After a wild week, why not ETF Yourself?

A timely update on risk-managed investing. Maybe our way should be your way?

If you are not familiar, in my semi-retired life, I’ve settled into a few outposts where people can find my work.

I publish ETF Yourself, which is our no-frills, no-BS Substack service about investing, with a particular focus on “building portfolios, using ETFs, by yourself!” It’s $150 a year or $15 a month. I maintain a model portfolio and you receive the full version of the Weekly ROAR, which includes my weekly bottom-line indicator on market risk level. What’s more important than that right now?

We’ve added a Founding Member tier, where for $600 a year, in addition to what’s in the main subscription, you gain admission to my live, weekly, interactive investment meetings, and can ask me anything relating to investing: the basics, helpful learning resources, market takes, ETF analysis, risk management techniques, anything.

We record those meetings and post them privately on our YouTube channel within 24 hours, so you don’t miss a beat. There’s a lot more coming to ETF Yourself soon, thanks to a strong initial burst of subscriber interest.

I also lead Sungarden Investors Club, an investing group at Seeking Alpha.

But this post is about right now

What’s occurring as I write this in late November is not a surprise to us here. We’re 16 years into a market cycle dominated by easy money, literally and figuratively. There’s been so much market liquidity supplied around the world, asset prices could just go up without many headwinds. “Buy the dip” has been the law of the land. For a long time.

That also made investors forget about how useful risk management can be. NOT as a way to dampen long-term returns. To increase them! By following my #1 rule: Avoid Big Loss (ABL).

Nearly 4 years ago, right in this Substack publication, I started tracking a simple, but highly effective 2-ETF portfolio. It was based on the ROAR Score (Reward Opportunity And Risk) indicator I created, based on 40 years of charting the markets.

This original version of the 2-ETF portfolio has expanded to a full set of them, and I’m creating more of them all the time. The goal is to help investors of all experience and skill levels to confidently approach investing…without a lot of jargon. And without the usual hype and salesmanship we’ve all become used to in my industry.

