The 3s Report: Will The Markets Care?

From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

Our "Reward Opportunity and Risk" (ROAR) score rises to 30 from 20 this week.

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 30% SPY and 70% BIL.

The S&P 500 is up 2% since the ROAR was lowered to 20 from 40 on 12/31/24.

3 Quick Thoughts on markets

This is one of those times when literally anything can happen. The new U.S. administration is in place, and now the process of seeing how much daylight ultimately remains between campaign promises and improvements delivered. In that respect, it is no different than it is every 4 years.

I never aim to predict the future, though it seems my whole industry has been built on trying to do that. Instead, I can look at where the "odds" are, and the story the market appears to be telling, for guidance at any point in time.

Right now it indicates that a bounce could happen, but it is likely to be measured in weeks, not months. Short-term charts look "OK" but longer term charts are between indecisive and downright awful, depending on the stock and sector. And rates may top out around here for a bit, but the overhang of the untenable U.S. debt level is an issue that won't easily vanish.

3 ETF (or index) charts I’m watching

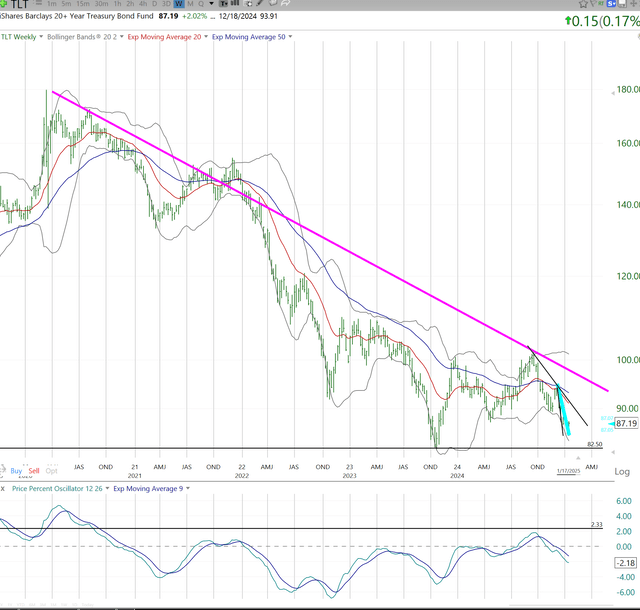

Long term bond prices still look more risky to the downside (yields up), even if we get a pause in the bond bear market along the way. That purple line could be a tough one to bust through.

Big surprise, Bitcoin is very difficult to chart! But using this longer-tenured ETF that goes back more than a year (when spot Bitcoin ETFs debuted), there's a case for a spike higher, which would jive with the whole "Trump is the crypto President" narrative that is whipping around Wall Street and social media, too. The possibility for this, and the massive risk I think accompanies this whole space, might just make for a good option collar, else a small unhedged position. No final decisions in Sungarden YARP Portfolio on this yet, but I've traded it a bunch the last year, to get more familiar with it.

If healthcare stocks are going to reverse the damage of their recent 15% selloff (over just 3 months late last year), they had best get a move on quickly. This chart outlines the "line in the sand" for this ETF, and I see nothing that makes me trust it beyond a bounce.

3 stock charts I’m watching

The best trades of the past year in many yield stocks were the ones I didn't make! Came close on biting on this one, but didn't. It still has a chance to find a resting spot around $80, but this is one of many situations in which my conclusion is as follows: there have to be a bunch of better reward/risk tradeoffs than this one! That's investing, a choice among many paths...

...because I'd never want to see THIS happen, as it did with Conagra when it faded back in July, then again when it broke that trend channel to the downside during Q4 last year. This is so typical of dividend investing now. A $30 purchase runs up quickly to $33, then gets rejected and poof! it's below $26. Wash, rinse repeat for MANY high-quality stocks yielding 2-5% or so. Risk management is SO important today.

Target was a very popular discussion area on Seeking Alpha after it tanked on earnings last quarter. I pointed out at the time that it bounced right off of the support level ($120 area), before sprinting quickly to $141. Now it is in the middle. But I'm not. I sold it at the end of last month. Again, too many other places to look. But all this, from one "blown" earnings report. Best feature here is that it has yet to break down fully.

Final thoughts for now

If you review the charts above and say to yourself, "this must be why Rob is adding a set of (option-)collared stock positions to Sungarden YARP Portfolio starting this week," you'd be in sync with where my mind is at, post-election, post-inauguration and pre lots of market gyrations as 2025 continues.

I see the stock market as a place to pursue return, but NO WAY am I going to let these modern markets destroy the wealth I've built up over decades. That is what leads me to be continuously trying to think a step ahead, as I think I'm doing by attaching protective puts and covered call options around many of my stock positions.

I did this for my then-clients way back in 2007, and was one of the few folks at the time to not lose big in 2008 (SPY down 37% that calendar year, and the start of 2009 was just as bad). I can't predict the future, but I can try to target and invest to the specific worst-case scenario for each portfolio position, where my analysis leads me. I'm looking forward to sharing more of that research with the investing group members, starting with yesterday's live call. Thanks to all who attended!