The 3s Report: What Do You Do With A Drunken Market?

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score remains at 30 for the 4th straight week. SPY is just above flat since that time, which syncs up with the continued conservative approach there.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 30%% SPY and 70%% BIL.

3 Quick Thoughts on markets

Modern markets have a version of "wash rinse repeat" that is very apparent to me in 2025: react with a selloff, decide it's not so bad, and climb back to where all the calamity began.

This is a lousy scenario for "long-term investing" but a historically opportunistic one for tactical investing ("renting instead of owning") and understanding how to use options as a low-risk surrogate for buying stocks and ETFs.

I am moving ahead full speed with that approach, as I see this as a most unique period in our financial lives. Why? Because the market is "drunk" on optimism and hype, some of which is eventually realized, but most of which is not.

3 ETF (or index) charts I’m watching

Dividend investing just ain't what it used to be. Unless you want to be a "yield glutton." That is, invest in stocks with high yields (5%-10% and more) and trust that they are not priced that way for a reason...and thus carry a lot of "surprise" risk that can wipe out years of principal before anything can be done. That's a 24% total return gap between SPY and the highest yielders within SPY, the past 3 years. That gap has been persistently high for most of the post-pandemic period. It will take a lot for a market-wide return to loving yield stocks.

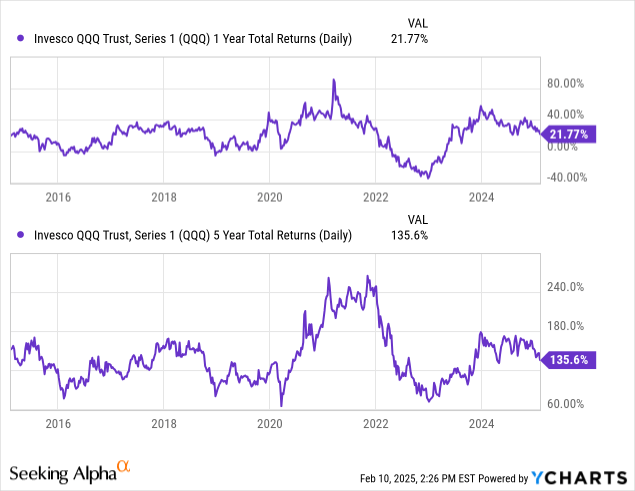

Warning: chart geeks like me get a lot out of this next one, but others might simply say "whatever." The technician in me sees 2 related risk management points here. Top chart shows the 1-year return of QQQ has been steadily falling since early 2024, from over 40% to just over 20%. Heard of the "frog in boiling water" analogy? That's what this looks like to me.

Lower part of chart is more a sentiment thing. "Only 135% in 5 years from QQQ?" 180-250% was the "old way" and I think the fascination with 0DTE options, crypto, meme coins etc. is a byproduct of this not being as exciting as it has been.

Here's a Rorschach test of sorts. What do you see in this picture of a gold ETF? 2 possibilities among many:

UP more than 40% the past 12 months, wow!

In the 12 years prior to that, total return was about 0% (no missing digits or decimals there!)

Modern markets 101 includes how "long-term investing" has evolved

3 stock charts I’m watching

This week, I chose to focus on a trio of Dow Industrials stocks that have not yet announced earnings, but will before February ends. Charts can't guarantee anything, but a lot of stocks tend to move one direction into earnings, then reverse course on the announcement. Buy the rumor, sell the news as they say.

We should all be descendants of Walmart founder Sam Walton, shouldn't we? Nice double in a year for an already huge stock. This is what we call a "parabolic" move.

Salesforce has been a market darling. But let's keep that in perspective. Since November of 2021, it has gone from $311 to $328. 5% total return in over 3 years. That's because the last time it stretched in price, the market took it back the next year. Today's market is littered with these.

Like Warren Buffett says, I have 3 trays on my desk: in, out and too tough. NVDA is in the latter one for me right now.

Final thoughts for now

Do not think for a second that I am "bearish" or "bullish." I think modern markets favor those who ignore traditional labels as well as binary thinking. Investing is not buy or sell, it is 3 simple steps:

WHAT will I likely fill my portfolio with, even if now's not the right time?

WHEN will I go from "someday" to "now?"

HOW will I express that view in the portfolio (stock, ETF, options, position size, hedged or not and to what degree, leveraged or not, inverse?). So many ways to be a flexible investor now.

And while markets are behaving erratically, there's a way to conservatively navigate that, while getting paid to wait for a clearer path. That's what I'm doing in Sungarden YARP Portfolio.

Note that as of today, our live sessions are now exclusively for paid subscribers to that service, except for 1 "open" general session each month.

If you are interested in joining that unique community of self-directed "serial investment learners” I lead at Seeking Alpha, click below.