24/24, I will caution that with SPY just about 4% from its all-time high...already...there's an excellent chance that this stock market is more like a sprinter than a distance runner.

3 ETF (or index) charts I’m watching

Not since Covid have we seen these types of swings in both directions. That means enjoy the ride, but be wary of it continuing for too long. This is what I refer to as "getting months worth of returns in days."

REITs are struggling, since interest rates are rising at the long end, again.

Here's a great example of an ETF I almost bought in mid-March, but passed on it. IDV has travelled nearly 30% up and down in just 2 months. Roller coaster.

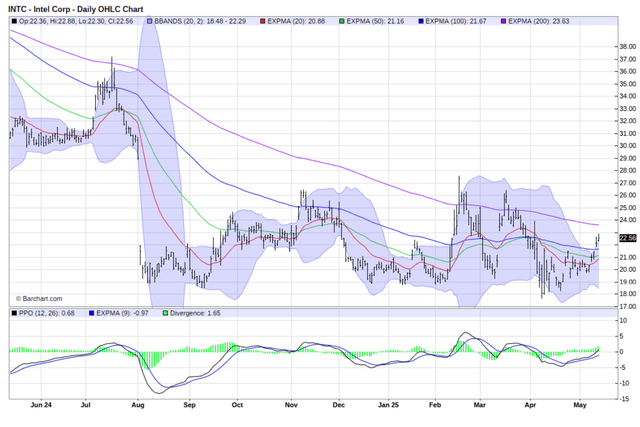

3 stock charts I’m watching

I have not "dog collared" this one (ask me if you don't understand that term), but it is getting more intriguing.

These types of consumer stocks ("staples") still look terrible.

Yet this one, a consumer "cyclical" is celebrating with its peers. Celebrating what? That the tariff boogeyman is gone. Or delayed. Or not as bad as assumed. My point: markets don't operate the same way as they used to. That calls for a more proactive approach to managing risk, and exploiting those gyrations.

Final thoughts for now

As I see at the racetrack all the time, the horse that sprints out in front often does not make it to the finish line first. That's not an issue at all for those who embrace tactical management, play offense and defense at the same time, and stay humble, not greedy. However, for investors who operate the traditional way: buy and hold, high income without much risk management, etc., they have been treated to the latest version of a giant whipsaw.

I think these are the markets we have, and will have for quite some time. 10-20% swings up and down that lead to zero net returns are the "new normal." The question is, is there another way to roll? I believe strongly that there is, and I've practiced it and evolved the process over the decades, to avoid fighting the proverbial last war.

This is a great time for investors to take account of how markets really work, not how they think they work.