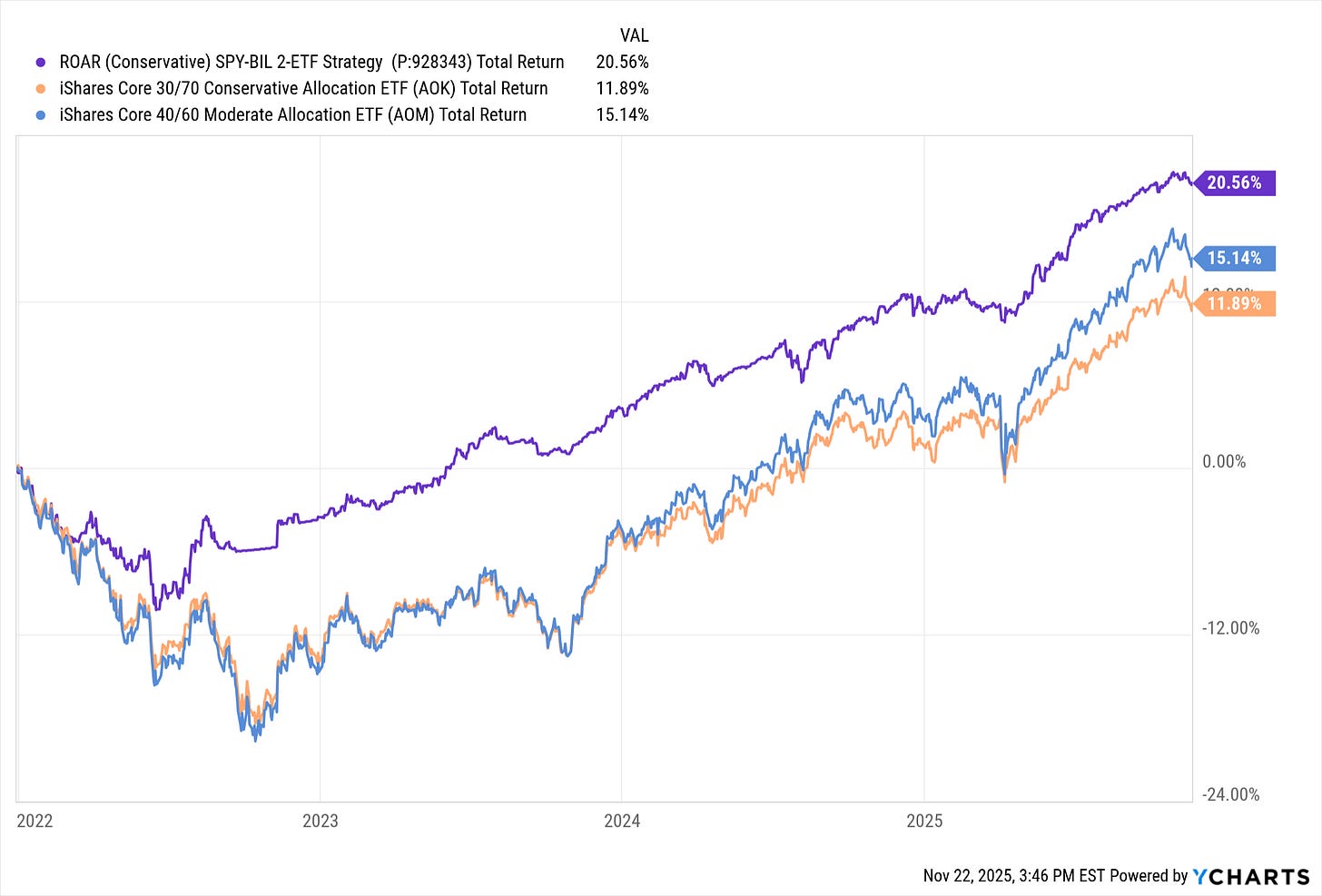

I’ll have more on this subject in an upcoming post. For now, here’s a quick visual of what “Avoid Big Loss” looks like, expressed through a simple 2-ETF portfolio.

That portfolio, which I use for part of my own assets since the start of 2022, simply allocates between an S&P 500 ETF (SPY) and a Treasury Bill ETF (BIL) looks like, in practice. Every Tuesday, our paid subscribers here receive the updated ROAR Score as part of our weekly newsletter, The Weekly ROAR.

This is going on 4 years, and that easy to learn and use, risk-managed, CONSERVATIVE portfolio has outperformed not only the iShares Conservative Allocation Index, but also the Moderate Index.

