ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score checks in at 40 for the 5th straight week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL remains at 40% SPY and 60% BIL.

In the "aggressive" model version of this simple 2-ETF portfolio, which forces SPY to be at least a 50% allocation at all times, the allocation remains at 70% SPY and 30% BIL.

3 Quick Thoughts on markets

Summer is approaching, we were delayed a 1/2 day in producing this, and the markets are not trending much. So I'll make this very quick. It does seem as if the investing world is calm at the top, but rumbling underneath.

Translation: some individual stocks, particular non-mega cap types, are really starting to look interesting. More on that below.

The S&P 500 is nearing its all-time high, and that might just be the signal. Of what? The start of another steep reversal OR a true "breakout" that could run it much higher through summertime.

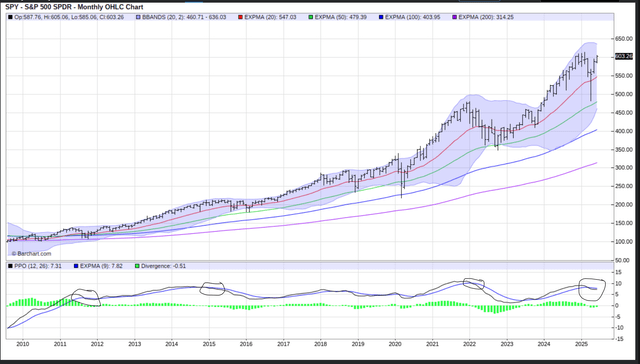

3 ETF (or index) charts I’m watching

I am ALWAYS on the lookout for a sudden downdraft in SPY. After all, it is the key piece of the ROAR Score. However, when I take a very long term view here (monthly chart going back 20 years), I see that it is more "stuck" at the top of that momentum indicator in the lower box. Early 2022 looked similar and we had a big decline. The other 2 circled at left were flattish time periods but not breakdowns. Conclusion: inconclusive. But investing is not about being Veruca Salt from the original Willy Wonka ("I want it noooowwww!"). It is about waiting for the market to tell us its story.

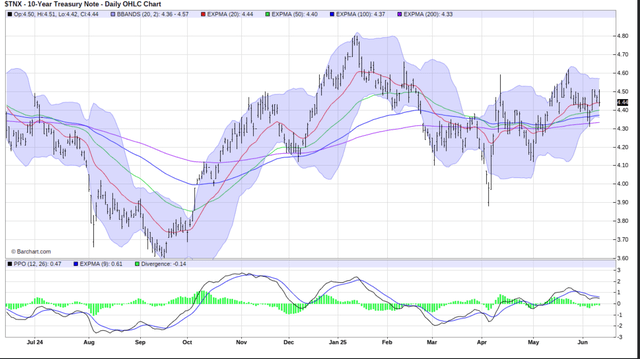

And that's why I'll show you the 10-year US Treasury Bond yield chart next. And in daily chart form. And guess what? STILL nothing! This is setting up for a showdown at some point. But for now, with T-bills still 4%+ and this one in a range from 4.0-4.8% since October of last year, bonds are not bad.

Speaking of charts that tell me "don't chase," here's Europe. This might re-accelerate, but buying in here is just guessing, technically speaking. Asia looks better, relatively.

3 stock charts I’m watching

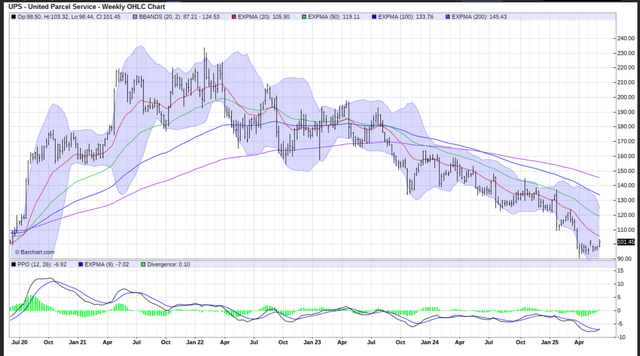

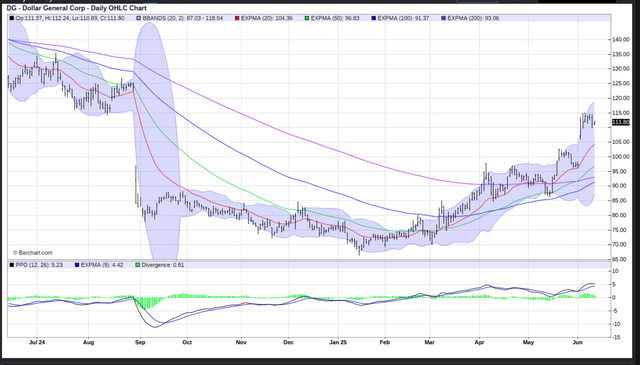

This is what big intermediate term winning stocks look like before they make their move. That said, while most work out, some don't, including some that fail miserably. Risk management, anyone?

And, this is what high reward/high risk tradeoffs look like.

Finally, this is what the "after picture" looks like on a successful tactical stock position. Bought stock, collared it with options to protect against big loss, rode it up, raising put strike price, sold much higher than purchased. Why sell? Objective achieved for now, technical valuation getting stretched, better to deploy money elsewhere. Can it still be a smaller sized position for me, unhedged? Yup.

Final thoughts for now

Does it feel like I'm waffling, saying above that essentially the S&P 500 can "go up or go down?" That's pretty freaking obvious, Rob! True, but this is what real tactical investing in modern markets is. Not going 100% one way or the other. Think ROAR Score! Investing is a balancing act.

What makes any of us different from any other is where the balancing starts and concludes, and with what frequency that balance is reconsidered. I'll let everyone else turn investing into a contest to see who is "right" or "wrong," or what to "buy" or "sell" right now. That's great for gambling I guess.

But for investing, remember my mantra:

ANY investment can go up at ANY time for ANY reason...the difference between stock XYZ and ABC is all about the level of risk we accept in order to pursue those returns. As I see it, those who embrace that simple and humble philosophy increase their chances of long-term success dramatically.

The rest? They will only be as good as the length of a bull market. Because they decide risk management doesn't matter. We like to think that the former group is who reads our free publications, and those who agree most earnestly join Sungarden Investors Club at Seeking Alpha, where they can learn with and interact with us.

The others are of a few types: those who want to learn the ropes from us, those who like our belief system but lack the $$$ to be part of the investing club, and those who have yet to hit "unsubscribe" each week, and instead just skip or delete these emails. Either way, thanks for reading!