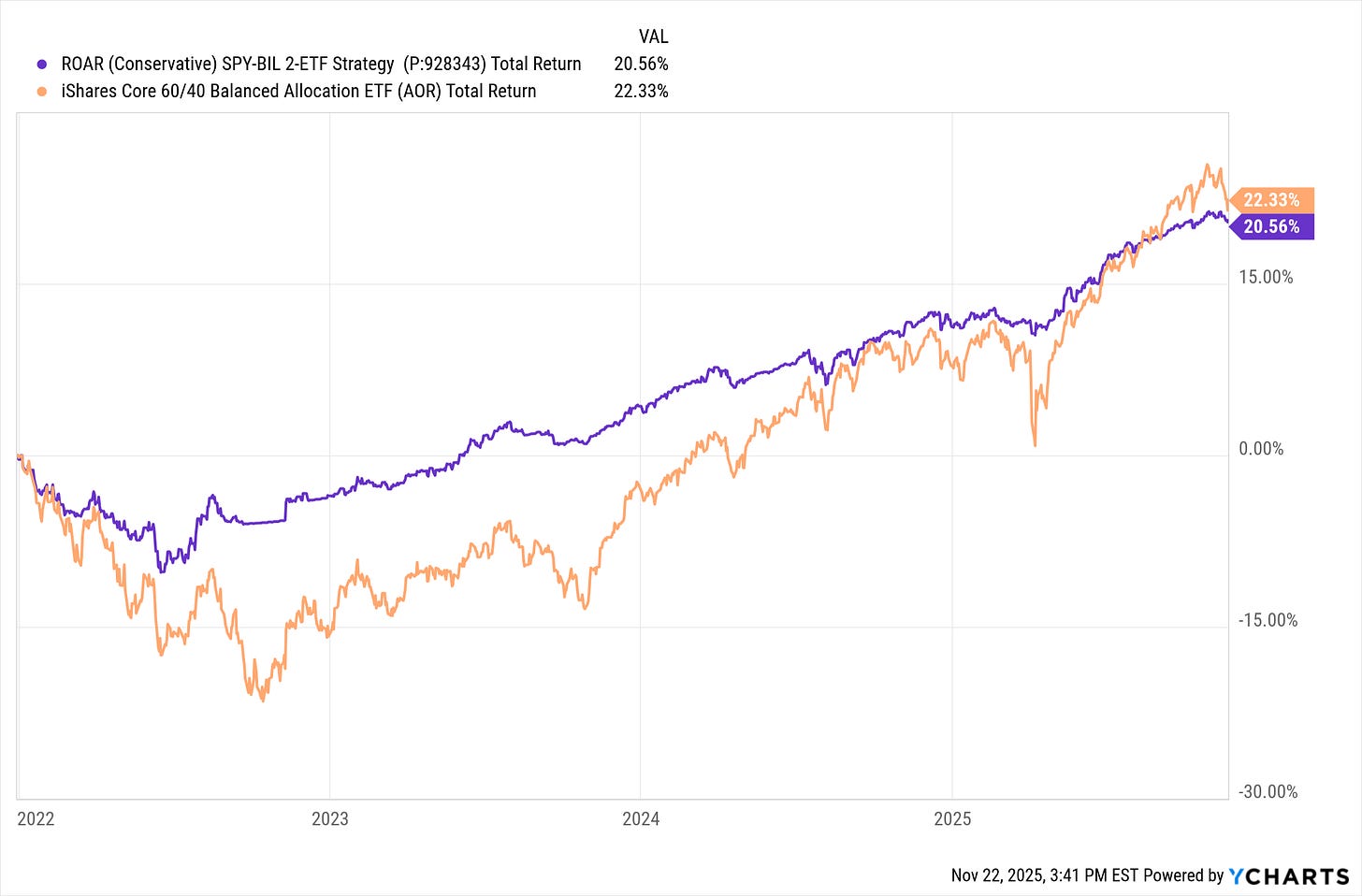

And, in what should be a total mismatch given how cautiously run the ROAR 2-ETF Conservative portfolio is, the recent pullback in stocks and bonds has it about neck-and-neck with the “famous” (but overrated) 60/40 Balanced Allocation portfolio index (AOR).

This is the best evidence I have that investing in modern markets can and should be:

Straightforward

Simple to understand (the complexity is behind the scenes, that’s my job!)

Aimed at keeping what you have, then growing it as market conditions allow

A step-by-step, gradual learning process. I’ve been at this since the 1980s, and I still learn every day.

Enough information and ongoing analysis to take what I do for myself, and allow you to customize it for yourself, however you wish.

We’re not a personalized advisory service…we’re ETF Yourself!

It concerns me that in this era of supposed investing bliss, the masses have been told only a fraction of what they should know to be truly self-directed, independent investors. Over my 40-year career, I’ve seen many investment cycles, and my job was to navigate through them. Not only when the weather was good, but also when it wasn’t.

Storm clouds have appeared

3 things you should know about how I approach modern investing markets:

They are completely different from those of the past. Indexing and algorithms are largely the reason for that. If you wish, add feckless global politics as a factor.

Process beats “picks” over time. Anyone can throw stock picks at you. My goal is to teach you “how to fish” and not just give you fish for a day, as others do.

Risk management and humility are what lasts. Arrogance and greed don’t.

I invest and trade my own portfolio more actively than ever, after retiring in 2020 from 3 decades of managing other people’s money. We started on Substack because I came to realize there was an audience for my alternative approach to the large crop of brand-new investing “experts” on Instagram and Tic-Toc. They are not us, and we are not them.

So, with markets threatening to unwind 16 years of friendly conditions, or at least transition to something more challenging for investors who have not grappled with anything but the buy-the-dip era, we want to take this opportunity to be available.

So as opposed to our typically laid-back approach to communicating with our Substack audience, I welcome you to ask a question, read some of the new free investment knowledge center material we have set up on the ETF Yourself site, or even join our community of risk-managed, modern investors.

We never know what the future brings, especially in the investment markets. But there’s a way to be prepared for just about anything. Not simply to protect wealth, but to exploit those conditions for profit. That’s the mission here. We hope to hear from you.

Best regards,

Rob Isbitts

Founder, ETF Yourself

Thanks for outlining your approach. Could you explain the difference between your Substack and what you offer on Seeking Alpha? I read you there as well. It seems like your high level is similar to what you offer on Seeking Alpha but I am not really sure. I like your idea of teaching people to fish. When I homeschooled my son for a year, we called ourselves The Fisher School.